Back The Truck Up

Robin Kingsmill - Feb 28, 2014

The option is simply to capture those older, existing preferreds that have been humming along happily.

Click Here to Read Original PDF

(February 2014)

The option is simply to capture those older, existing preferreds that have been humming along happily.

Back the truck up! This cannot last!

We noticed that Trans Canada Pipe chose to call in their perpetual preferred share. P2 rated, it had been humming along since February 1999, yielding 5.6% plus a Canadian Dividend Tax Credit to its holders. Nice income.

We wondered why it was called now since preferred shares, as we said last month, are unloved and trading below par. "Ahah," said I! Let's take a look at what Bank of Canada Bond rates were when the security was brought out. It is all relative:

-

1999: 1 year was at 4.95% 5 year at 5.03% ...and this preferred was brought out at 5.6% A good deal.

-

2014: 1 year is at 0.97% 5 year at 1.69% ...and the preferred should yield ...what???

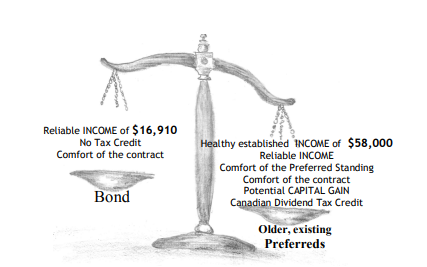

Rates are now one third of 1999 and we can still get that great yield which was offered as a really good deal in 1999? ...and get a Canadian Dividend Tax Credit as well!? Maybe with the potential of Capital Gain AND the income? Compare that to the new issues, and shake your head!

That has got to be amazing. It is not often that you can go back in time to capture a great deal! But this time it's as if you can! The option is simply to capture those older, existing preferreds that have been humming along happily. And there are several!

You have to ask yourself, "Are there similar corporations thinking to call in their issues paying higher than the market is demanding, such as this?"

A little more pondering had me put myself in the shoes of a Board's Finance Committee. If new issues of preferreds are offering a lower yield (on average about 4%) then why not save the corporation paying out the higher yield, by simply calling in the older, higher yield issues and replace them with newer but lower yield preferreds and put the savings to work for the corporation!? Eureeka! That means the holder has been paid their yield all this time with a Canadian Dividend Tax Credit, likely a capital gain and now the par value to re-invest! Let's think about where to put it.

Should we expect other Finance Committees to recommend such a move? We think so. We think there are a lot of 'unloved' and older, existing preferred shares of good corporations that may well have a good use for the savings this will bring about.

Will they lay about waiting for long? We think not.

Let me sum it up:

- In 1999 your $1M bought a 5 year Canada bond and it yielded you $50,300 income

- In 2014 your $1M will buy a 5 year Canada bond that will yield you $16,910

Now have we got your attention? There are several such older, existing preferreds currently trading below par value: P2 rated issues still yielding 5.8% and P1 rated still yielding 5.3% that may, as we have noted, be called in. That could mean capital gain, Canadian Dividend Tax Credit, with good cash flow until then [if it is called] and without actually going back in time!

But their availability just cannot last.

Permit me to re-iterate the questions from last month:

- Might the current lower purchase price of older preferreds be put to work for you? • Does that low selling price bring a yield high enough to override the 'common thought?'

- Does the preferred share’s cash flow trump the current value or its purchase price?

- Will the additional tax benefits be of value?

- Might that Preferred be called in that you might soon appreciate a capital gain while a Finance Committee's strategy works for the corporation, too?

- Would a move today provide you greater cash flow which, allowed to accumulate over time, would pay you more, anyway?

...and again: I heard that! “Oh indeed! The cash flow!” Surely that has rung the bell, this time.

This would be a good time to call us.