Houston, we have a problem.

Derek Shevkenek - Apr 17, 2020

In a 2014 newspaper column I’d compared the explosion of the Apollo 13 missions’ space-craft oxygen tank, to the explosion in money printing that had been occurring since the 2008 global credit crisis.

Coincidentally, today marks the 50th anniversary of the Apollo 13 space crews’ miraculous return to earth. And during this anniversary, the world finds itself battling the Coronavirus, with further explosions in money printing:

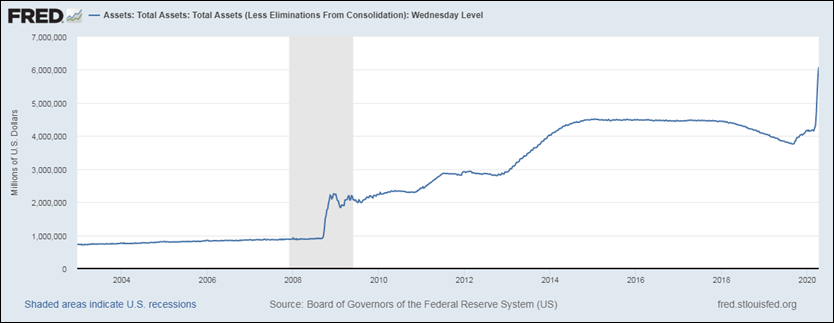

“The Federal Reserve’s balance sheet increased to a record $6.42 trillion this week as the central bank used its nearly unlimited buying power to soak up assets to keep markets functioning amid an abrupt economic free fall due to the coronavirus pandemic.” (Reuters, Apr 16/20)

As a comparison, below is an updated version of a similar chart found in the column. It was about $3.5 trillion in 2013, and now stands at $6 trillion+:

OK, so what’s the bottom line here? I posed a question at the conclusion of the column. I believe an answer to that question is to include precious metals as part of a solidly diversified investment portfolio.

Aside from the increased stability that precious metals tend to afford portfolios over the long term, I think they also serve as a form of “financial insurance”.

Because as quoted in the column, unlike the monetary printing press, gold is strictly limited in supply.