2024 Winter Newsletter

Fortin Wealth Advisory Group - Feb 28, 2024

How we’re evolving to serve you best.

~ a personal note from Christine.

I’ve always considered exceptional client service a non-negotiable. Meeting (with the goal of exceeding) your needs is part of the reason I’ve had the privilege of working with many of you for almost 25 years.

Continuous improvement is a necessary part of that goal—excellence isn’t a product of complacency. To that end, I’ve been working on building a black belt core team for quite some time. Now, I can confidently say, “we’ve got it.”

And that means more than having the right people on board for the long term. Ryan, Jordan and I have spent a year thoughtfully evaluating our individual skills and passions, and discussing how we can align these with our roles and responsibilities to optimize our collective output. Put another way: we took the necessary time to figure out how to make the whole greater than the sum of its parts.

The result? A robust, expeditious, and effective service model for our clients.

Clear communication continues to be a part of that, so I’m sharing what this evolution looks like in practical terms. Here’s how each of us contribute to your success, both behind the scenes and working with you directly:

Christine: your value-driving, solution-finding, big-picture guide.

Behind the scenes:

I am profoundly involved in portfolio management, as I’ve always been, looking for new ways to drive value within the context of our unwavering guiding principles: we are goals-focused and planning-driven, not reactionary. I meet with peer groups to see how we can implement that philosophy better, ensuring we’re consistently staying ahead of the curve. I also spend a great deal of time on non-portfolio aspects, from advocating at the firm level for an improved BMO Private Wealth client experience, to strategizing on your behalf with your tax and estate specialists, whether they are part of our extended team or your external professionals.

Working with you directly:

When those specialist discussions prompt substantial or strategic change, I will be there to communicate and clarify the ‘what’ and the ‘why’ (we’ll just take care of the ‘how’). And I’ll be there for every other ‘big picture’ moment, from laying the groundwork with respect to aspirational goals, to managing major disruptions to your established roadmap. Whether you’re moving, selling a business, acquiring a business, or having some challenges within the family, you'll have ready access to the full depth of my experience. These discussions are often time sensitive; we’re now structured to enable me to be available when I’m needed, to navigate through the options, have the tough conversations, and quarterback the best solutions.

Ryan: your plan-perfecting, detail-oriented, day-to-day steward.

Behind the scenes:

I am extraordinarily fortunate that Ryan has over 15 years of experience serving clients with complex, generational wealth. It’s more than many lead advisors have—and he adds to this with his lived experience as part of the next generation of a successful entrepreneurial family. Here’s what that looks like in practice, combined with his passions and skillset: he stays in tune with the minutiae of cash management for tax purposes, is ahead of the curve on utilizing day-to-day strategies to eke out every opportunity, and has elevated insights when modelling scenarios in your financial roadmap.

Working with you directly:

While Ryan and I jointly decide on portfolio changes, with his expertise acquired while a Director of High Net Worth Planning at BMO Private Wealth, he offers unparalleled capability in preparing the detailed information you see in reviews, and walking you through the specifics of implementation in the meeting. When things are ‘steady as she goes,’ know that he’s the steward keeping things up-to-date and steady—and your best source of knowledge for account-specific queries.

Jordan: your efficiency-focused, action-oriented, client / team bridge.

Behind the scenes:

Jordan is critical to keeping the machine running efficiently. He liaises with our internal specialists and your external advisors, consolidates and analyzes the information, and prepares it for Ryan and myself to review. He is responsible for implementation after meetings, ensuring all resulting action items get diarized to the right team member. When needed, he’ll step in to assist our service team on administrative items, and act as our unofficial tech support.

Working with you directly:

Jordan’s presence in your meetings allows him to fully understands the nuances of the discussion, and efficiently and effectively translate that into what needs to be completed by our team post-review. It also enables him to quickly address your concerns and requests. Our youngest team member, he’s passionate about sharing knowledge that’s useful and interesting to his fellow Gen Zers (be sure to check out Jordan’s Corner in this newsletter—it can actually be useful to just about everyone).

As the evolution of our service model is put into practice, we understand there may be concerns about how things are changing. Change of any kind can feel uncomfortable and unwelcome. We encourage your open and honest feedback, and I offer you my assurance: I would never consider any change if I did not truly feel it was to the benefit of our clients.

If you have any questions about how this will affect you specifically, please reach out.

FAMILY DYNAMICS

Submitted by CF

I was asked the other day what my biggest challenge on a daily basis is. The person asking didn’t really know about my institutional money management background and they were expecting me to comment about a market or investing challenge.

I piped up “my biggest challenge is also my most wonderful rewards. It is my raison d’etre.” I went on to say that my biggest challenge is that there is no one size fits all. That is to say that each discussion with each family is completely unique despite similarities with their “on paper” profile. Each family has a different view towards money, how they would like the next generation to steward the family wealth, what they choose to spend money on, how they want to grow the family’s financial footprint. AND the personalities! The challenge is to be able to incorporate each family member’s vision into a concise roadmap that addresses the whole as well as each family member’s unique perspective.

Our clients have the privilege of insight into what other wealthy families are doing, because we are exclusive in who we work with. However, that doesn’t mean that the *application* will be the same.

The flipside, this is also my greatest reward. Who else gets to talk to some of the smartest business owners and family businesses and heads of families daily? Learning about industries outside of my own, gaining appreciation into how well they know their trade, their passions, and the torch that they wish to carry on. I adore when families aren’t necessarily aligned in their approach towards their wealth, and I have the honour of facilitating those discussions to bring everyone together towards a common goal.

Sadly, most often, these families have not had a quarterback to help navigate all of the choices but that is the reward for me to “tie the bow on it” so to speak.

One of the items that comes up time and again are the importance of family meetings. In chatting with one of our Family Office team members, Shelley Forsythe, she mentioned that "Family meetings are an important part of the family governance process. They act as the forum for discussions, sharing of information, learning and education, and decision making. The goal of family meetings is to build communication, trust, and connectivity in the family, through a framework of goals, structure, and engagement. Ultimately, they can assist with guiding family unity, and the successful stewardship of wealth."

So the rest of this article is devoted to the 101 on Family Meetings.

Why are Family Meetings Important?

Family meetings offer an opportunity to discuss important topics that will affect one or more family members, and to share expertise or knowledge across a range of topics, including planning, legacy, individual and collective family objectives, as well as aspirations. Some families develop Family Values and Vision Statements during this time together, examining beliefs about life and family, and where they stand on issues common to all. Both younger and older generations can add valuable insight to these discussions.

It is also an effective forum for family members to support one another if individuals are experiencing a stressful situation or facing a challenge which they do not have the expertise to deal with. Though many families avoid sensitive topics in front of each other, family meetings can allow for training on how to develop skills and comfort at navigating difficult conversations. This happens over a period of time but can tackle many issues before they become entrenched.

How to Conduct Family Meetings

Logistics may seem like the obvious; however, items such as agendas, frequency, location, and family member roles should be given due consideration to ensure everyone is comfortable and should be outlined at the outset of family meetings. Additional formality would include adding categories for agenda items to differentiate what topics are for discussion, for information, for decisions or for learning. This ensures family members know what to expect in advance of the meeting.

When forming family meeting agendas, consideration should be given to the following:

- Inclusive – include every member of the family where appropriate

- Transparent – disclose relevant materials, facts, figures

- Timely – deal with essential topics at hand today

- Actionable – offer some practical takeaways to help drive progress

- Reflective – offer an opportunity to think, review and reform

It is important that formality does not take away from the value of the meeting. Family members should look forward to these gatherings because they are productive and fun. Dr. Lee Hausner, Senior Managing Director, First Foundation Advisors, states that, “Productive and structured family meetings that support family unity are common among ‘Legacy Families’ who have survived through four generations.”

Meeting structures and processes should grow and evolve with the family, ensuring that communication and relationships are of paramount importance. Ongoing forums for meetings can assist families with critical connections and bonding.

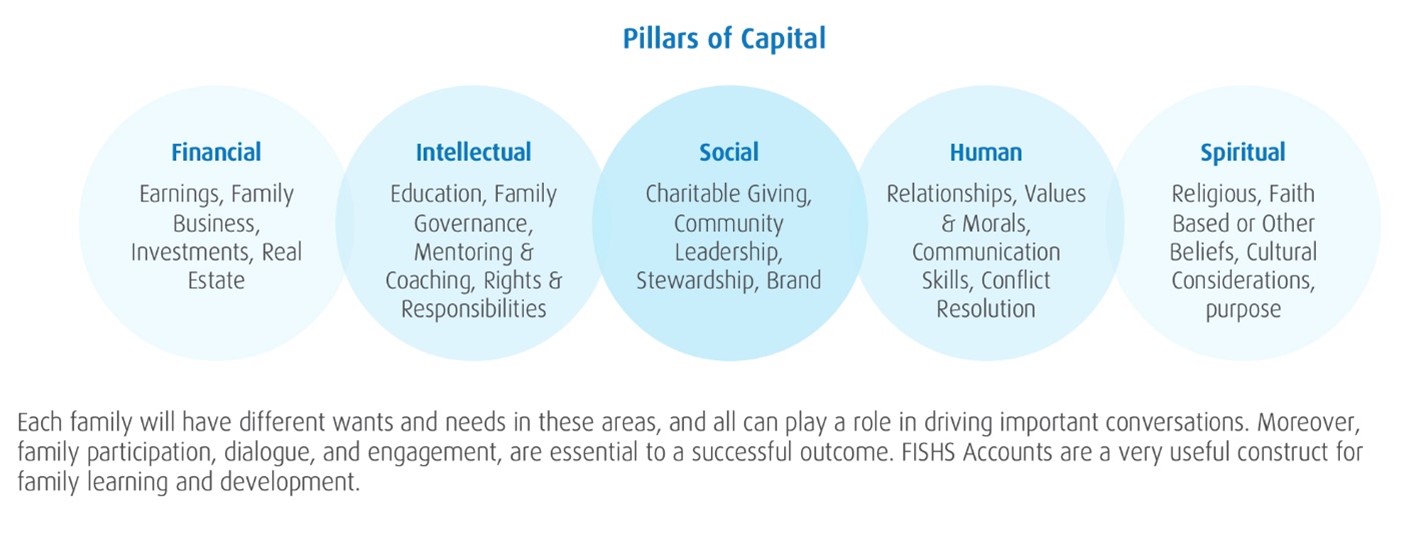

The Pillars of Capital (FISHS Accounts)

When attempting to steward multi-generational wealth successfully, family meetings can focus on both the tangible (financial), and intangible (non-financial), pillars of capital. The primary focus of family discussions is usually centred around financial capital, however, the qualitative, non-financial capital, such as intellectual, social, human, and spiritual, are rarely discussed or solved for, and can impact the chances of success for the family. When you have a family enterprise, each of these FISHS Accounts must be considered as they are highly correlated to one another.

Source: Family Meetings: Step one of family governance - BMO Private Wealth

Four Cornerstones of Family Meetings

Four cornerstones for consideration at family meetings are family enterprise, learning, cohesiveness, and fun. The below chart represents the four cornerstones framework of goals and broad topic areas for the FISHS Accounts. A good rule of thumb is to ensure family meeting agendas are balanced to spend approximately 1/4 of your time in each area, while considering content (the WHAT – sharing and conveying information), and the process of family meetings (the HOW – interaction and exploration).

The Role of the Family Council

Within larger families, it is often helpful to establish a governing body called a family council that acts on behalf of the larger family (the family assembly). This does not include every member of the family, or everyone who would attend the family meeting. However, instead, it would be comprised of select individuals, representative of each generation or family branch, who can take a leadership role in helping to organize family meetings and provide structure for the development of all family members and policies. It is often the case that the business intertwines with the family, and this requires a careful balance to create guidelines for governance within each of the family, business/enterprise, and ownership. Roles of the family council can include:

- Establishing family member development and education

- Setting collective values, mission, vision, purpose and goals

- Promoting communication and conflict resolution

- Managing philanthropic goals within the family

- Liaising with leadership from other circles (business, ownership)

- Building capabilities for succession and leadership within the family

- Guiding the family constitution or charter

It’s important to be mindful of which “hat” one is wearing when discussing issues at family council meetings. Wearing the appropriate “hat” in each respective family, business or ownership forum is an important consideration, together with understanding where each family (or non-family) member has a voice versus a vote. Being respectful to allow everyone’s perspective to be heard and input acknowledged is critical prior to certain decisions being made that impact family members.

In Conclusion

Each family’s situation is unique however, there are common themes which many families encounter. Careful planning, and establishing the appropriate governance framework, is a good starting point to keep the family connected, and family meetings can play that critical role in establishing a communication process within the family enterprise. They are also an effective forum to share ideas, strategize, reflect, and create progress. Although this article concentrated on the family circle, governance integration and coordination of the interdependent circles of the business/enterprise and ownership is recommended, along with guidance of the family’s advisors.

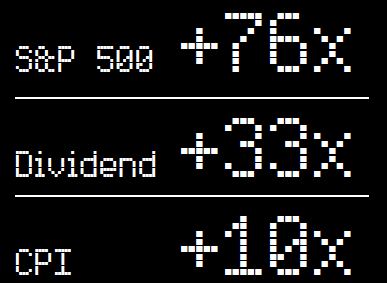

The Sixty-Two Year Scorecard

Each year at this time, we consider the performance of the mainstream equity market—absolutely, and relative to consumer inflation—after all, the purpose of our investable assets are to drive cash flow faster than inflation allowing us to have increasing lifestyle expense coverage OR re-invest at an increasingly higher rate, depending on where we are in our lifetime.

People turning 62 in 2024 were born in 1962—the year the Beatles auditioned for Decca Records and were rejected, John Glenn became the first American to orbit the earth, Marilyn Monroe died, the New York Yankees won the World Series for the twentieth time, and—in the Cuban Missile Crisis—the world came closer to thermonuclear oblivion than at any time before or since.

So we ask three questions:

• Where did the S&P 500 close out the year just past, relative to where it ended in 1962?

• Critically important to our clients on the cusp of retirement: how much did the Index pay in cash dividends last year versus 1962?

• And how did both price performance and the trend of dividend payments compare to consumer inflation—which, in a two-person, three-decade retirement, will be what matters most.

And the answers:

• The S&P 500 closed out 1962 at 63. It ended this past year

at 4,7701.

• The cash dividend paid out during 1962 was $2.15. Last year

it was $70.301.

• The Consumer Price Index ended 1962 at 30. It closed out

2023 at 3072.

Thus the 62-year scorecard, in round numbers:

Source: Nick Murray Interactive

So really, if inflation is up 10x. And cash flow is up 33x. AND the value of the underlying asset is up 76X, is there any further discussion required?

Inflation has not been an issue for our clients in the last two years as the increase in cash flow being created from their portfolio has crushed inflation.

There are certainly ebbs and flows as there is in any asset. And, for our Vancouver real estate investors, the growth of the last decade has been mind numbing. And, the increase in cash flow has not caught up. So, it is no wonder that most families have a balance in real estate, private markets and public markets to ensure they are hitting their own personal efficient frontier in investing.

Sources:

- pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/spearn.htm

- Statistics Canada- CPI Index

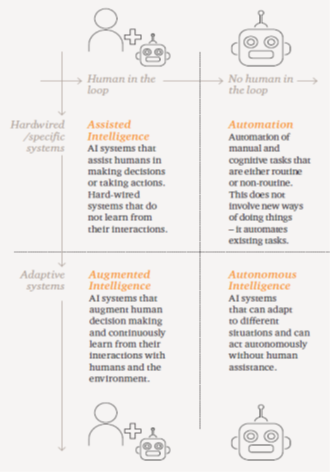

Artificial Intelligence is Here, But what is it?

Ryan’s corner

AI can mean many things and as we see it today, it’s simply the simulation of human intelligence by machines. While the term and use of artificial intelligence has been around for over 50 years we have reached a point in which the access to big data, high power computing and advances in algorithms have all made it possible and economically feasible to utilize AI in day to day business.

AI is a new canvas in the world of technology as it differs from traditional software programs in that it can extract knowledge from data and learn without having to be manually programmed to do so. In a recent interview with Nvidia CEO Jensen Huang he states that “AI and deep learning is not a hardware or chip program, it’s a reinvention of computing problem”. We are still in the early stages of this innovation as majority of hardware, software needs to be reinvented and retooled in order to efficiently utilize the capabilities of AI.

Source: PWC

AI and the Economy

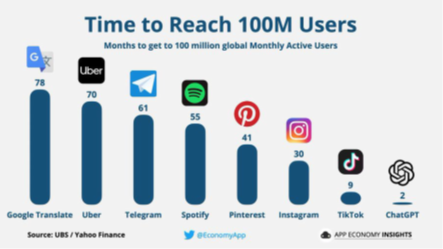

Studies conducted by Bloomberg and Zion Market Research in 2021 had estimated that the AI market size was valued in the neighbourhood of $59.67 billion and projected to grow at a compound annual growth rate of 42% to $422.37 billion by 2028 and 1.3T by 20321

A report conducted by PWC states that the value added by the addition of AI is projected to increase the global GDP by $15.7 trillion in 2030. $6.6 trillion of that is estimated to come from increase in productivity and $9.15 trillion from increase In consumer consumption.2 As see in the infographic below there Is demand for new technologies and the rate add which we adopt these new technologies continues to get faster and will continue to as we begin to deploy more AI integrated technologies such as ChatGPT2.

Source: UBS/Yahoo Finance

AI and Creating Value

BMO Wealth Management recently conducted a study and summarized areas AI can create value for business:

- Cost Reduction: Applying AI and intelligent automation solutions to automate relatively low value and repetitive tasks can reduce costs through improved efficiency and quality. For example, automating data entry an d patient appointment scheduling using natural language processing.

- Speed to Execution: Reducing the time required to achieve operational and business functions by minimizing latency. For example, expediting the process of drug approval by using predictive insights to create a synthetic trial.

- Reduced Complexity: Leveraging analytics to improve understanding and decision making through pattern recognition in increasingly complex sources. For example, reducing factory downtime by predicting machinery maintenance needs.

- Transformed Engagement: Changing the way customers interact with technology can enable businesses to better understand the demands of the market – increasing their market share relative to competitors. For example, using conversational bots that can understand and respond to customer sentiment.

- Fueled Innovation: Redefining where to play and how to win by using AI to enable innovative new products, markets, and business models. For example, recommending new products, services, and features based on customer needs and preferences.

- Fortified Trust: Securing a business from risks such as fraud and cyberattacks can improve the quality of the business while enabling greater transparency to enhance brand trust. For example, identifying and anticipating cyberattacks before they occur.

3 Source: BMO Wealth Management – Artificial intelligence primer

Sources:

2 PWC – Report: Sizing the prize What’s the real value of AI for your business and how can you capitalise?

3 BMO Wealth Management – Artificial intelligence primer

Financial Literacy for the Next Gen

– by Jordan

In the last newsletter I had the opportunity to write about the one of the most powerful accounts that Canadians are allowed to hold, the TFSA. This month I thought it would be fitting to touch on the Registered Retirement Savings Plan, or RRSP for short.

These accounts are savings accounts that are meant to be contributed to over your working life. When you decide to retire or become age 71, this account gets converted into what is known as a Registered Retirement Income Fund or RRIF account that allows you to draw income.

The amount you are allowed to contribute to your RRSP depends on income. As of 2024, you can contribute 18% of your earned income to your RRSP up to a maximum of $31,5601.

Source: How contributions affect your RRSP deduction limit - Canada.ca

So, what are some of the benefits of an RRSP?

- Firstly, it reduces your taxable income for the year in which you contribute to the account, or you can carry this deduction to future years. Meaning if my taxable income was $100,000 this year and I contributed $20,000 to my RRSP you could deduct that $20,000 from your taxable income from the year making it $80,000. Or, you could push that deduction forward to use in a later year.

- Secondly, growth within an RRSP is tax-deferred. This means that any gains that occur within the account are not taxed.

The idea behind an RRSP is that you contribute to the account while you are making a higher tax bracket in order to take income from the account when you are in a lower tax bracket. This doesn’t mean that you can’t withdraw from the account. There are actually a few ways other than turning the account into a RRIF.

- You can deregister funds at any time from an RRSP. The only caveat is that the funds that you withdraw will be added to your taxable income for the year

- Utilizing the RRSP Home Buyer’s Plan is another way you can withdraw from the account. When you decide to purchase or build your first home you can borrow up to $35,000, tax free from your RRSP to help with the down payment. With this plan you must repay the borrowed amount over the next 15 years in equal increments

- The RRSP Lifelong Learning Plan is a plan that allows you to take up to $10,000 from your RRSP in order to pay for your full-time education or training for yourself or your spouse. Like the Home Buyer’s Plan you must pay back the withdraw in equal increments over the next 10 years

The RRSP is a great investment vehicle that has lots of different uses. If you would like to learn more about RRSPs, feel free to reach out to myself or anyone else on the team and we’d be happy to let you know how an RRSP can be best utilized.

Source: Registered Retirement Savings Plan (RRSP) - Canada.ca

Admin UPDATE

Tax- hot and heavy. It's coming, the busiest time of the year for us. Reminder that many slips have a March 31st deadline and thus won’t be produced until after that time. Click Here for a list of slips and dates. All BMO Private Wealth produced tax slips are available through your on-line access (T3s for mutual funds are produced directly by that trust, not by us, so those are separate).

TFSA Contributions. The limit increased this year to $7,000. By now we have reached out to each one of you to facilitate that contribution to ensure that you have it in and working on a tax free basis as early in the year as possible.

Stop the Presses Paper! REMINDER to log into your on-line access every 6 months or paper statements will start back up again. Blame the regulators! But in all seriousness, if you do forget to log in and the paper starts up again. Simply log back in and select electronic delivery.

Robin Esrock's Bucket List

Travel personality and bestselling author Robin Esrock has reported

from over 100 countries on 7 continents. This month he shares his

winter 2023/24 travel inspiration.

Global Dream of the Winter: El Nido, The Philippines

Not so much an island as a chain of 45 limestone jewels, El Nido sits at the north of the province of Palawan, the largest island in the island nation known as the Philippines. This spectacular region inspired the movie and book “The Beach” even though both were set in Thailand. With crystal water, white beaches, water sports and ocean-villa resorts, El Nido is a less flashy but culturally more interesting (and more affordable) paradise. Best time to visit is January to April in the dry and sunny months.

Source: Robin Esrock

Canadian Dream of the Winter: New Years at Sun Peaks

Sun Peaks, the second largest ski resort in the country, is my perennial favourite destination for champagne powder, family-friendly ski escapes. On New Year’s Eve, sign-up for the torch-light descent of the slopes led by Olympic downhill legend Nancy Greene. Skiing in glowing formation under the stars, kicking off an early evening fireworks display, is just magical to witness or be a part of. With its vast terrain and a homely village, the rest of Sun Peaks is great too.

Source: Robin Esrock

The Cold Truth About the Northern Lights

Seeing the aurora sits on many a bucket list, but know what you’re getting yourself into. There’s just no guarantee the lights will pop, or what kind of spectacle you’re in for. Viewing typically takes places after midnight, when you’re tired and it’s absolutely freezing. Both Whitehorse and Yellowknife are ideally located under the Aurora Oval, but it’s always a risk if you’re only visiting to see the lights. Stack the odds in your favour by consulting the aurora forecast and long-term weather forecast, avoiding full moons, and resting up during the day. As usual, lowering expectations is the best technique to be pleasantly surprised.

Source: Robin Esrock

Pro Tips:

Is it safe to drink the water? In many parts of the world, this simple question could mean the difference between staying hydrated, and spending way too much in the bathroom. Technology to the rescue! The Lifestraw Go is a niUy water bo]le with a built-in micro-filter that protects you from 99.999% of all bacteria, parasites, microplastics and dirt, reducing chlorine, improving the taste, with a filter good for up to 4000 litres. No ma]er where you go, fill up your bo]le from a tap, stream or lake, and voila, it’s always safe to drink the water.

Let’s Go:

In fall 2024, I’m hosting a walking tour with Can Geo Adventures and Exodus Travels in Italy. We’ll explore historic landmarks and classical ruins in Rome and Assisi, then stroll (and eat) our way through Italy's countryside, staying in a lovely four-star resort in the hills of Umbria. Fine wine, chocolate, delicious food, bucket list travel and the chance to leisurely walk it off too. The 8-day trip departs October 19.

Don’t Quote Me:

“Travel is fatal to prejudice, bigotry, and narrow-mindedness.”

Mark Twain

If you have any travel-related questions or inquiries, feel free to email me at

robin@robinesrock.com

HAPPENINGS

As our end of review season event, the team enjoyed an afternoon at the gun range.

Christine’s Christmas eve at her chalet was filled with a day full of hitting the slopes. She was able to snap this picture of the sunset on one of her runs.

Ryan and Amm spent Christmas holidays local with family and hosted a Family dinner for the first time in their new home. Christmas is all about the baby, so they had to make sure to stop by and see Santa for their annual family photo. Things are set to get busy for Ryan and Amm as they are expecting their second child in March. Ryan is focusing on getting his sleep in now as he will be working overtime with Daddy duties.

After a long year of studying Jordan was able to complete the necessary tests to become a Chartered Investment manager. The only remaining item for him to receive the designation is work experience, which should be fulfilled in August this year.