Trusted, Full-spectrum Financial Solutions for Clients with Complex Needs

With over 30 years of investing experience, deep knowledge of full-spectrum wealth management and the robust resources of our diverse network of partners within BMO Financial Group, The Takeda Group advises affluent small business owners and commercial enterprises as well as successful individuals, families and professionals. We earn our clients’ trust by following our disciplined, long-term investment philosophy; integrating BMO’s diverse specialized wealth planning services; and calling proactively to provide perspective and emotional support when market downturns occur.

The Importance of Starting with a Financial Plan

One of our team’s most important differentiators is that we place financial planning at the centre of all our conversations. Our rigorous financial planning process helps to uncover goals, liabilities and realities that may impact your overall wealth. Your Wealth Plan will drive our investment recommendations.

People who are busy with life often come to us without updated wills, tax planning strategies or financial plans, which can adversely affect loved ones. Our team will ensure that your financial house is in good order and help you employ strategies to minimize tax, plan a rewarding retirement and establish a thoughtful estate plan.

About BMO Private Wealth

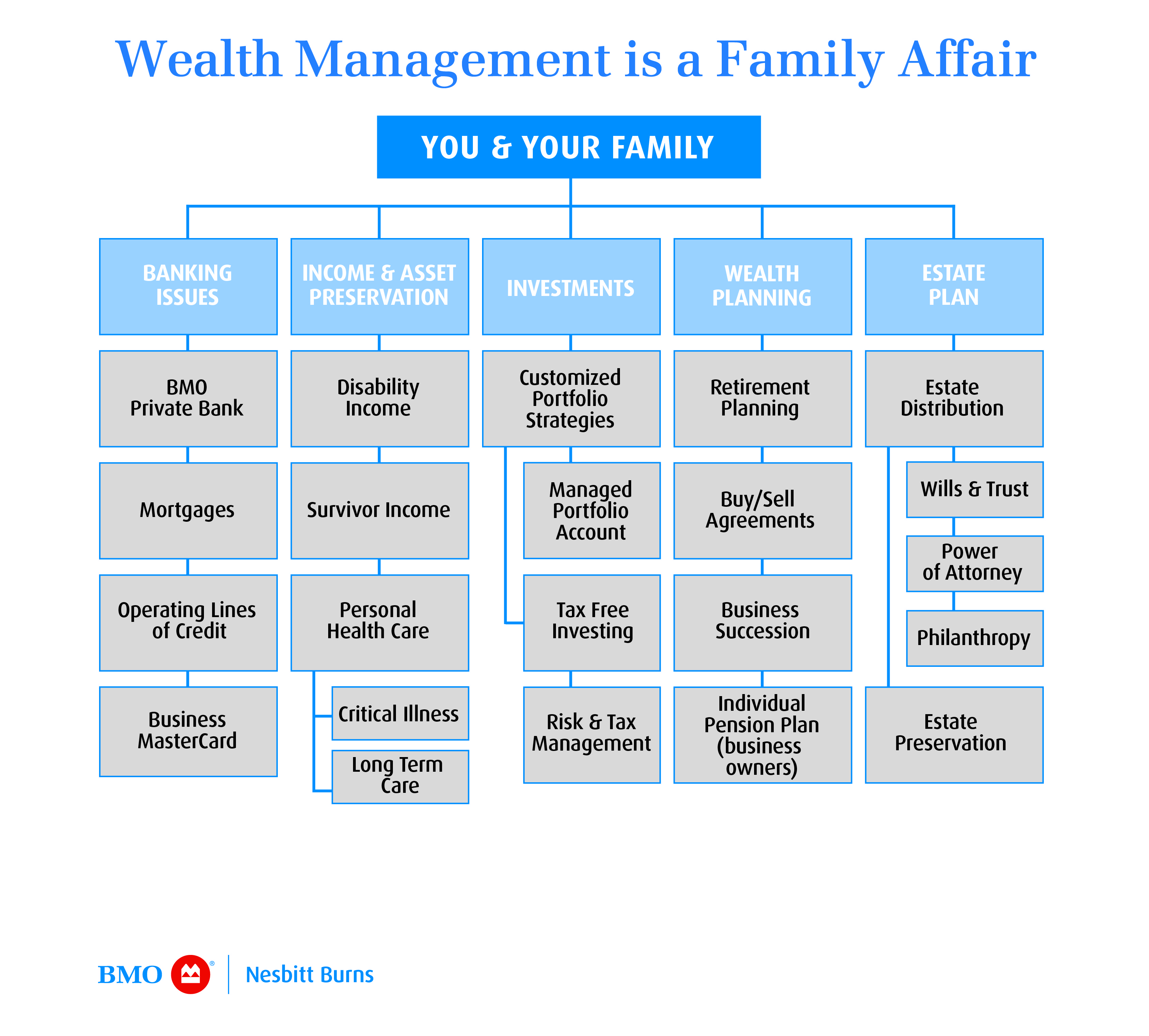

BMO Private Wealth is a multi-disciplinary team of professionals from BMO Nesbitt Burns, one of North America’s leading, full-service investments firms and BMO Private Banking, one of Canada’s best private banks. We offer a range of strategies and solutions in private banking, investment management, trusts and personal and business financial planning tailored to help you navigate managing your wealth.

BMO Private Wealth is a brand name for a business group consisting of: Bank of Montreal, BMO Nesbitt Burns, BMO Private Investment Counsel Inc. and BMO Trust Company. Not all products and services are offered by all legal entities within BMO Private Wealth. Further details.