McCreath Group - November 2016 Newsletter

James McCreath - Nov 09, 2016

Welcome to the second edition of our client newsletter, Semper Anticus, which means “always forward” in Latin. We continually strive to put clients in a better financial and personal situation and this newsletter is an extension of our efforts to communicate ideas, trends and investment market themes with clients.

Our mission statement is to provide clients with superior wealth planning on a timely basis while exceeding their expectations for service, portfolio management, trust and integrity. As Scott often likes to say, “Whether you’re a barber, dentist, teacher or lawyer, everyone needs assistance setting sail for retirement.”

Should you ever have any concerns or questions about your investments we’re always here to help, so please email or call any time. And most importantly, we thank you for being clients … Alison, Ashley, Rob, Lila, Steve, Brendon, James and Scott

Included in this edition is information on:

-

A reminder on phishing and suspicious communications

-

A summary of the McCreath Group’s 24th annual business planning retreat

-

The McCreath Group Market Overview

-

BMO Wealth Institute: Saving for retirement – One size does not fit all

-

Interesting articles and books we’ve recently read

A reminder on phishing and suspicious communications

Over the last few years as society becomes more reliant on electronic forms of communication, there has been a rise in phishing, which is an attempt to obtain sensitive information such as usernames, passwords, and financial details for malicious reasons by masquerading as a trustworthy entity (such as a bank or the Canada Revenue Agency) in an electronic communication (typically email).

If you receive a suspicious email from a member of BMO Financial Group, do not reply or click on any links. Instead, report the suspicious email to online.fraud@bmo.com and contact the McCreath Group immediately.

A summary of the McCreath Group’s 24th annual business planning retreat

For the 24th successive year, our team met for a weekend retreat (Oct. 21-23) to review our business plan in an effort to optimize the services we provide clients and enhance our group strategy. Very few investment teams in our industry go to this level of planning to enhance their practices and it’s a track record of strategizing we’re proud to have. Below is a list of summary topics of interest to clients that we covered:

-

We continually refine our abilities to identify high-quality investment ideas and themes. At the bottom of this newsletter is a list of the sources we rely on to uncover those ideas. When we’re not talking to clients, a considerable amount of our time involves reading research reports and interpreting opinions to best position our clients’ portfolios. It’s important clients know how much of our time and intellectual energy we direct to this essential aspect of the business. As Scott so often says, “It’s an idea business.” On that note, later this month our team members are attending investment conferences where we’ll be able to identify investment ideas: Steve is in New York and Scott and James are in Toronto.

-

We remain committed to helping a select group of family households manage their investments. Increasingly our clients want more information on:

-

Wealth management (estate planning, insurance, financial planning, banking). Going forward, we’re open to discussing these topics in much greater detail with clients. Whether the resources are internal to BMO or external, we have many professionals you can access for these topics.

-

Assisting children through RESPs, home purchases, initiating registered accounts (RRSPs and TFSAs) and beyond. It’s important you know we’re here to help your children, whether young or old, with any financial advice or assistance they require … now or in the future.

-

-

The compliance and regulatory side of our business continues to proliferate. Our focus remains on reducing the queries and forms we have to discuss and mail clients while fully respecting our regulatory obligations. It’s an element of the business that takes up an increasing amount of our time and we do our best to simplify and expedite regulatory requirements that clients are required to address.

-

Among the topics we’re increasingly required to discuss/disclose with clients is investment fees. We believe its important clients know what they pay for the services we provide and should you have any questions on the topic, please ask us. As well, beginning in early 2017, clients will receive a disclosure of the annual fees they’ve paid us per account.

-

As a side note, our planning sessions have largely been held each year at rocky mountain lodges and resorts often off the beaten path. This year’s business planning session was the Prairie Creek Inn near Rocky Mountain House, Alberta. For our clients in the Western provinces looking for a great weekend getaway location, we highly recommend visiting the locale … it’s a hidden gem: http://www.theprairiecreekinn.com/

The McCreath Group Market Overview

As formulated from multiple sources including BMO Nesbitt Burns’ Portfolio Advisory Team

The market continues to largely ignore the bearish chorus. From 2008 onwards this remains one of the most despised bull markets (from March 2009 when the TSX bottomed until the end of October 2016, the TSX Composite index is up 95%). Investors aren’t getting much support from the media in determining fact from fiction. Whether you’re watching BNN in Canada or CNBC in the USA, the talking heads are quick to pounce on any sign of negativity and drive a nail into whatever coffin of concern needs sealing: Greece, US politics, Brexit, etc., etc. For example, the election-related market volatility we witnessed in the days leading to the US Presidential election and the days that have followed (and similar to market activity around Brexit) demonstrates the difficulty in predicting the short-term direction of markets. It was costly for those who sold into fear on election night when the Dow Jones Industrial Average futures dropped more than 800 points, only to recover almost 1,100 points by the end of Wednesday, Nov. 9.

Of course a market pullback can happen at any time, but we believe any weakness in the near term will be short lived. It was recently reported that investors globally are holding $50-trillion (USD) in cash. At some point that cash will need to find a home as the purchasing power erodes with inflation. As well, should interest rates rise, money will be pushed out of the bond market as the principle erodes. Some of this money will seek a home in the equity markets.

We believe pullbacks should be used as an opportunity to add to high-quality stocks that pay dividends. Perhaps our clients tire of the rhetoric; we believe your principle investment objective is to build a well-diversified portfolio of investments that pays enough income to replace the income one receives while working.

Among the strategic topics we often discuss with clients, timing the markets remains a constant client fascination. Our beliefs on this subject align with two of the greatest investors in the last 50 years:

-

Peter Lynch: "I can't recall ever once having seen the name of a market timer on Forbes' annual list of the richest people in the world. If it were truly possible to predict corrections, you'd think somebody would have made billions by doing it."

-

Warren Buffet: "People that think they can predict the short-term movement of the stock market — or listen to other people who talk about (timing the market) — they are making a big mistake."

In late October, Bloomberg News highlighted market timing, noting that missing the last leg of a long-term advance is one of the costlier mistakes in investing. An ill-timed decision to get out early is generally a bigger mistake than hanging on through a marketing bottoming.

Trying to time market cycles increases the number of investment decisions. The three decisions any investor must make are to buy, sell, or hold. If you time an exit at the top of the market correctly, you now have an additional decision to make of when to buy back and more decisions increases the probability of making a mistake that will impact portfolio returns. Studies have shown that the most consistent performance comes from investing savings on a recurring basis regardless of what the market is doing.

Here’s how BMO’s portfolio advisory team approaches the topic of timing markets: Some investors often try to time the market. However, the problem with this strategy is that if they mistime their entries and exits, market timers may miss out on significant opportunities for portfolio appreciation.

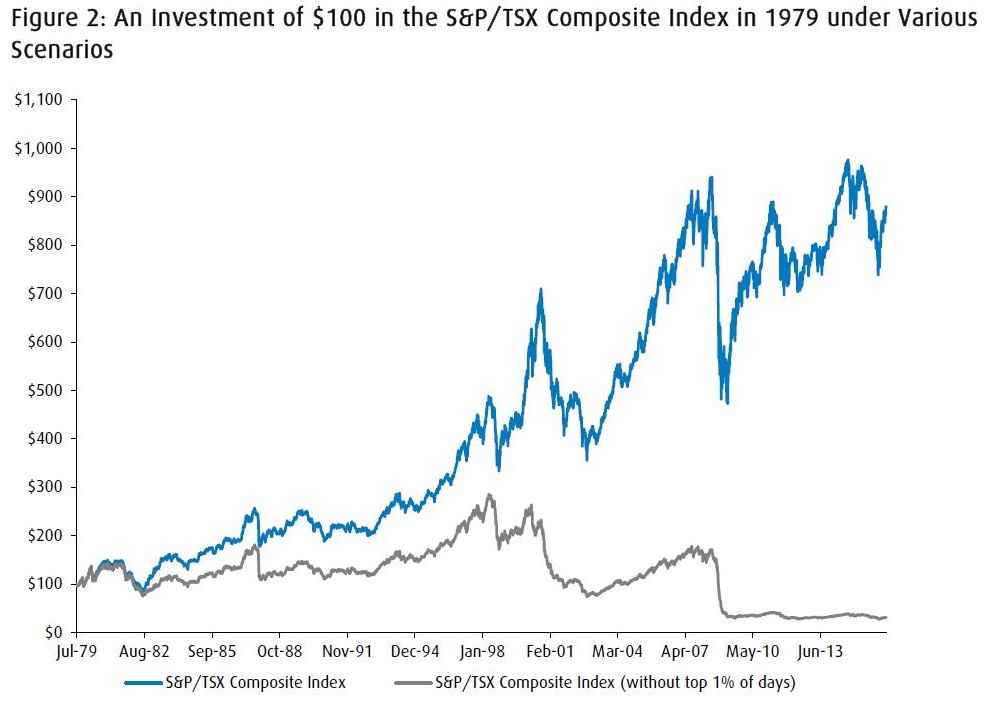

The chart below shows how an investor performs if they miss out on investing in the best one percent of days (since 1979) in the S&P/TSX Composite Index. Clearly, that investor would underperform the benchmark if they accidentally stay on the sidelines for the best one percent of days. Whereas, a permanent investment of $100 would have turned into almost $900 by 2016 (excluding dividends). The market timer who misses out on the top one percent of days will find that their portfolio has deteriorated and is only worth $30 by the end of 2016.

BMO Wealth Institute: Saving for retirement – One size does not fit all

When it comes to retirement savings, theories, assumptions, and rules of thumb abound. How much money you will need really depends on your personal circumstances and the kind of retirement lifestyle you want. There is no one-size-fits-all solution and common retirement savings theories should be carefully reviewed.

Once you know what you are saving for, there are two key components to a successful retirement:

-

Save diligently - despite all your expected and unexpected expenses, saving diligently can really add up in the end

-

Review your plan often - Both your circumstances and your view of an ideal retirement can change, which will affect how much you will need. Your plan should be adjusted accordingly.

Canadians are living longer. Five- to ten-year retirements experienced by previous generations are a thing of the past. Now your savings might have to last 25 to 30 years. In addition, the cost of long-term care, should it become necessary, can have a major impact on your retirement savings especially since government subsidies do not cover 100 per cent of the costs.

A full version of the report is available at: https://www.bmo.com/pdf/mf/prospectus/en/Saving_for_Retirement_E_final.pdf

Interesting articles and books we’ve recently read

-

The Imperial Oil CEO discussed the future of energy at the company’s investor day in September … one in six people globally don’t have access to electricity and even as renewable energy’s share expands, demand for oil and gas will continue to grow … http://business.financialpost.com/news/energy/imperial-oil-predicts-demand?__lsa=6237-daa1

-

The perils of teaching certainty by Seth Godin … “We've trained people to be certain for years, and then launch them into a culture and an economy where relying on certainty does us almost no good at all.” … http://sethgodin.typepad.com/seths_blog/2016/09/teaching-certainty.html

-

Applying the founders mentality from Harvard Business review podcast … Right now, barely one in 10 companies in the world achieve even a modest level of growth. 80-85% of business fail as a result of one of these three issues: crisis of overload, stall out and business obsolescence … https://hbr.org/ideacast/2016/06/getting-growth-back-at-your-company.html

-

Fully Invested by famed Calgary portfolio manager David Bissett. The book doesn’t appear on book Web sites such as Amazon, but it can be bought at the Indigo Spirit in Calgary’s Core Shopping Centre. It is worth tracking down for anyone wishing to extend their investment knowledge.

Thank you for being clients ... and please contact us any time with questions, concerns or feedback ... The McCreath Group … (403) 261-9552