Our current investment strategy and analysis of opportunity focus on the following factors:

Equity Selection

Philosophy

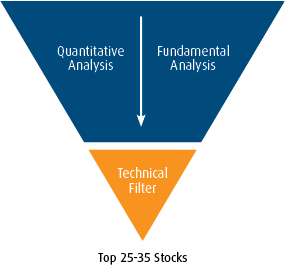

Our stock selection process starts by focusing on industries most favored in the current economic cycle based on our macroeconomic analysis. We look at businesses with high barriers of entry that have competitive advantages while focusing on dividend value oriented stocks. This has proven to provide long term risk adjusted returns.

Fixed Income Selection

Philosophy

We select our fixed income based on up-to-date positive macroeconomic outlooks; we watch key variables such as interest rates, earnings/economic growth and inflation expectations. Based on our analysis we determine target duration, term structure and sector allocation.

Third Party Managers

We select third party managers Exchange Traded Funds, Mutual Funds and outside Portfolio Managers (Architect) to access segments of the market where we see added benefit to our portfolio returns. We monitor each mangers performance to ensure they are meeting their objectives and providing value to our clients.