Investment Insights Winter 2026

Paul D'Elia - Jan 15, 2026

- Estate Planning

- Financial Planning

- Investment Services

- Portfolio Management

- Retirement

- Special Reports and Newsletters

- Tax Planning

- Total Client Experience

- Wealth Management

In This Issue • For a New Year: Harness the Power of Time • Investing Wisdom From the World’s Greats • Get Ahead With Seven RRSP Considerations • Equity Markets: What’s Driving Advances? • The Importance of Connection

Ten Years From Now

A decade can change more than we might expect. Over the past ten years, we’ve bid farewell to the BlackBerry smartphone, Canada Savings Bonds and DVDs, and embraced what once seemed unimaginable: tap-to-pay from our phones, hailing a ride from a stranger (Uber) and groceries delivered to our doorstep.

As we look ahead to a new year, sentiment may feel somewhat conflicted. The economic landscape evokes something akin to Charles Dickens’ Tale of Two Cities: “It was the best of times, it was the worst of times.” We are living through one of the most prosperous eras in history, marked by longer, healthier lives, technological breakthroughs and one of the highest standards of living. Yet we’re also contending with challenges: a soaring cost of living, widening inequality, high debt levels, sluggish productivity and ongoing geopolitical tensions.

In 2025, financial markets continued their climb, driven by a bifurcated “K-shaped” economy in which higher-income households supported overall activity.1 While significant gains—fuelled largely by excitement surrounding artificial intelligence—have been encouraging, many investors remain cautious. Canada’s new Fall Budget highlighted the concerns: weak business investment, lagging productivity and persistent trade tensions. Where will growth come from in the years ahead?

The simple answer, of course, is that markets and economies are cyclical by nature—they expand and contract, rise and fall. Indeed, it’s worth looking beyond a near-term horizon; a longer-term perspective allows us to view the full cycle of events, including both peaks and troughs.

Consider how the economy has evolved over the past decade. Back in 2015, Canada’s middle class was still considered “the envy of the world.”2 At that time, the government was “able to provide significant tax relief to Canadian families while remaining on track to return to balanced budgets”— two concepts that feel substantially implausible today.3 But in 2016, oil prices collapsed from around $115 per barrel in 2014 to under $30, and Brexit created turmoil in Europe. The following years brought continued uncertainty, including a U.S.-China trade war and slowing global manufacturing weighing on growth. At home, Canada faced lingering energy-sector weakness and NAFTA renegotiations in 2018. Then came the global pandemic, a brief recession, followed by a short reprieve with a surge in oil prices due to the Russia-Ukraine conflict and inflation not seen in decades.

Yet through it all, investors who stayed the course were ultimately rewarded. The S&P/TSX Composite opened at 12,920 in 2016 and since crossed 30,000 in 2025—an average annual return of around 8.8 percent, excluding dividends. Even amid uncertainty, progress has a way of compounding over time.

The point is to suggest that longer-term investors should not become overly preoccupied with what might happen tomorrow or in the months ahead. Instead, a more prudent focus may be a time horizon measured in years and even decades. With patience and perspective, investors can draw on past resilience, avoiding short-term pitfalls and capitalizing on opportunities that emerge over time.

A decade is, of course, an arbitrary number, but for many of us it’s a fair time frame. Even retirees can plan with that horizon in mind, given our increasing longevity. A lot can happen over 10 years, and one of the best ways for investors to continue benefiting is to continue participating.

Here’s to a new year ahead—and all the opportunities the next decade may bring!

1. In Q2 2025, the wealthiest 10% accounted for 49% of U.S. consumer spending; 2. https://www.nytimes.com/2014/05/01/upshot/canadianshave-plenty-of-concerns-but-also-a-sense-theyre-better-off.html; 3. https://www.budget.canada.ca/efp-peb/2014/pub/chap03-eng.html

For a New Year: Harness the Power of Time

Building wealth relies on the impact of compounding over time.

A market observer recently noted that “quiet compounding”—the silent, gradual growth over long periods—has given rise to some of the most remarkable features of the universe: from towering sequoias and complex organisms to majestic mountains. This concept also holds true in investing: compounding power can yield noteworthy results, though it’s often overlooked because it requires time. As we start a new year, the following may serve as a reminder of its potential impact over time.

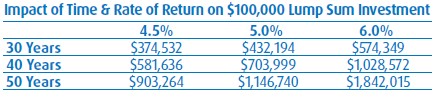

1. How $100,000 can grow over time. If left to compound at an annual rate of five percent, a one-time investment of $100,000 would grow to over $1.1 million in 50 years. Modest increases in the rate of return can influence long-term outcomes: A one percent rise to six percent would yield over $1.8 million in 50 years. Time similarly has an impressive impact. Extending an investing period from 30 to 50 years leads to substantially greater outcomes:

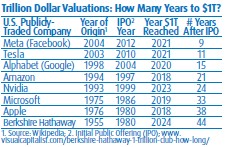

2. Building meaningful wealth, whether for individuals or companies, takes time. In October 2025, Nvidia made the headlines when it became the first company to hit a $5 trillion market value. Only 10 U.S. companies have surpassed the one trillion-dollar market capitalization mark (defined as share price X shares outstanding). Achieving this status didn’t happen overnight. The first non-tech company to join this group, Berkshire Hathaway, relied on nearly six decades of perseverance. Warren Buffett stepped down as the CEO at the end of 2025, but consider that he first took control in 1965 when Berkshire was a struggling textile mill valued at around $22 million. He took the company public in 1980, but it would take another 44 years to reach trillion-dollar status. Buffett attributes much of his success to compounding—with profits reinvested into new investments, allowing the company’s value to grow steadily over time.

Investing Wisdom From the World’s Greats

As we begin another year, here are some investing resolutions derived from the wisdom of the world’s greatest investors.

“Sometimes the tide is with us, and sometimes against. But we keep swimming either way.” — Charlie Munger

1. Keep swimming. After a few years in which the tide has clearly been with investors, some may naturally question what comes next. But as Buffett’s longtime business partner often reminded us, markets move in waves and the goal shouldn’t be to predict the tides, but keep swimming through them. Markets rise, fall, and sometimes surprise. Volatility is inherent to investing; yet, these fluctuations are what enable equities to deliver strong long-term returns. The market’s best days often occur near its worst; missing even a handful can meaningfully erode returns. Over time, steady participation has consistently rewarded those who keep swimming.

"The best time to plant a tree was 20 years ago. The second-best time is now.” — Proverb

2. Don’t overlook the value of time. After substantial market gains, it may be tempting to think the best opportunities have passed. Yet time remains an investor’s best ally. When combined with the power of compounding, even average returns can lead to remarkable results. A one-time investment of $100,000 compounded at an annual return of 5 percent would grow to about $432,000 in 30 years (article above). Over 75 years, it would exceed $3.8 million. And, given our increasing longevity, it’s never too late to start.

“All these noises and jumping up and down along the way are really just emotions that confuse you.” — John Bogle

3. Pay less attention to the noise. When markets rise, everyone sounds like an expert, and we may fear missing out. When they fall, the media can magnify economic misery and instill fear. In this age of connectivity, it’s never been easier to get swept up in the emotions of the moment. Yet, at the end of the day, thoughtful analysis—not excitement or fear—should guide decisions.

“Do not save what is left after spending, but spend what is left after saving.” — Warren Buffett

4. Save more. Saving is among the few aspects of investing that we can fully control. Moreover, it is a fundamental pillar in the process of wealth accumulation. Building wealth is possible even with a modest income, yet it becomes improbable without a commitment to saving.

“Any sound long-range investment program requires patience and perseverance. Perhaps that is why so few investors follow any plan.” — John Templeton

5. Have confidence in your plan. As advisors, our role is to support every step of the investment journey to help create lasting progress toward achieving your goals. This includes providing guidance and discipline through saving, investing and comprehensive wealth management—covering tax, retirement, estate planning and more. Studies continue to show that advised clients accumulate over 2.3 times the assets of non-advised investors after 15 years—evidence that steady guidance compounds outcomes.1 With a plan in place, continue looking forward with confidence.

1. Source: CIRANO, The Gamma Factor and the Value of Financial Advice, 2021.

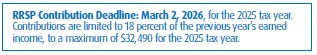

Get Ahead With Seven RRSP Considerations

Thoughtful planning can help you or your loved ones get more from Registered Retirement Savings Plan (RRSP) contributions.

With RRSP season upon us, it’s a good reminder that careful planning can help every contribution work harder. Here are seven considerations for you—or to share with younger folks just starting out:

1. Time Deductions & Contributions — With any RRSP contribution, you’re entitled to a tax deduction for the amount contributed (within your limit). You don’t have to claim the tax deduction in the year the contribution is made. You can carry it forward if you expect a higher future income that puts you in a higher tax bracket, potentially generating greater tax savings. Contributing earlier in the tax year, rather than waiting for the deadline, gives your funds more time for tax-deferred growth.

2. Think Twice About RRSP Withdrawals — Be cautious about making withdrawals from your RRSP to pay down short-term debt, as these are considered taxable income. You may pay more in tax than you save in interest. Once withdrawn, the valuable contribution room cannot be restored. If funds are needed, a TFSA—where contribution room resets each calendar year—may be a better option.

3. Review Beneficiaries — It may be beneficial to review account beneficiaries (in provinces where applicable), especially after major life changes. For instance, depending on provincial law, following separation or divorce, named beneficiaries may not automatically be revoked, meaning the designation of an ex-spouse may still be in effect.

4. Use a Spousal RRSP Strategically — For couples where one spouse will earn a high level of income in retirement while the other will have less, a spousal RRSP can be an income-splitting tool. If you’re still working past age 71 and have a younger spouse, you can no longer hold your own RRSP after the year you turn 71, but you can still contribute to a spousal RRSP as long as your spouse is 71 or younger at year-end and you have contribution room. This may provide a current-year deduction while shifting income to your spouse for future tax savings.

5. Consider a Meltdown Strategy — There may be tax advantages to gradually drawing down (“melting down”) RRSP funds as you approach retirement, particularly if you are in a lower tax bracket than you expect in the future, or want to minimize income-tested benefit clawbacks (i.e., Old Age Security). Some use RRSP withdrawals to fund TFSA contributions (subject to available room). As the TFSA grows, it provides flexibility since income is tax-free, augmenting or replacing future Registered Retirement Income Fund (RRIF) withdrawals. At death, TFSA assets pass tax-free to heirs, unlike residual RRSP/RRIF funds, which are subject to tax.

6. Consolidate Multiple Accounts — Some investors hold multiple RRSPs, often from changing employers. Consolidation can simplify management, prevent “orphan” accounts, improve asset allocation or potentially reduce fees.

7. Turning 71? Don’t Forget the “Forgotten” RRSP Contribution — If you’re still working at age 71, you may earn new RRSP room for the following year. Since your RRSP must be collapsed by December 31 of that year, contributions must be made before year-end, creating a temporary overcontribution. Overcontributions incur a one percent per month penalty, but the tax deduction may more than offset it. For example, a $20,000 overcontribution would generate a $200 penalty (if made in December; contribution room would be available in January), but at a 40 percent marginal tax rate, it could provide $8,000 in tax savings. Don’t forget: a lifetime $2,000 overcontribution is permitted without penalty.

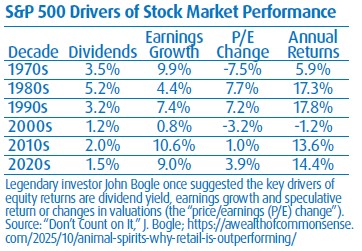

Equity Markets: What’s Driving Advances?

With indices reaching record highs in 2025, equity market valuations have grown considerably, prompting some to ask: What is driving markets higher, and can this continue?

Many factors influence stock market movements: headlines, geopolitical events, economic growth, inflation, interest rates and government policy, to name a handful. Yet, one of the key long-term drivers is corporate earnings. When consumers and businesses spend more, companies see higher revenues, which, after costs, translate into profits.

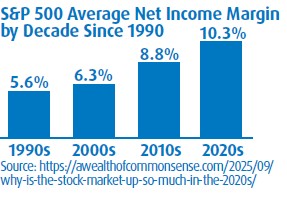

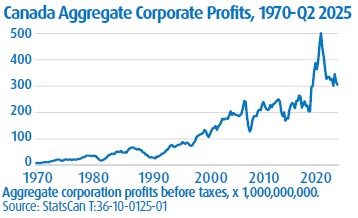

Notably, profit margins have trended upward. In fact, the average S&P 500 net income margin this decade has been 10.3 percent, almost double what it was in the 1990s. Canada’s corporate profits have followed a similar trajectory, though aggregate profits have been influenced by commodity prices (e.g., the spike in 2022; see chart below).

Of course, earnings growth doesn’t guarantee high returns.* But it remains one of the most important longer-term drivers and shouldn’t be overlooked as a key contributor to the market’s recent strength. Looking ahead to 2026, here’s to continued earnings strength so the bulls can continue their run!

*History reminds us that earnings alone aren’t everything. In the 1970s, earnings growth was strong (+9.9%), yet high inflation and external factors (such as the oil shocks) kept equity returns subdued.

Ways to Live a Longer Life: The Importance of Connection

In the longest-running study on happiness, Harvard’s Study of Adult Development found that social connections are the strongest predictor of happiness and health, which may contribute to greater longevity.1

Retirement planning is more than a “number.” Of course, our role is to support your wealth management, so you have the means to live the life you envision in retirement and beyond. Yet often overlooked is how we’ll maintain life satisfaction as we age.

We live in an era of unprecedented global wealth, with a standard of living that is at its highest in history. Yet, levels of unhappiness are also at record highs. Social disconnection has become such a recognized issue that the UK and Japan have appointed government “Ministers of Loneliness,” and in 2023, the U.S. surgeon general declared loneliness an “epidemic.”2 A recent media headline even suggested that Gen Z may avoid the proverbial ‘midlife crisis’ not because they are happier, but because unhappiness has become so common much earlier in life.3 In the past, happiness tended to follow a “U-shaped” curve across the lifespan. Today, this may have shifted to an upward-sloping line, with young adults now the least happy and older adults still reporting the greatest happiness.

Why this change is happening may be linked to various factors—the effects of job and housing prospects, the after-effects of the pandemic, growing wealth inequality and, of course, the rise in social media and smartphones that have created broader connectivity, which inundates us with negative news and comparative envy. Yet, this kind of connectivity does not sustain us. A thriving human experience is fuelled by face-to-face interactions, which foster self-expression, creativity, optimism—and ultimately happiness.4 In fact, these interactions can rewire our brains to change how we perceive the world more positively. Neuroscience shows that in-person interactions engage the brain in beneficial ways that video calls cannot replicate.5

Is there any evidence to support this connectivity as a predictor of longevity? One study following nearly 1,500 older adults over a decade found that those with large networks of friends outlived those with fewer friends by more than 20 percent.2 Conversely, social disconnection is linked to higher risks of cardiovascular disease, stroke, depression, dementia and premature death. One study showed that loneliness increased the risk of early mortality by 26 percent and social isolation by 29 percent.6

The Longevity Benefits of Connecting to Others

Importantly, connectivity is not only about how many physical friends we have, but also about how we engage with others. Those who participate in “prosocial” behaviours—acts intended to help or benefit others—tend to enjoy better health themselves. This can include volunteering or even making a charitable donation. For instance, seniors who spent about 15 hours per week tutoring and mentoring young children experienced measurable improvements in both cognitive and physical health. Volunteering has been linked to longer life spans.7 Acts of giving can lower blood pressure, reduce stress and even decrease cortisol levels (the stress hormone), while boosting feel-good brain chemicals like dopamine and serotonin.8

As we enter a new year, this may be worth a moment of reflection: By giving our time, resources or attention to others, we not only make an impact on others, but may also enhance our own happiness, health and longevity. Staying connected—not just financially, but also emotionally and socially—can help us live fuller, more satisfying lives as we plan for retirement and beyond.

1. https://www.adultdevelopmentstudy.org/; 2. https://hsph.harvard.edu/news/the-importance-of-connections-ways-to-live-a-longer-healthier-life/; 3. https://www.newsweek.com/gen-z-midlife-crises-happiness-mental-health-2120019; 4. https://www.washingtonpost.com/wellness/2024/05/28/in-person-friendships-health-benefits/; 5. https://www.sciencedirect.com/science/article/pii/S1053811922007984; https://www.nature.com/articles/s41598-024-52587-2; 6. https://pubmed.ncbi.nlm.nih.gov/25910392/; 7. https://journals.sagepub.com/doi/10.1177/1359105305057310; 8. https://pubmed.ncbi.nlm.nih.gov/16905215/; https://lifestylemedicine.stanford.edu/how-social-connection-supports-longevity/

To Our Clients:

Happy New Year! We hope your holiday season

was busy in the best way, and you’re entering

the year with fresh perspectives, a clean slate

or a renewed sense of purpose.

Just as a new year gives us a chance to reset

personally, certain financial elements also reset.

The 2026 TFSA dollar limit is set at $7,000, and

RRSP season is in progress: two tax-savvy ways

to put funds to work. Keep your hard-earned

money working for you; the only way to miss

out on potential growth is to sit on the sidelines.

As we begin another year, remember that

we are here to take care of your wealth

management—positioning investments,

managing risk and providing objective advice—

so you can focus on other meaningful areas of

life. Wishing you a wonderful year ahead.

D’Elia Wealth Advisory Group

BMO Nesbitt Burns

Paul D’Elia

B.Comm. (Hons), CIM®, PFP®, FCSI®

Senior Wealth Advisor

Senior Portfolio Manager

BMO Private Wealth is a brand name for a business group consisting of Bank of Montreal and certain of its affiliates in providing private wealth management products and services. Not all products and services are offered by all legal entities within BMO Private Wealth. Banking services are offered through Bank of Montreal. Investment management, wealth planning, tax planning, and philanthropy planning services are offered through BMO Nesbitt Burns Inc. and BMO Private Investment Counsel Inc. Estate, trust, and custodial services are offered through BMO Trust Company. Insurance services and products are offered through BMO Estate Insurance Advisory Services Inc., a wholly-owned subsidiary of BMO Nesbitt Burns Inc. BMO Private Wealth legal entities do not offer tax advice. If you are already a client of BMO Nesbitt Burns Inc., please contact your Investment Advisor for more information. BMO Nesbitt Burns Inc. is a Member – Canadian Investor Protection Fund and is a Member of Canadian Investment Regulatory Organization. BMO Trust Company and BMO Bank of Montreal are Members of CDIC. “BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

BMO Private Wealth provides this publication for informational purposes only and it is not and should not be construed as professional advice to any individual. This newsletter was produced by J. Hirasawa & Associates, an independent third party for the individual Investment Advisor noted. While every effort is made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions which are accurate and complete, the author does not accept responsibility or liability resulting from the information or content provided. The information contained in this publication is based on material believed to be reliable at the time of publication, but BMO Private Wealth cannot guarantee the information is accurate or complete. Individuals should contact their BMO representative for professional advice regarding their personal circumstances and/or financial position. The comments included in this publication are not intended to be a definitive analysis of tax applicability or trust and estates law. The comments are general in nature and professional advice regarding an individual’s particular tax position should be obtained in respect of any person’s specific circumstances.

BMO Private Wealth is a brand name for a business group consisting of Bank of Montreal and certain of its affiliates in providing private wealth management products and services. Not all products and services are offered by all legal entities within BMO Private Wealth. Banking services are offered through Bank of Montreal. Investment management, wealth planning, tax planning, philanthropy planning services are offered through BMO Nesbitt Burns Inc. and BMO Private Investment Counsel Inc. If you are already a client of BMO Nesbitt Burns Inc., please contact your Investment Advisor for more information. Estate, trust, and custodial services are offered through BMO Trust Company. BMO Private Wealth legal entities do not offer tax advice. BMO Trust Company and BMO Bank of Montreal are Members of CDIC.

® Registered trademark of Bank of Montreal, used under license.