2023 Spring/Summer Newsletter

Fortin Wealth Advisory Group - Jun 15, 2023

A Message from Christine

I am writing this on the back of our busy Spring review season coupled with tax time. As always, we love connecting with each of our clients to review their goals and aspirations, learn of the family updates and ensure that we are delivering our part so that family’s wealth goals are being not only met but exceeded.

We also learn how we can deliver services more in line with what our clients are asking for. Unequivocally, each and every review, clients were asking for FINANCIAL LITERACY for their kids and grandkids. There is a massive gap in our industry whereby there is no education available until you have x dollars to invest. AND, the level of expertise that you receive from a professional is commiserate with their investable assets.

Firstly, as a reminder, a value add of our team in working with clients is that we are always available for wealth counsel for children and grandchildren. We absolutely want to talk to the next two generations at critical points in their life: moving in with a common law partner, buying their first house, obtaining a credit card, buying v. leasing a car. These are all critical parts of someone’s financial life and their approach can craft their view toward money over time.

Secondly, we have a series of financial literacy sessions already curated, such as: Budgeting 101 and Investing 101. Over the summer months, we are building out that library to include items like: what affects your credit rating, how can you use investments to purchase your first home, how should you be investing in your 20s, 30s, etc. We will also be looking to conduct a Summer Financial Camp next year targeting grades 6-12. Lastly, we will make ourselves available on a one-on-one basis for any family who would like their kids to come in this summer and run through our Investing 101 programme. If you would like to participate, email Jordan at: Fortinwealth@bmo.com

Thirdly, we are going to be building out our Next Gen tab on our website to keep short video snippets on various topics in quick 30 second videos. Jordan is working on that through the summer and fall and we will send out an announcement when it is complete. We will also be going into local schools, targeting Grade 6, and offering some of our literacy programmes to provide guidance to kids who don’t have access to a team like ours. If you would like us to come to your school – either in person or via zoom – let us know!

Lastly, we have a new part of our newsletter that is entitled “FINANCIAL LITERACY FOR THE NEXT GEN” These are specific articles submitted by Jordan Goh for you to pass on to the Next gen in your family. Please let us know if there is a specific topic that you would like us to include.

I will wrap up to say that our team is heading out for our end of review season team event – 007 Escape Room. Hopefully we still get along after that! And then I am off to Africa with my family for our summer vacation. So, by the time you receive this email – I will be on the other side of the world! Enjoy your summer and we look forward to connecting again in the fall!

~Christine.

A GIANT RESOUNDING THANK YOU TO OUR CLIENTS!!!

Note: As per tradition, I am forgoing any market related commentary for Spring Summer Newsletter as traditionally we publish our SEMI-ANNUAL LETTER to CLIENTS in January and the summer. I will be sending it out after my return from family vacation in August.

As we head into the summer and as I write this newsletter at the beginning of June, we are thankful for so many elements of our day to day: a team that is respectful to each other and embraces differences, beautiful weather which has already started, the prospects of lovely family dinners outside and time spent enjoying the great outdoors, exciting summer travel adventures, our own health, getting through another tax season (whew!) and a wonderful team focused on a great client experience.

It is the last item that I wanted to send a great big thank you out to all our clients. When we ask you what you would like *more* of from us and what you would like *less* of from us; we truly mean it. We don’t improve our value to your family, without ensuring that we are not just delivering on, but exceeding, your expectations. It isn’t lip service. What you tell us you would like us to improve on, we implement. You see, what defines us as a group, is that we are delivering an exceptional level of wealth management and service that disrupts the status quo.

I am so proud to say that once again our Team has been recognized for Distinguished Client Loyalty, putting us within the top 20 Wealth Professionals in the country from over 2000 teams. It is truly a team-effort, and I can say with confidence that Ryan, Joanna and Jordan all believe in our core values and deserve this recognition for their tireless efforts for clients.

WHO WILL ACT AS YOUR EXECUTOR?

Our client meetings of late all seem to gravitate towards the issue of who will continue to carry on for us in the family business, who will disperse assets and who will manage the trust for family members after we have passed on. It isn’t an easy decision. Most of our friends are aging with us, our children have very busy lives and the onus on executors has been increasing at an alarming pace – not to mention the legal liability. It is no wonder that more and more Wealthy individuals rely on expert Corporate executors to settle their estate. Melanie McDonald, LL.B, TEP, our VP and Regional Director for the Trust Company, and Lydia Potocnik, LL.B, TEO, FEA, our Head of Estate Planning and Philanthropic Advisor Services delve into the steps that HNW (high net worth) and UHNW (ultra nigh net worth) families have been taking around the administration of their estates.

Is It Time To Consider A Corporate Executor For Your Will?

RYAN’S CORNER

Next Gen Planning – First Time Home Buyer

With the conclusion of Spring review season upon us we take away many great conversations with clients around next gen as they embark on the path to home ownership. With interest rates pushing to levels not seen since the early 2000’s we look to advise clients on ways to utilize government initiatives to help with a first home purchase.

First Home Savings Account (FHSA)

Receiving its Royal Assent into law in late 2022 the FHSA is the newest initiative to help first time homebuyer save funds efficiently for a down payment on a qualified first home purchase. While the details of the account can be lengthy, we use this as an opportunity to highlight some of the key functions of the account.

The new registered plan helps prospective first-time home buyers to contribute up to $40,000 towards saving for their first home on a tax-free basis. The unique features of the account allow for contributions to be tax deductible similar to an RSP contribution, and for withdrawals to be tax free similar to a Tax Free Savings Account (TFSA) when purchasing a first home. In addition, all investment income and gains are non-taxable.

While the lifetime limit on contributions is $40,000, the starting annual contribution limit is $8,000 with any unused amounts to be carried forward for those who have an active FHSA opened.

All information and updates on the FHSA can be found directly on the CRA website (link below).

First Home Savings Account (FHSA) - Canada.ca

RRSP Home Buyers’ Plan (HBP)

An older and more widely used strategy for purchasing a home for the first time is the use of the RSP home buyers’ plan that currently allows for individuals to withdraw $35,000 from their current RSP account without having to pay any withholding taxes.

Participants in the Home Buyer’s Plan must repay the amount they withdrew within 15 years. An example of this would be by taking the amount withdrawn and dividing it by 15 years ($35,000/15 = $2,333/annual repayment). The first payment back to the RSP is due 2 years after you make your first withdrawal. The plan also provides flexibility to repay the RSP sooner if funds are available.

All information and updates on the HBP can be found directly on the CRA website (link below).

What is the Home Buyers' Plan (HBP)? - Canada.ca

For those looking to begin the journey of home ownership, feel free to connect with our team as we can help to arrange a meeting with a BMO Mortgage Specialist to review all the home purchasing tips and strategies.

TFSA FOR MY CORPORATION?

As much as we have been having many discussions around Executors, we have been having equal discussions around Insurance. Did you know that Insurance is one of the last TAX AVOIDANCE opportunities in Canada? It has the potential for significant tax savings. This and your principal residence tax exemption and TFSAs. All three strategies avoid tax.

Many HNW and UHNW families will have much more assets than they will ever use. Which means, they are paying an annual tax bill just to hold onto those assets. What if they could shelter those assets whereby, they avoid the annual tax, the amount then passes tax free to their beneficiaries and as a bonus they also avoid probate? Further, what if your final tax bill is so high that your family would need to liquidate family assets that were meant to pass onto the next generation just to pay CRA?

The below article focuses specifically on Business Owners and Incorporated Professionals as there are some additional benefits for Corps, but the concept from my paragraph above is equally relevant. It would be rare in today’s day for a HNW family to not have insurance as an asset class – and the below article discusses some of the significant tax savings.

Insurance Considerations for Business Owners and Incorporated Professionals (sharepoint.com)

FINANCIAL LITERACY FOR NEXT GEN

The Power of Compounding

By: Jordan Goh

Being the youngest person on the Fortin Wealth Team, I thought it would be beneficial to highlight some things that might be interesting or useful for people at or around my own age. Whether these concepts are very basic or slightly more advanced, my goal is to provide these ideas in an easy to digest format that you can use going forward. While my aim is to elaborate on topics that will be useful for the next generation, this is not to say that this article can’t be useful to everyone!

In the case study below, we are going to discuss compounding interest and the power that it holds.

To start off, we must ask the question what is compounding interest? Compounding interest is the interest that you earn on both the money that you have saved and the interest that you have earned.

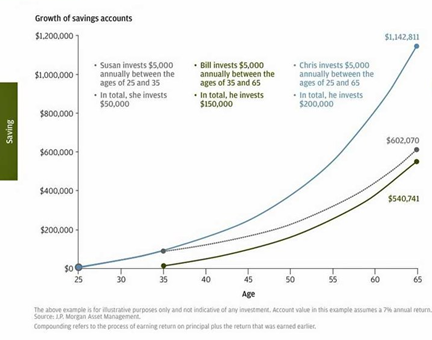

As an example, I have included a picture below of two different people, Susan and Bill. Susan invests $5,000 annually between the ages of 25 and 35. In total she invests $50,000. Bill on the other hand invests $5,000 annually between the ages of 35 and 65. In total he invests $150,000.

As shown in the graph below, when both Susan and Bill reach age 65, Susan will have amassed $60,000 more than Bill. Since Susan invested earlier and spent more time in the market, she had more of an opportunity to realize the effects of compounding interest.

This means that by age 65, Susan would have accumulated 10% more in savings then Bill, helping her to reach her goals more efficiently.

We now must ask the question: Why does this happen?

There are two main points that we can takeaway from this case study. The first is that time causes the exponential growth of money. The second is the longer you stay in the market, the stronger the effect will be.

The ability to recognize the power of compounding interest is especially useful when you are first entering the market as a young person. It allows you to spend more time in the market and thus will exponentially grow the money invested.

A quote that I love about compounding interest was given by Albert Einstein it says:

“Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn't… pays it.”

-Albert Einstein

I’ll leave you with this, at the end of the day it matters less when you put money in the market when compared to how long it stays in the market.

Robin Esrock’s Bucket List

Travel Blog – Contribution by Renowned Travel Writer Robin Esrock

You may recall we hosted a Virtual “Fill your Canadian Travel Bucket” with Robin Esrock in February of 2022 as we all got set to ramp up our travel again. The response was terrific. Places not yet having been considered were being booked by clients, as well as Christine.

Robin is a bestselling author and travel personality who has reported from over 100 countries on 7 continents. We’ve invited him to share some travel inspiration.

Global Dream of the Summer: Slovenia

Of all the countries that once made up the former Yugoslavia, Slovenia has emerged as the undiscovered gem of Central Europe. The country boasts lush countryside, medieval fortresses, the sweeping Julian Alps, crystal lakes, and the culture-rich capital of Ljubljana. Straight out of a central European fairytale, mountains overlook green valleys that are so smooth you’d think they grow vegetables on manicured fairways. Romantics will love the old church sitting in the middle of Lake Bled, a vista you may have seen in popular screensavers. Horse-lovers will relish a bucket list visit to Lipica, the ancestral home of the classic white Lipizzaner. Ljubljana is quintessentially European: think cobblestones, churches, old town squares, canals, parks, bicycle lanes and busy outdoor cafes. Easy to get to via air or if visiting from neighbouring Italy, Austria, Croatia and Hungary, Slovenia offers great European value with abundant options for nature, culture, food and history.

Canadian Dream of the Summer: Prince Edward Island

What do you do with an abandoned province-wide railway line? You turn it into a 400km-long recreational trail running tip-to-tip across Prince Edward Island, resulting in an unforgettable bucket list East Coast adventure. With your bags shuttled ahead to homely inns and B&B’s, the trail takes you through gorgeous forest, beaches, rivers, farmland, restored railway stations and small towns bursting with Maritime charm. An Ottawa-based outdoor travel agency called Great Canadian Trails takes care of all the logistics, offering a customizable week-long itinerary that cherry-picks the best sections of the trail, including the stunning Gulfshore Parkway, and beautiful Anne of Green Gables country. Kicking off at the Confederation Bridge, load up on local lobster, pop into bays with the world’s best oysters, and work it off with some healthy daily exercise. An optional e-bike upgrade can make it especially easy and fun for the whole family.

Leaving the Pandemic Behind

In May 2023, the WHO officially declared that the COVID-19 pandemic no longer constitutes a global health emergency. Instead of wild celebrations that the pandemic is finally behind us, we’ve quickly moved onto new fears and uncertainty, heavily promoted by media that thrives on bad news (remember: if it bleeds it leads). Tourism continues to boom, with heavy demand for airfare, accommodation, and activities. Prices are skyrocketing, as operators and airlines eagerly recoup lost profits. It’s been a year since The Great Chaos of 2022, and the tourism industry has prepared for the rush. Industry employment is almost back to pre-pandemic levels, and efficient new technologies have been implemented. It’s going to be busy out there, but summer 2023 will see a significant improvement over 2022.

Pro Tips: Staying Safe

A surge in tourism brings a surge in opportunistic crime. You’ll often hear “Use Your Common Sense” but little about what common sense actually means. Very simply: Avoid flashing your wealth or drawing unnecessary attention to yourself. If a local or guide advises you not to go somewhere, take their advice seriously. If something looks or sounds too good to be true, it usually is. Keep secure online back-ups of your passport, banking, and insurance details (you can just email it yourself or leave a copy with someone at home). Credit cards are accepted just about everywhere, so don’t carry too much cash. Avoid unnecessary confrontation, and when in doubt, ask for help. With a little common sense, it’s highly unlikely anything terrible will happen. Scams and crime grabs attention, but both are statistically rare for travellers worldwide.

Let’s Go:

Do you know about e-SIM cards? They save you a bundle when you travel, and they work like a charm. Check out Airola, which offers e-SIMS for 200 destinations. Simply download the e-SIM from your phone, purchase your preferred data package, and switch over cell-phone networks when you land in your destination. It’s data-only (email, web, apps) but you can use Whatsapp to make video and audio calls. I’ve used it half a dozen times and had no issues. When you sign up, use the referral code ROBIN3696 to give us both $3 off our next e-SIM purchase. Note: I do not work with Airola in any capacity.

Don’t Quote Me:

“Travel is fatal to prejudice, bigotry, and narrow-mindedness.”

-Mark Twain

If you have any travel-related questions or inquiries, feel free to email me at robin@robinesrock.com

HAPPENINGS

Top Woman Advisor

There is so much to report since January on what has been transpiring on our team! From awards and recognitions, to major industry achievements, where to start? I’ll defer our Annual Industry Achievements until our Fall Newsletter and will take the time there annually to highlight each member and just focus on some key highlights from the last 6 months.

In addition to Christine being recognized as a Top Wealth Advisor in the Province of British Columbia by the Globe and Mail and Shook Research in the Fall of 2022, Christine was recognized as a Top Woman Wealth Advisor nationally by the Globe and Mail and Shook Research in May 2023. She travelled to Toronto for the conference and recognition and got to spend some time with other amazing Women Advisors from BMO Nesbitt Burns in our Toronto HQ and then got to celebrate a lovely dinner together.

President's Council in Austin, Texas

Fortin Wealth has consistently formed part of the prestigious President’s Council of the firm for well over a decade. This recognition is celebrated abroad each year and affords time to spend on levelling up our skills and liaising with the other top Advisory teams in the country in order to idea share as well as celebrate each other with comradery! Spouses are invited and this year Christine’s husband, Kent, was able to attend and clearly, he enjoyed everything that Austin had to offer!

Off to Africa!

As usual, Christine, Kent and Kase (who is now 9 yrs old), spent spring break skiing up at their ski chalet. This summer they will be embarking on an adventure to Africa – stay tuned in the Fall for photos!

Summer Sports for Kase

In addition to Kase playing flag football this spring, he tried his hand at baseball. So far, his favourite position is pitcher. He has a real knack for it.

Christine's Birthday Surprise

Christine took another turn around the sun in May and entered her 6th decade! In celebration that morning, her personal training set up a special 50th birthday session for the first 30 minutes of their training! She felt every one of those 50 years after that!

Aanya and Ryan Celebrate One Year

Ryan celebrated his one year anniversary at Fortin Wealth in April and it has been a year to remember not only at work but for his Family as Ryan and Amm also celebrated their Daughter Aanya’s first birthday in March.

Big Trip for Ryan

When not in the office, Ryan is out with his Family taking on new adventures as they plan for their next big family vacation to the UK, Italy, and Greece in August. Weekends are spent relaxing and spending time with Aanya as she begins taking on early investment seminars like the Annual Berkshire Hathaway Shareholder Meeting for tips on how to invest her RESP.

Jordan's Mediterranean Trip

Jordan has just returned from a trip around the Mediterranean. He cruised from Barcelona to Rome making different stops in Spain, France, and Italy along the way. “The food, the sights, and the people were the best part of the trip” is what Jordan has to say about his time away.

Check out the picture Jordan took from one of his stops in Portofino, Italy!

Joanna and Elizabeth's Adventures

Joanna works for sanity and a break from her daughter, but honestly everything is about her daughter. Elizabeth is 3 years old, into everything and loves the outdoors so with the weather warming up they spend most days and weekends outside. If they are not riding bicycles in the neighbourhood and saying hello to all the doggies, they are learning to kick and throw balls at the park, throwing rocks into the ocean and or eating ice cream while waiting for the train to come pass and having playdates at the various playgrounds. Spring is Joanna’s favourite time of the year because all the plants wake up and show off so she loves seeing all the plants flower and sprout new sprigs. Joanna and her family are also fortunate to live close to a little duck pond and have been visiting the baby ducks and seeing them grow. Every day without fail Joanna will share something new that Elizabeth has done or learned

Lastly, to stay up to date, please consider following our Fortin Wealth Facebook Page by clicking here: