Our approach is different. Because our clients are different.

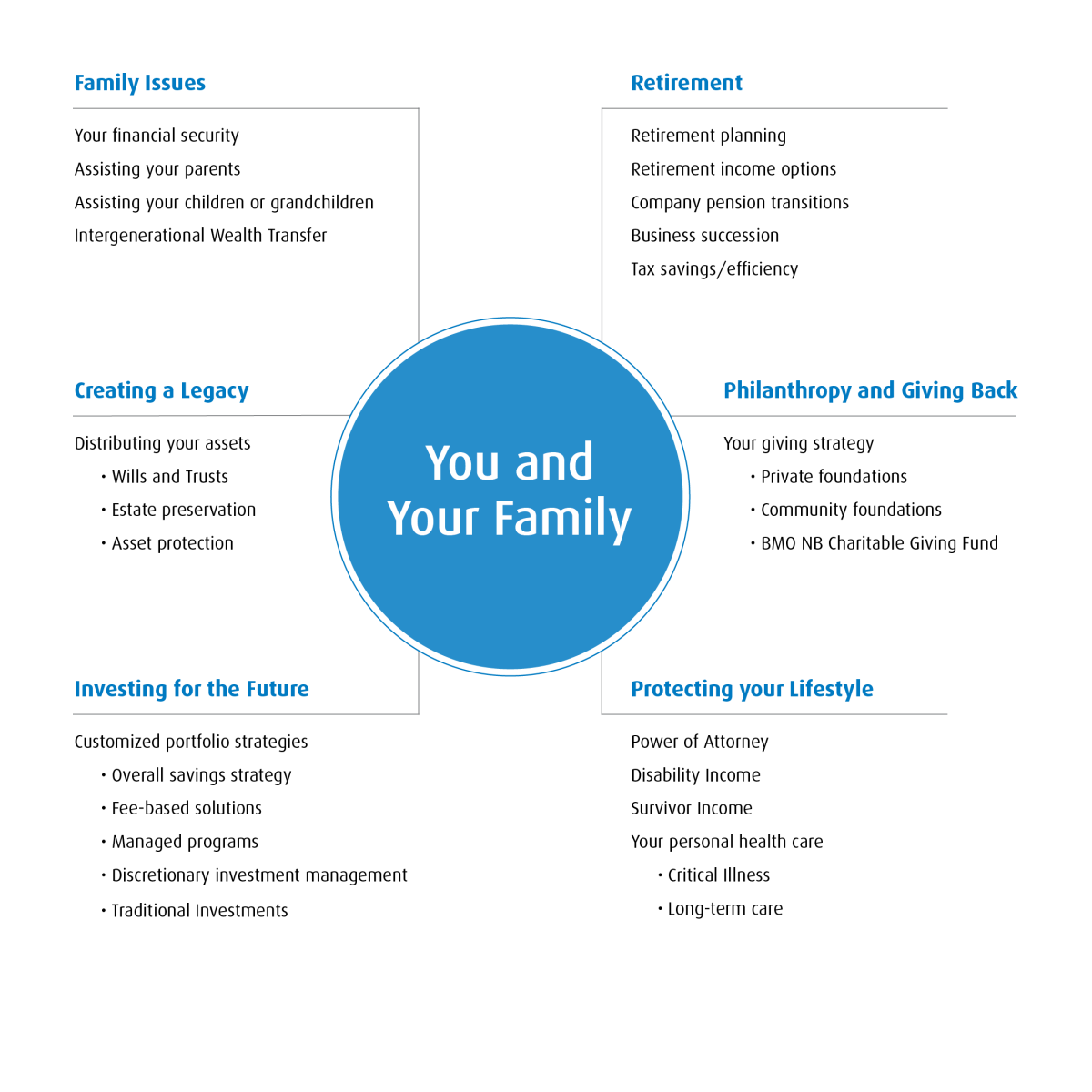

What is most important to you? We will tailor a solution specifically for you, to maximize opportunities and mitigate potential challenges down the road. We apply disciplined, holistic, transparent and independent guidance, maintaining open and regular collaborative lines of communication, listening to you, and keeping you informed.

We are here to understand your life priorities and deliver on our commitment to:

Assess your financial goals and level of risk tolerance

Assess your financial goals and level of risk tolerance

Develop a strategic and effective in-depth plan based on your current financial picture

Develop a strategic and effective in-depth plan based on your current financial picture

Put your customized investment plan into action

Put your customized investment plan into action

Monitoring its progress over both the short and long term, with a responsibility to keep you informed

Monitoring its progress over both the short and long term, with a responsibility to keep you informed

Meet at your desired frequency to review your portfolio, re-evaluate and re-balance where necessary

Meet at your desired frequency to review your portfolio, re-evaluate and re-balance where necessary