The Differences Between Interest, Dividends and Capital Gains

Scott Kok - Jan 13, 2026

A brief intro to the difference between Interest, Dividends & Capital Gains.

Here's brief intro to the difference between Interest, Dividends & Capital Gains.

While investments should not be chosen specifically based on taxes alone, understanding how various forms of investment income is taxed plays a vital role in ones investment portfolio.

There are three basic types of investment income.

- Interest

- Dividends

- Capital Gains

Interest

- Can be received from various types of investments such as Saving Accounts, Guaranteed Income Certificates (GIC's), Bonds and Real Estate Investment Trusts (REITS) to name a few.

- Taxed at your marginal (highest) tax rate

- You will receive a T5 Statement of Investment Income at tax time

Example: Joe invested in a GIC which that and he earned $10,000 of interest income in his taxable account. His marginal tax rate is currently 30% which will result in him owing $3,000 back in taxes.

Tax Calculation:

Interest income multiplied by his marginal tax rate

$10,000 x 30% = $3,000.00

Capital Gains

- The profit realized when disposing of an asset such as a stock, bond, real estate and other investment at a higher price than your Adjusted Cost Base (ACB).

- As of 2026, only 50% of personal capital gains are taxable (the "inclusion rate" is 50%)

- Taxed at your marginal tax rate

- You will receive a T5008 Statement of Securities Transactions at tax time (most commonly for stocks/ETFs in non-registered accounts)

Example: Joe invested in a stock that he originally purchased for $10,000 which then grew to a value of $20,000. He decided to sell that stock for $20,000. Joe has a Capital Gain of $10,000 of which only 50% is taxable and the other 50% is tax free. His Marginal tax rate is currently 30% which will result in him owing $1,500 back in taxes.

Tax Calculation:

Half of the capital gain multiplied by his marginal tax rate

$5,000 x 30% = $1,500.00

Dividends

- Most commonly received when owning shares of a publicly traded corporation. Some companies will pay their shareholders a part of a company's earnings in the form of a dividend.

- Dividends are either Eligible or Non-Eligible (Non-Eligible are most commonly paid by Canadian small businesses / CCPCs)

- Taxed at your marginal tax rate, but dividend tax credits (federal + provincial) are available to help offset tax

- You will receive a T5 Statement of Investment Income at tax time

Example: Joe resides in Manitoba and invested in the stock of a company that paid him $10,000 in eligible Canadian dividends in his taxable account. His Marginal tax rate is currently 30%.

Tax Calculation (Eligible Dividend Example):

Gross up the dividend of $10,000 * 1.38 = 13,800.00 taxable dividend

$13,800 * 30% = $4,140.00 in tax

Federal Dividend Tax Credit (on taxable eligible dividends) ≈ $13,800 x 15.02% = $2,072.76

Manitoba Dividend Tax Credit (on taxable eligible dividends) = $13,800 x 8% = $1,104.00

$4,140 - $2,072.76 - $1,104 = $963.24

Quick note: The exact outcome can vary depending on income level and credits available, but the “why” stays the same: dividends get a gross-up and credits, which can reduce the effective tax rate versus interest.

To Summarize

- $10,000 in Interest = $3,000 taxes for Joe

- $10,000 in Capital Gains = $1,500 taxes for Joe

- $10,000 in Eligible Dividends = $963 taxes for Joe

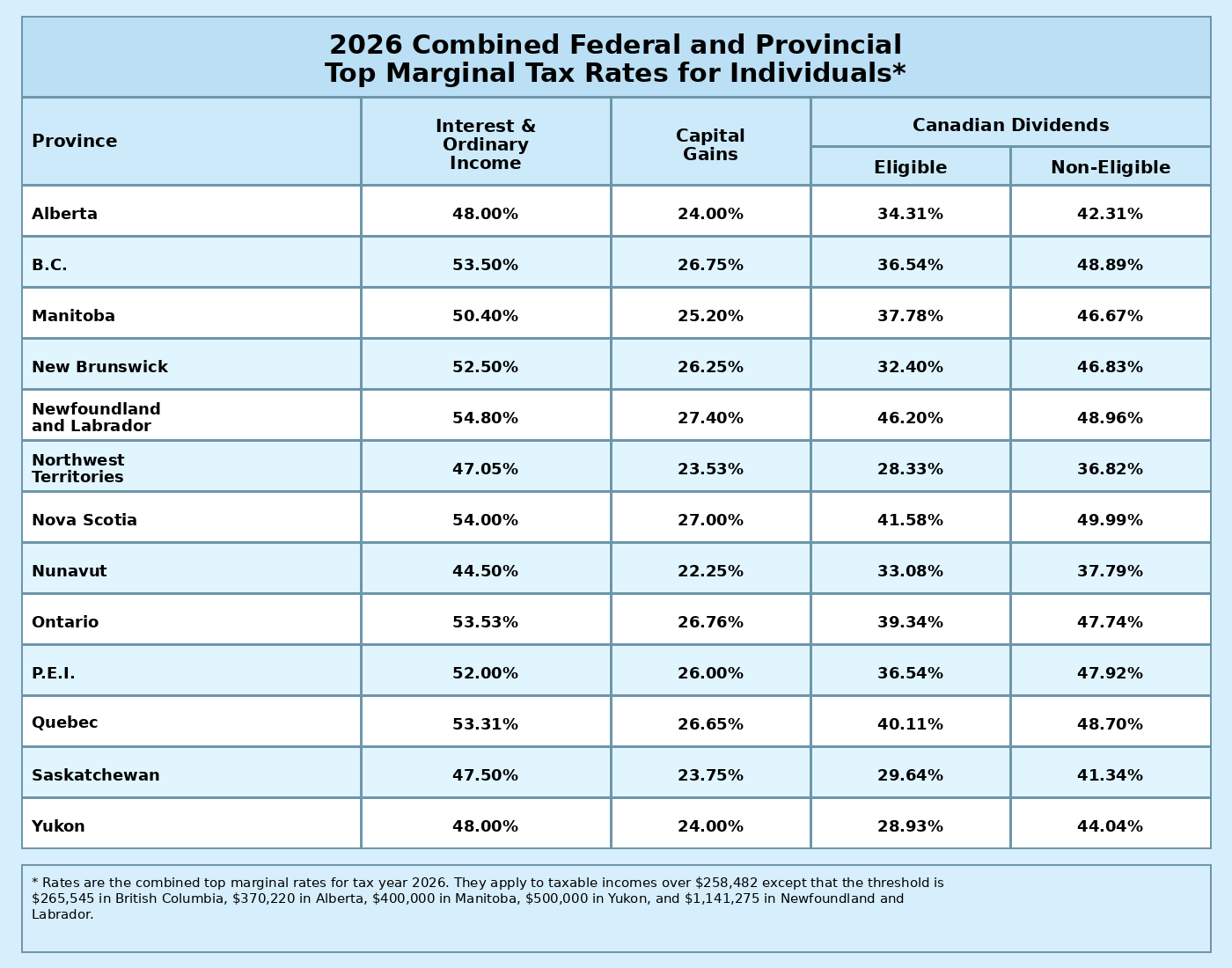

2026 Top Marginal Tax Rates (by Province/Territory)

The table below shows how Interest, Capital Gains, and Canadian Dividends are taxed by Province/Territory at the highest marginal tax rate (combined federal + provincial/territorial rates).

(Reminder: these are “top bracket” rates — most people pay lower effective rates.)

2026 Outlook (What to Watch)

A couple of potential changes could matter a lot, depending on your situation:

1) Capital gains inclusion rate (proposed for 2026)

There’s a federal proposal to increase the capital gains inclusion rate from 50% to 66.67% on annual capital gains above $250,000 (individuals), starting January 1, 2026. If this goes through, larger one-time gains (selling a cottage, big stock sale, business sale, etc.) could be taxed more heavily.

2) Federal “bottom bracket” tax cut (2026 and onward)

Legislation has been introduced to reduce the lowest federal personal income tax rate to 14% for 2026+ (it’s effectively 14.5% for 2025 due to the mid-year change). This won’t change the top marginal bracket directly, but it can slightly affect people who are mostly in lower tax brackets and the value of certain credits.

3) Entrepreneurs / small business owners

There are also measures tied to entrepreneurship and exemptions (like the Lifetime Capital Gains Exemption and the proposed Entrepreneurs’ Incentive). If you’re in that camp, it’s worth planning early — timing can matter.

If you're looking for a financial advisor I'd love to work with you and help you meet your goals. I'm always open to chatting and you can book a call with me by clicking the link below.

Scott Kok, PFP®

More information can be found in this article. How Investment Income is Taxed

*Information is for general information purposes only

*Calculations based off of investments in Manitoba, Canada