January started the year off nicely in positive territory but not without the continued volatility – similar to what we saw in 2022. Both stock and bond markets are up, and all of our signals are flashing Green Zone. Therefore, we are fully invested in various Exchange Trade Funds; which like mutual funds, are more broadly diversified to minimize individual security risks. We are currently holding ETFs (rather than individual stocks)because market and economic risks, though moderated, are still prevalent.

However, based upon our short term “Price Action” charts, or Footsteps, the higher probability is that markets will continue to move higher and with that, see us begin to drill down into the stronger sectors and or individual stocks as greater opportunities present.

The Fundamentals have changed:

Inflation is still high but particularly in the U.S., it has moderated in the past few months. With that, the likelihood that although interest rates will continue to rise, they will do so at a lesser increments. We expect another quarter point at the next central bank meetings in both U.S. and Canada, but further increases will be more data dependent. And then we could soon see central banks move to the sidelines. Many economic analysts are expecting rates to decline again late this year or early next year. Growth stocks in particular have recently been reacting positively as the prospect of their costs of doing business stabilize or even decline.

Second, the Chinese government has reversed course on covid crackdowns, announcing the re-opening of its economy accompanied by new, arguably modest, razor-focused spending initiatives. The weather in China and elsewhere has been warmer than expected and thus, a reduced rise of covid. That allows for a greater potential for growth and reduced supply line issues.

Inflation, as stated has moderated (or at least stopped increasing). In particular, Oil prices have dropped from their highs and more importantly, Natural Gas prices have plunged. This has seen bond yields (interest rates) to flatten out, giving stocks the opportunity to rally.

All these factors have also been quite positive for the global economy and particularly for the beleaguered Eurozone, which had been economically well into recession and hardest hit during the pandemic and most of last year.

On the downside, inflation though flattening, is still high. And the Fed can still err in raising rates and reducing the stimulus too much or too fast. If it has not done so already. If that is the case, we could still see a “hard landing” recession. Most analysts, so far agree, that it is more likely to be a soft landing.

Future rate increases are partly dependant on the Labour market – and it may be tight and still causing concerns, but the numbers are expected to improve. Artificial intelligence and automation may also help to relieve some of the labour issues in the long term but are not set to disrupt in the near future.

Further on the downside, the Russian invasion of Ukraine is of course still tragically raging, and no immediate end is in sight. Though the west has dramatically increased its support of Ukraine in hopes of pushing it to some sort of end. China too is expressing their concerns to Russia. And on China, they continue to raise concerns in the south seas, but they still rely on the west as their market and are being cautious with their rhetoric and activity.

These negative factors remain of consideration not so much for downside, but more so due to the fact they cause uncertainty which leads to confusion and volatility. But as we have stated in the past, markets look ahead twelve to eighteen months and see the “light at the end of the tunnel” and react well ahead of the actual improvements in the economy.

The Technicals have changed:

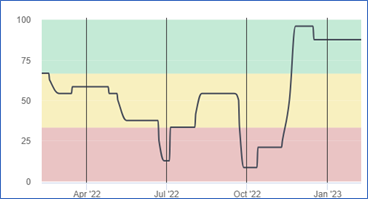

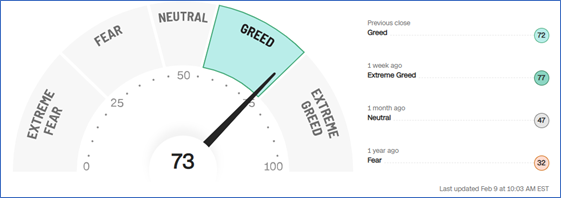

From a technical point of view, our mid to longer term Equity Action Call moved into the Green Zone in December. Investor sentiment has also improved as can bee seen by the CNN Fear and Greed Index.

We did mention last month however the mid-longer term signals can be slow to react. We therefore now put more emphasis on the shorter term signals of Price Action or “Footsteps”. Below are the charts we look at each day (and during the day). Each of the red and green bars represents all the trades in a day. Without getting too technical, the point to note is that the long term red channel down has been broken - to the upside (last small green channel up) - and looks to be holding. Therefore, the good news is that the downtrend looks to be over and should it hold, barring any major negative catalysts, the greater probability is a return to the topside.

In the very, very, short term, we have seen a run from the recent lows of January and markets may take a sideways move or short pullback before starting the next leg up. As that happens, we expect to put any remaining and new cash to work.

Bottom Line:

The economic situation and market trends have all improved. And although we cannot predict the future, we can, and do trade on the probabilities. The higher probability now is that the stock markets have seen their lows, that the bottom is likely in. The downtrend of 2022 has now reversed and going forward the expected move is for the markets to return to the upside. Our mid-longer term indicators are all in the Green Zone signalling farther out, that the potential is positive.

We are still cautious given uncertainties and still elevated volatility levels. We are however closely watching our short term signals which are also in the Green Zone. We are expecting some small potential movements sideways to down, but to be short-lived. Generally, those short term trends are also positive. Should we see some negative catalyst, and markets instead breakdown, we are ready and prepared to move to the sidelines and safety once again.

Should you have any questions or concerns for your portfolio, please contact us. We are pleased to meet online or in office at your convenience.

Best regards,

John and Megan