Portfolio Management

Four Key Factors Used To Evaluate Investment Managers

Idea Generation

The key attribute that a manager needs to possess to have the potential to outperform over the long-term is the ability to generate value-adding investment ideas

Portfolio Construction

The quality of a manager’s portfolio construction process will determine how effectively its value-adding investment ideas are converted into consistent outperformance

Implementation

For a manager to outperform, the value added through its investment ideas and portfolio construction process must outweigh

the drag on its performance due to transaction costs

Business Management

Well managed investment firms are more likely to maintain and enhance the competitiveness of their investment strategies over time than poorly managed firms

Investment Philosophy

Enhancing investment return potential while attempting to limit the volatility of returns.

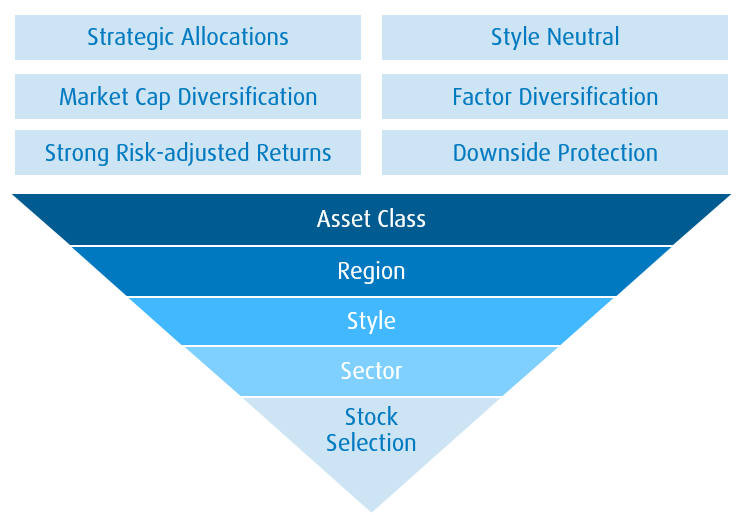

Our approach to portfolio construction is based on the belief that active management outperforms as it provides more consistent value added returns with less volatility, particularly in weak markets. Active management not only at the security selection level, but also the asset allocation level help produce higher risk adjusted returns.

A well structured and disciplined investment process

Client Profile: Create a unique investment profile by establishing a clear understanding of your investment objectives, risk tolerance, preferences, requirements and restrictions.

Asset Allocation: Asset class, Geographic location, Investment style & Manager.

Portfolio Construction: Manager selection.

Control and Monitoring: BMO Nesbitt Burns, Managed Assets, Strategy & Analytics, Team, Mercer Investment Consulting & Investment Advisor.