The Markets Are Down! Doom?

Robin Kingsmill - Oct 28, 2014

The Markets have a life of their own; they can be volatile, they move up and down based upon ideas and concepts.

Click Here to Read Original PDF

(October 2014)

The Markets have a life of their own; they can be volatile, they move up and down based upon ideas and concepts.

The Markets are Down! Doom? Doom and Gloom?

…and look! My Portfolio is still getting its regular infusion of cash from the assets I hold. How does that work? If the Markets seem to be so unhappy, shouldn’t I be worried, too?

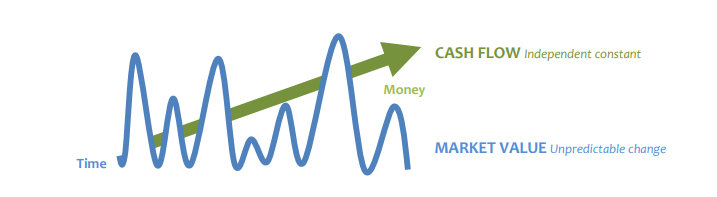

And therein lies the reason you can sleep at night. The Markets have a life of their own; they can be volatile. They move up and down based upon ideas and concepts. The nature of the Market is change …and it can show some pretty dramatic and unpredictable impacts as hedge funds and money movers flow in and out …often for their own reasons, usually far too arcane to be described here.

You, on the other hand already own the assets included in your portfolio. Only part of the reason you selected any investment was the price you had to pay for it. If you do not have your own reasons to sell it immediately, how much does it matter what the paper value appears today amid the profit-taking and tsunamis caused by hedge funds in selloff mode to pay their loans? It was also chosen for the regular and consistent yield that it continues to pay.

Let’s just be clear here: the vagaries of the Market have not got in the way of that company doing its business. They are still producing a yield out of profit and paying you, just as promised.

The best part? You get to get paid while you wait for the Market Values to rationalize from the hurly burly. You get to use that dependable infusion of cash and sleep at night, because that infusion of cash is created by the business of the company, not its market value.

We do not pretend that it is easy, but we do stress that the portfolio decisions we make so that you will Own your Future™ are based not just on the price that the Markets deem appropriate for an investment, but we do the work to find you solid companies that will pay you a regular dividend or yield, as well as be able to stand up over time to the vagaries of trends in the Market such as we keep hearing about in the news.

Our canniest clients are taking some of that regular and consistent infusion of cash from their investments, and are buying while prices are down, taking advantage of the ‘sales’ in the wake created as those that need to make big moves do so for their own big and often lumbering reasons.

You know your portfolio: those are companies that produce their yield from profits because they are quality assets that have the potential to grow and show an increase in the value that the Market will pay for it over time.

Some think we are ‘Cash Flow’ investors. We might not disagree.

When was the last time you asked for a Cash Flow report from your portfolio? That’s really where the work of your portfolio gets done. And please do not get overly concerned by their domino effect as hedge funds and money movers wreak havoc on values while they make the big moves that drive their business …the nature of which is often diametrically opposed to that of the independent investor such as you: you invest for stability and growth and that reliable cash flow (or yield) that defines your portfolio.

Call us. Don’t lose sleep over this. Maybe this is the time to capitalize on that hurly burly in the Market.

We are the Kingsmill Saar Wealth Management Group, we would be happy to speak with you anytime