Oil is Political not Cyclical

Robin Kingsmill - Feb 27, 2015

The Energy Sector: Still an investment worthy of consideration?

Click Here to Read Original PDF

(February 2015)

The Energy Sector: Still an investment worthy of consideration?

Oil is political not cyclical

The Energy Sector: Still an investment worthy of consideration?

#timeforsharks

News outlets of all kinds are busy reporting a variety of theories regarding what is driving today’s oil pricing:

-

Is it a political game between the OPEC countries that refuse to cut production while the US and other western countries such as Canada maintain production growth? Does OPEC fear losing their position of control?

-

Might OPEC and The West be ‘ganging up’ on Russia to bankrupt them with manipulation of the price of oil?

-

Is someone manipulating the market to their advantage?

-

Is it a surplus of oil? Have we finally reduced consumption and facing a situation od oversupply?

-

But do not miss the fine mystery theories including the missing barrels of oil that have been produced and are unaccounted for. Do it! Google: Missing barrels ..!

Inflammatory rhetoric is just a distraction. What should the canny investor do? In our view, buy while there is blood on the floor! But, what??

Rather than rely upon colourful articles that sell papers and air time, clients of The Kingsmill Saar Wealth Management Group benefit from insights from Gordon Tait, and the Nesbitt Burns’ award winning analysts from whom we source charts such as these, along with our conversations with top Energy Sector professionals such as Steve Smith of Norrep. We all agree on many things, but in particular: there are many hot deals in the market, right now.

Energy Sector Securities: some will survive and profit exponentially. Some will not. Will the company you are looking at or hold be a 'predator' or its 'prey' in response to market forces, and when their balance sheet is stretched? There is no question that this is a major financial and political issue.

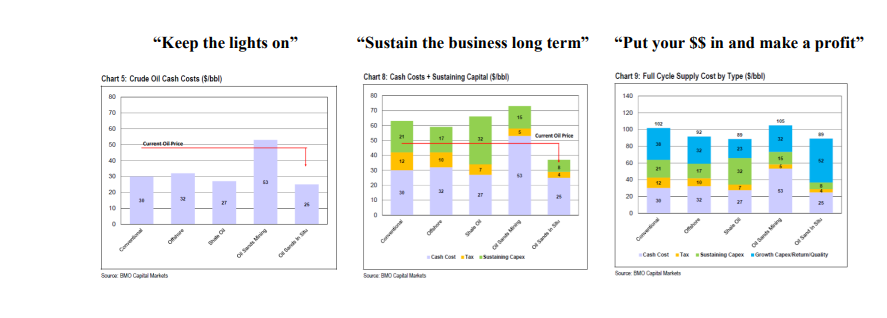

The charts below demonstrate the supply cost to meet demand. Oil is much more than a commodity and insights as to how its pricing affects the business to maintain, sustain or grow in this sector are clearly important to assessing the value of such assets in your portfolio.

In our view, this is certainly not the time to hold an ETF, that bundles energy sector assets that intermixes the 'prey' and the 'predators'.

The best insight we will give you here is: In rough times, ensure you have culled the prey.

These are complicated subjects. With investment products that have unique tax advantages, clients of The Kingsmill Saar Wealth Management Group have access to 'predators' that may well prove the rule. These are conversations well worth having, but the detail of those insights are for our clients only.

Our clients know the difference between 'predator' and 'prey'. What was that advice? Buy when there is blood on the floor. It may seem harsh, but it will pay longer-term.

We are The Kingsmill Saar Wealth Management Group. Thank you for taking the time to read the Income Advisor. What can we do for you?