Winter 2026 Newsletter

The Fortin Wealth Advisory Group - Jan 13, 2026

Our Annual Letter to our Clients | Written By Christine Fortin

A Year of Progress And a Clear Path Ahead

We’re delighted to share that 2025 was another exceptional year in our shared journey toward your most meaningful financial goals. Our entire team’s commitment remains unwavering: your wealth optimization journey is guided by your goals, family enterprise tax strategies, and customized wealth optimization strategies not by market noise or economic guesswork. That will never change. It is simply the core of institutionally based wealth management.

Our Philosophy: Built for Your Success

- Let me start by restating some of our core believes that guide our wealth optimization and wealth management approach, and then offer a few comments about the current economic/financial backdrop.

- Your Goals, Our Focus: Every decision begins and ends with what your unique wealth profile and Family Vision Document. Full Stop.

- Long-Term Perspective: We know that the economy cannot be consistently forecast, nor the markets consistently time. Moreover, we find no predictable pattern in the way markets react to – or choose to ignore – economic developments. That is to say we don’t chase trends or attempt to time markets. Instead, we rely on disciplined industrial grade strategies that include both public and private markets.

- Stay Confident: We conclude from the above beliefs that the only way to be reasonably confident of capturing the full premium of equities is to ride our their frequent, sometimes significant, but historically *always* temporary declines.

- Drive Cashflow: The price of admission to increasing your cash flow by 5-8% annually is maintaining the investment. Imagine locking in an increase in the cash flow of your business by 8% year ad infinitum or a top end salary. That is what you already have in place with your investment portfolio.

- Consistency Over Headlines: Your plan doesn’t change because of short-term news. It changes only if your goals do. What about Venezuela? Same same.

- “ The First law of compounding is to never interrupt it unnecessarily” ~Charlie Munger: Time and patience are your greatest allies. The end.

What We’re Seeing Today

- Strong Market Performance: 2025 delivered a third consecutive year of double-digit equity returns, supported by a resilient economy and robust corporate earnings. And in a surprise vs. what you may have “predicted” in April – Canada’s equity market outperformed the S&P500 by over 10% in 2025.

- Positive Outlook: Analysts project earnings growth of approximately 15% for both 2026 and 2027 (source: Yardeni Research).

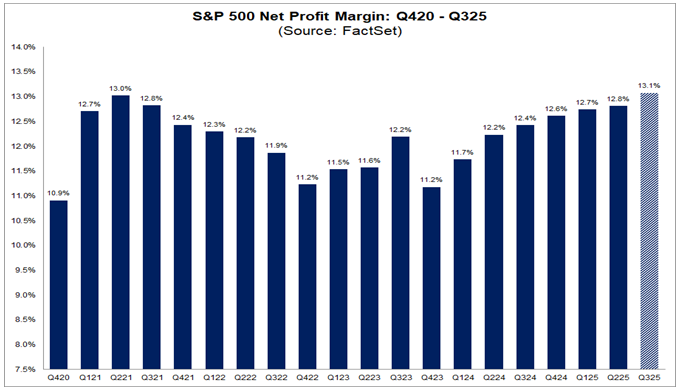

- Profit Margins at Record Levels: Somewhat remarkably, profit margins have continued to expand reaching 13.1% in Q3 2025—the highest in 15 years (source: FactSet).

- Employment Trends: the single important weak spot has been the employment picture, which has continued to soften. But even this has its significant bright side: strong economic growth and a flattish employment situation mean that per capita productivity has been rising strongly. Unemployment may have recently ticked up to 4.7%, but the other 95%-plus of the workforce is putting out significantly increased products/services per hour; that allows companies to raise wages without triggering inflation.

- Monetary Policy: After six rate cuts, the Fed’s stance is significantly more accommodative, setting the stage for continued economic momentum. Expect lagged effects to start appearing in 2026.

- Tax Tailwinds: Middle-class households in the USA are expected to benefit from meaningful tax refunds this season, adding a potential boost to GDP. This continues to fuel lifestyle brands and discretionary spending. The impact is expected to be in the neighbourhood of 150 billion. The fed will be looking for the impact on the economy.

The fact remains that a very strongly rising equity market may (and indeed should) have taken these data into account—and maybe then some. Thus, the burning question all year long was “Are we in an AI bubble?” This replaced the previous year's burning question “When and by how much will the Fed cut rates?” Which in turn replaced 2023's “Will there be a recession?”

Looking Ahead

Well there was no recession, but that’s beside the point. Which is that the universal burning question is usually if not always the wrong questions, and a distraction from the wealth management approach that one should be taking.

Market concentration in a handful of tech giants has raised questions about valuations and the so-called “AI bubble.” Our view: valuation is not a timing tool, and your upcoming portfolio rebalancing (which we review Quarterly) will address concentration risk.

The next market shock, there’s always one, will likely come from an unexpected source deep out of left field. And when it comes, it will have very little to do with us, other than a wildly efficient bargain hunting exercise.

I talked about this in a video I made years ago. The financial market may not repeat itself, but it certainly rhymes. The greatest risk is always the one we don’t see coming.

We wish all of our friends and clients – because to us they are the same thing – a healthy, happy and prosperous 2026. Thank you for being our clients. It is a privilege to serve you.

~Christine.

Building Wealth the Buffett Way: Quality, Patience, and Dividends Growth | Written By Ryan Lidder

As we step into the new year its important to take a pause and reflect on the amazing career of Warren Buffett. As of Jan 1, 2026, Warren would retire from Berkshire Hathaway after a 60-year career and hand off the reigns to his successor Greg Abel.

While Warren has announced he will be going quiet moving forward, his investment philosophy forever influenced modern portfolio thinking. Built on the Benjamin Graham’s foundation and refined by his team, Buffett’s approach to buying understandable businesses at a fair price, backed by capable management, predictable and increasing cash-flow provided the recipe for strong portfolios that could compound over the long term.

Historical Context with Real World Examples

Buffett’s pivot from early discounted bargains to high-quality franchises is visible in flagship holdings. In 1988–89, Berkshire accumulated Coca-Cola after the 1987 crash, attracted by the brand’s global moat, pricing power, and predictable cash generation. Over decades, dividends from KO became a significant part of Berkshire’s cash inflows while the position compounded in value. More recently, Berkshire’s Apple stake (initiated in 2016) reflected similar logic: an ecosystem with loyal users, recurring cash flows, generous buybacks, and shareholder friendly capital returns.

Dividend Growth and Compounding Returns

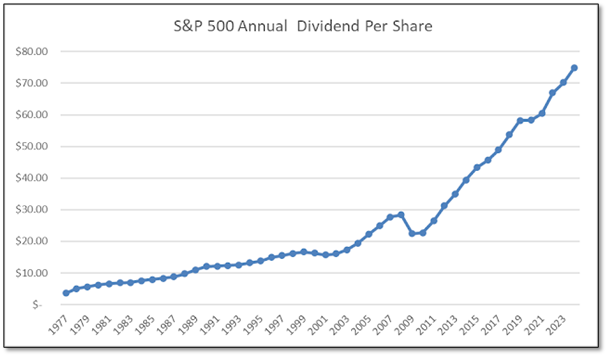

Across modern market history, the S&P; 500’s dividend stream has proven resilient and increasingly diversified. While yields have trended lower since the 1990s as prices rose and buybacks grew, the growth of dividends has remained a durable contributor to total return. Over long horizons, reinvested dividends often account for a substantial share of cumulative wealth—underscoring Buffett’s preference for cash generative businesses.

Over the past 75 years we have seen the S&P 500’s dividend per share increase from an estimated $1.84/per share to an estimate $78.92/per share in 2025 resulting in a 41x over that 75-year period. While the yield has come down over the years due to the increase of growth-oriented tech stock and corporate policy shifts to stock buybacks relative to dividends. This trend further stresses the importance of diversification around traditional indexing and building portfolios that align with Buffett’s philosophy compounding from cash generative, high quality businesses drives wealth. (2) Dividend growth—not just yield—has materially supported total returns in the S&P; 500. (3) In modern markets, combine rigorous valuation with patience and a focus on shareholder aligned capital allocation.

S&P 500 Dividend Growth Since 1970

Source: 2024 was a record year for US Dividends - Dividend Growth Investor

As we bid farewell to Warren Buffett I chose to conclude the piece with some of my favourite quotes from his final annual letter:

- Definition of Greatness: Buffett wrote that true greatness is not found in money, publicity, or power, but in helping others. "Kindness is costless, but also priceless".

- Living Your Obituary: He urged readers to decide what they want written in their obituary and then live a life worthy of it.

- Continuous Improvement: Buffett advised not to dwell on past mistakes, but to learn from them and move on: "It’s never too late to improve

S&P 500 Dividend Yield: Past, Present, Future

HartfordFunds | The Power of Dividends: Past, Present, and Future

Financing vs Leasing a Car: Which Path Fits Your Journey? | Written By Jordan Goh

Thinking about a new car? For many early investors and young professionals, the decision between financing and leasing is one of the first big financial choices you’ll make. I have created a video that shows the differences between financing and leasing to help you determine which option is best suited for you.

This edition of our EARN series is meant to expand on things that should be considered if you are faced with a decision of financing vs leasing a vehicle.

Applying Financial Principles to Everyday Life

- Understanding Opportunity Cost

When you choose between financing and leasing, you’re weighing the trade-offs: ownership versus flexibility, higher payments now versus lower payments with potential costs later. This is opportunity cost in action: which is a core concept of investing and personal finance.

- Budgeting and Cash Flow Management

Monthly car payments, whether for a lease or a loan, affect your ability to save and invest. Learning to balance these commitments with other financial goals (like building an emergency fund or making contributions to your RRSP/TFSA) is essential for long-term success.

- Evaluating Total Cost of Ownership

Looking beyond the sticker price of the vehicle, considering insurance, maintenance, and depreciation allows for you to fully assess the financial impact of any major purchase. This mindset is crucial not only when purchasing a vehicle but also when evaluating things like your investments, future home ownership, or even potential career choices.

- Planning for the Future

The decision to lease for flexibility or finance for ownership relies heavily on your financial plan: Are you prioritizing short-term convenience or long-term value? Early investors benefit greatly from thinking ahead and aligning decisions with their personal goals.

Your Financial Journey Starts Here

I have a video that goes further into detail on the differences between Financing and Leasing a vehicle. And use this as a practical tool to reflect on your own broader financial habits and priorities. The lessons learned here about trade-offs, budgeting, and planning, apply not only to purchasing a vehicle but to every financial decision you’ll make, from investing to retirement planning.

Sources:

Opportunity Cost vs Depreciation: Which Matters More in Car Buying? - My Car Heaven

https://www.navyfederal.org/makingcents/auto/how-to-budget-for-buying-a-car.html

Making the decision: lease or buy (article) | Khan Academy

How Financial Literacy Can Help You on Your Car-Buying Journey | Capital One Auto Navigator

Start Early, Grow Big: The Real Impact of Compounding on Your Future Wealth | Written By Dylan Farrago

What if one simple decision today could add hundreds of thousands to your future wealth?

That’s the power of compounding, the idea that your money earns returns, and then those returns earn more returns. Over time, this snowball effect can turn modest contributions into something truly substantial.

Albert Einstein called compounding the “eighth wonder of the world.” Why? Because it rewards patience, not perfection. And the earlier you start, the bigger the payoff.

Why Compounding Works

Think of compounding like planting a tree: the sooner you plant it, the longer it has to grow. Every dollar you invest generates earnings, and those earnings generate more earnings. The longer you let this cycle run, the more exponential the growth becomes.

Real-World Steps You Can Take Today

You don’t need a big windfall to make compounding work for you. Here are three practical moves:

- Max Out Your TFSA

Every dollar in your Tax-Free Savings Account grows completely tax free. In 2026, the annual limit was just increased by another $7,000, start contributing now and let time do the heavy lifting.

- Grab Your Employer Match

If your company offers a retirement savings match, take it. It’s free money that accelerates your compounding curve. Skipping the match is like turning down a raise.

- Automate Your Contributions

Set up automatic transfers so investing becomes a habit. Consistency beats timing the market.

The Time Advantage: Side-by-Side Scenarios

Here’s where it gets real. Let’s assume:

Annual contribution: $7,000

Portfolio return: 6% per year

Investment horizon: until age 65

Now compare four investors who start at different ages:

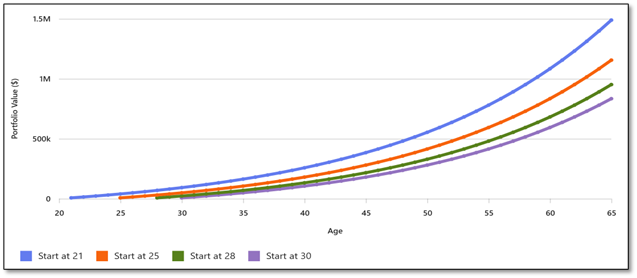

Start Early, Grow Big: Portfolio Growth with $7,000/year at 6% (to age 65)

The takeaway:

Start at 21: Portfolio approaches $1.6M by age 65.

Start at 25: Ends near $1.2M.

Start at 28: About $950K.

Start at 30: Roughly $800K.

Why Starting Early Matters

It’s not just about math, it’s about peace of mind. Starting early means less stress later and more flexibility for life’s curveballs. Compounding rewards patience, not prediction.

Happenings

Christine

It was an incredibly jam packed Q4 for Christine who was juggling launching a new initiative designed to support career development of the next generation of advisors (more to come in the next newsletter), while supporting some urgent needs of the family enterprises that she serves, and finishing up a home reno and balancing a multi sport household!

– we said multi-sport. Christine now experiences minor heart attacks several times a week as the mom of a goalie. Rumour has it she stands alone during games with airpods in – listening to distracting music and tracking shot counts!

As you know, Kase is still actively involved with both Flag Football and Tackle. He played both WR and Linebacker this year for North Langley Bears making it to the playoffs.

Christine's interior decorating project is now complete. The house feels like a home. Many little nooks for reading, working and contemplating exist – even a negroni + cribbage table for her and Kent. Below is her favourite reading spot. Plug for one of the best interior decorators and designers she has ever worked with. Linda Lam of Quintessential Living. She primarily focuses on Vancouver, N.Van and West Van – but has some stunning projects in Crescent Beach and South Langley. She arranges everything right down to the plant pot selection and plants and coasters TRANSITIONAL LUXURY — Quintessential Living

We finished the year with a fantastic Fiscal Year End 8 course tasting menu in Christine’s home with colleagues in Commercial and Private Banking with whom we supported and vice versa to enjoy each other’s company outside of the office.

In other news, following what could be the greatest 7th game in World Series history, Christine had the opportunity to discuss leadership and coaching with none other than John Schneider.

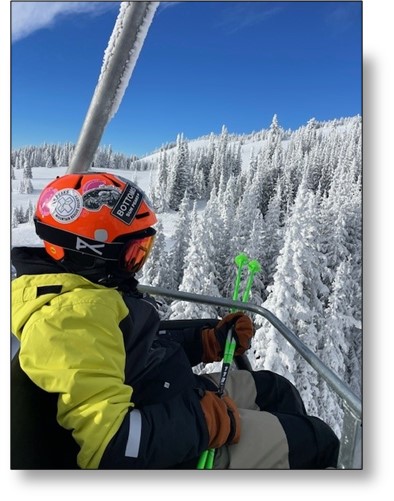

– the last 2 photos are from New Year’s Eve. Skiing with her favourite chair lift pal – who now skies blacks sitting on his skis getting up to jump moguls and cliffs with cheers from the chair lift riders… also said chair lift riders encouraging mama to do the same! , the sunset on NYE from deck on her ski chalet.

Ryan

Ryan was able to take off some time during the holiday season to spend time with his family. The break involved many family dinners and a busy Christmas morning with all the little ones from the extended family getting together to open their gifts.

From cooking classes to skating Aanya was busy as she passed her first skating level and will be on to solo practices this Winter. Kids also started attending Home Depot building session which have been super fun for both the kids and Ryan.

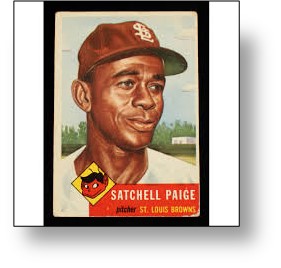

Ryan continues to re-ignite his childhood hobby and the sports card/”art” (as he likes to tell his wife) collection continues to grow. Recent additions include a 1953 Satchell Paige and a set of hockey boxes that he has put aside for his children as a long-term investment.

Jordan

Jordan managed to catch one of the best NFL regular‑season games of the year, a wild 38–37 Seahawks comeback win over the LA Rams.

Over the holiday break, he took things slow and just enjoyed it on a day by day basis. According to him, the highlights were the cooking, the cleaning, and the general home‑chore life he’s gotten into now that he’s living on his own.

I’m not sure I totally believe him, haha.

Dylan

Dylan spent his winter break shredding the slopes up at Whistler, hitting some great runs at Harmony, Jersey Cream, and of course, 7th Heaven. December delivered perfect ski days, clear skies, full visibility, and fresh powder. Honestly, you couldn’t ask for better conditions.

His family was also in town, so he got some quality time with the whole gang back together. It ended up being one of those breaks that was both relaxing and exhausting… as proven by how wiped he looked after that last ski run.