Minuk's Musings and Leap Years

Richard Minuk - Mar 01, 2024

Yesterday was February 29th – a leap day.

Without a leap day once every 4 years, our calendars would be all out of sync. In 100 years, calendars would be 24 days off. In 700 years, Northern Hemisphere summers would begin in December.

This year’s leap day had some amazing parallels to the last leap day in 2020.

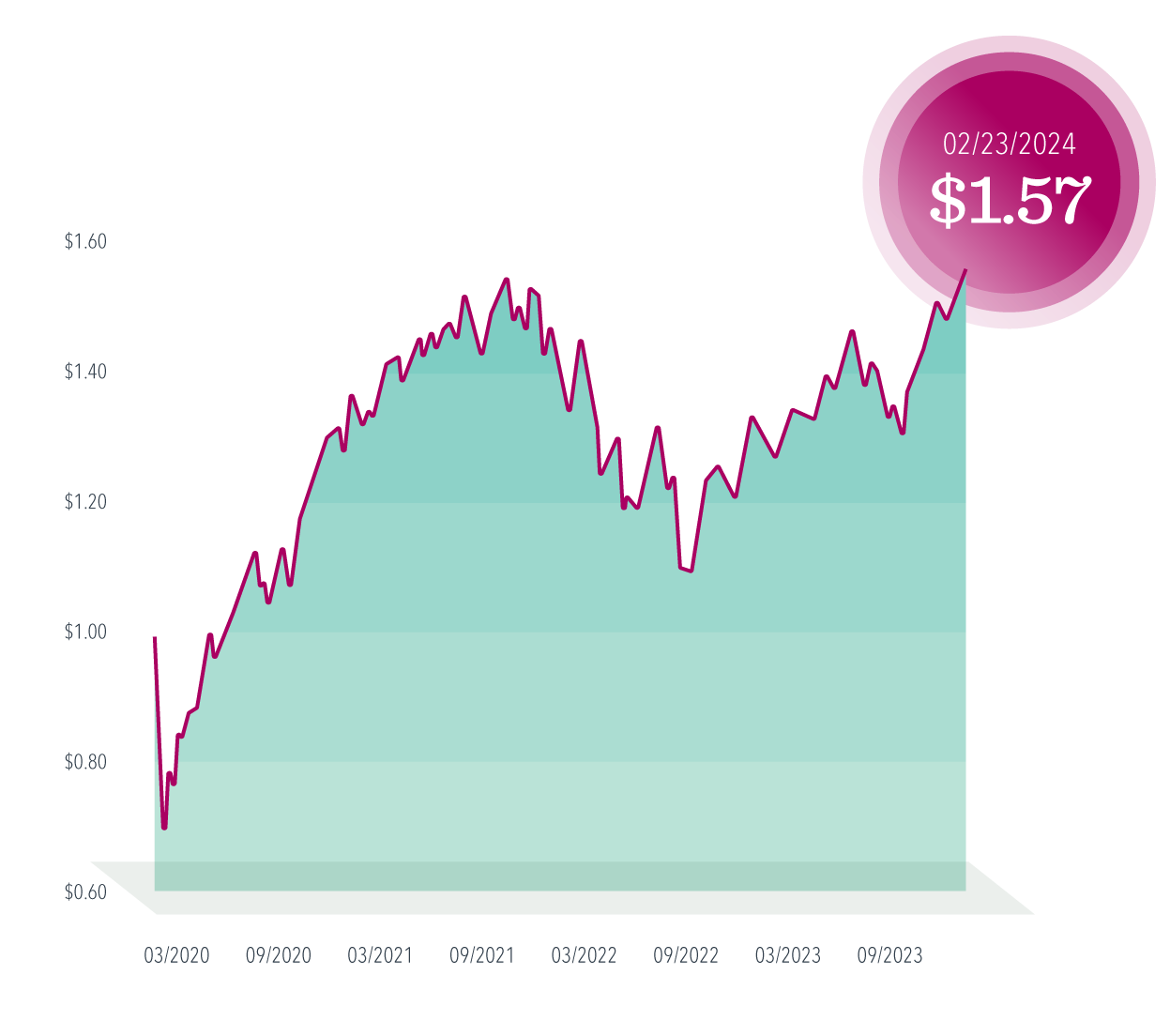

- We’re right at a new high in the US stock market.

- Billie Eilish won song of the year at the Grammys.

- The Kansas City Chiefs defeated the San Francisco 49ers in the Super Bowl.

Yes - amazingly, these same events of 2024 unfolded just before leap day four years ago too.

Hopefully, not everything from the past four years repeats – I’d certainly prefer avoiding another pandemic, but it’s worth noting how the stock market rewarded disciplined investors during that tumultuous period.

In addition to the pandemic, we continue to face a highly contentious political environment, terrorism, terrible wars around the world, government debt concerns and more.

And yet, despite all these events, the global equity market rose by 57% since the last leap year.

Past performance, including hypothetical performance, is no guarantee of future results.

Based on the MSCI All Country World IMI Index (net div. USD) from March 1, 2020–February 23, 2024

Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Data presented in the Growth of $1 chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment. MSCI data © MSCI 2024, all rights reserved.

Credits to Wes Crill, PhD, Senior Investment Director and Vice President @ Dimensional Fund Advisors

It goes to show you that predicting the future of stock returns based on global macro events is very hard. In fact, macro events are often completely irrelevant to the disciplined, long-term investor who focuses on buying high quality businesses.

Warren Buffet says it the best.

“We don’t have to be smarter than the rest, we just have to be more disciplined than the rest.”

As always, I hope you have a lovely weekend and please reach out if you need me.

Rich

Investment Advisor