Specialized financial strategies for healthcare professionals

Financial health

Our team specializes in advising physicians, dentists, specialists, residents and other healthcare providers at every stage of their medical careers. With long hours, busy schedules and the other extreme demands of your profession, you need even your most complex financial affairs to be as streamlined and simplified as possible.

We offer experienced, integrated wealth management advice to help you pay down debt, maximize your income stream, plan wisely for retirement, and enjoy the wealth you’ve worked hard to achieve. Our services include tax-efficient strategies, asset allocation and asset location strategies, and medical professional incorporation advice.

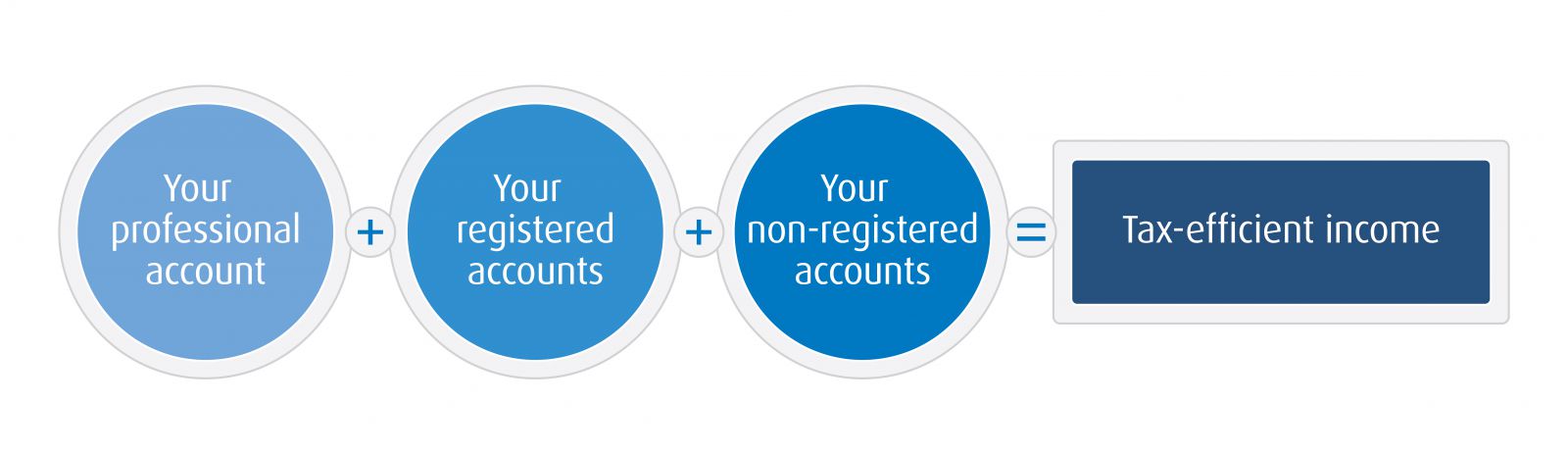

The first question we will ask is, “Have you created a tax-efficient asset allocation that encompasses both your personal and Medical Professional Account?” Since physicians and dentists can be paid to a corporation rather than earning directly, we will use your Medical Professional Corporation (MPC) or Dentistry Professional Corporation (DPC) to minimize tax and then invest your retained earnings with expertise according to your goals.

Insurance solutions

As a healthcare practitioner, you and your ability to care for patients are the essence of your practice, so disability and critical illness are important for income protection in case life throws you an unexpected curve. Our team will collaborate with insurance specialists to ensure you have the right insurance planning for risk assessment and risk management. We also use life insurance as a very tax-efficient estate planning tool and cost-effective investment strategy.

Reducing stress

Physicians have never faced so much stress and burnout than they do today. Knowing that you and your loved ones are covered financially can help with your overall wellness and mental health. We will put a solid plan in place and execute on it reliably, integrating all the moving parts.

In addition, our Private Bankers’ tailored services save you time by taking financial details off your shoulders and their customized lending and deposit strategies can help to reduce stress.

The result? You can focus on practicing medicine and spend more time doing what you value most.

Incorporating your medical practice

Advising you according to the College of Physicians and Surgeons’ regulations and working with BMO Financial Group specialists, we can help you to incorporate your practice to maximize your wealth and minimize taxes in context of all your wealth management needs.

Here’s how it works:

-

By incorporating, you create a Medicine Professional Corporation (MPC) that owns your practice.

-

You own shares in this corporation and pay yourself a salary, bonuses and dividends.

-

Your accountant and bookkeeper manage the revenue, expenses, assets, and debts, which are all held separately from your own personal assets.

Benefits of incorporating:

-

More of what you earn stays in your own pocket, so you have more to invest in your portfolio and medical practice.

-

Corporate tax rates are much lower than personal tax rates, both federally and provincially. In Ontario, earnings retained in the corporation are taxed at a combined rate of about 12.2% for a small business under $500,000 while personal income over $220,000 is taxed at a combned federal and provincial rate of 53.53%.1

-

When it’s time to divest your practice, we can help you maximize its after-tax sale value by liaising with leading practice appraisal experts and succession planners.

1Figures as at Month Year.