Bank Notes

Robin Kingsmill - Dec 07, 2017

This security is interesting. The industry calls them 'Bank Notes'.

Click Here to Read Original PDF

This security is interesting. The industry calls them 'Bank Notes'.

Bank of Montreal Canadian Bank Callable Equity Income Principal At Risk Notes, Due June 14, 2023

There's a mouthful. We talked about this in June.

Contingent Cash Flow 7.4%

Forgive us if we review a bit. This security is interesting. The industry calls them 'Bank Notes'. They are highly time sensitive with the features of a bond including a maturity date, but with features of a stock as well.

Notable in this example:

- Semi-annual AutoCall

- Linked to S&P/TSX Bank Index

- 7.4% per Annum contingent Coupon paid semi-annually

- 20% Contingent Protection at Maturity

This is one of several such hybrid notes. Time sensitive and timely. A downside protection with cash flow potential, contingent upon the underlying index: Bank, Utilities, TSX and more.

Such hybrid note is demonstrating the value of its design: a contingent protected value, with downside protection to boot.

It looked interesting in June this year. Today, we have demonstrable reasons to consider ‘Bank Notes’ for your portfolio. While these have been previously issued, and no longer available, they do tell a good story.

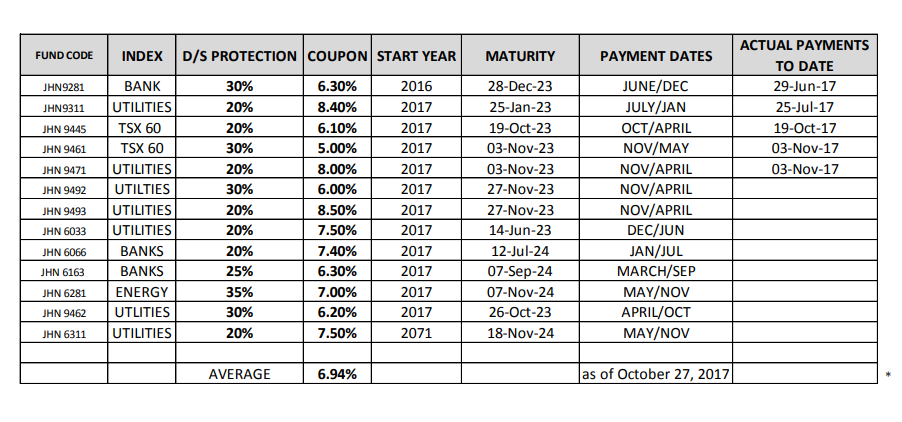

Take a look at how these various ‘Bank Notes’ have fared, as of October 27, 2017:

Clearly there are several to choose from, should you choose to add one, or perhaps a few 'Bank Notes' to your portfolio.

Let’s talk about it. We are a phone call away: 905-897-5212 or 1-800-387-9314.

We are The Kingsmill Saar Wealth Management Group. We are here to help.

Investment Advice, Free Standing Income Strategies, Insurance Consultation, RRSP/RRIF Advice, Business Planning, Portfolio Management, Financial and Retirement, Planning Wealth Protection Strategies, Estate Planning, Philanthropic Planning