How Much You Need to Retire by City in Canada

Surcon Mahoney Wealth Management - Aug 19, 2025

Discover how much you need to retire in Canadian cities from Vancouver to Winnipeg to Toronto. Compare costs, inflation impacts & planning strategies

Retirement planning in Canada isn't a one-size-fits-all situation. Where you choose to spend your golden years can make a massive difference in how much money you'll need to save. We're talking about differences of hundreds of thousands of dollars depending on whether you retire in Vancouver or Brandon, Manitoba.

Here's what really matters: after accounting for government benefits like CPP and OAS, you'll need anywhere from $95,000 in Brandon to $473,000 in Vancouver for a comfortable retirement. That's nearly a five-fold difference! And with inflation eating away at purchasing power year after year, these numbers are only going up.

Let's break down what this means for your retirement plans, starting with the foundation that every Canadian retiree can count on.

The Role of Government Benefits in Retirement Planning

Before we dive into city-specific costs, you need to understand how government benefits work. These programs form the backbone of retirement income for most Canadians, and they'll significantly reduce how much you need to save on your own.

Canada Pension Plan (CPP) Benefits

CPP benefits aren’t going to make you rich, but it's nothing to sneeze at either. As of 2025, the average monthly payment sits at $844.53 for new beneficiaries starting at age 65. That works out to about $10,134 per year.

Now, there's a maximum monthly payment of $1,433, but the truth is, most people won't hit that. You'd need to have contributed the maximum amount for most of your working life, and that's just not the reality for the average Canadian worker.

Old Age Security (OAS) Benefits

OAS kicks in automatically once you hit 65 (assuming you've lived in Canada long enough to qualify). The current rates are between $727.67 and $800.44 monthly, depending on your age. If you're between 65 and 74, you get the lower amount. Once you hit 75, it bumps up to the higher rate.

These benefits are indexed to inflation and adjusted quarterly, which helps protect your purchasing power as prices rise. You're looking at roughly $8,732 to $9,605 annually from OAS alone.

Combined Impact of CPP and OAS

When you add CPP and OAS together, you're getting about $18,866 per year in retirement income. That's a solid foundation that covers 50-70% of retirement needs in many Canadian cities. But…in expensive cities like Vancouver or Toronto, this might only cover a third of your expenses.

Provincial and City Breakdown of Retirement Costs

Now let's get into the meat of it. How much you actually need to save based on where you want to retire.

British Columbia – Premium Coastal Living

BC is gorgeous, no doubt about it. But that West Coast lifestyle comes with a hefty price tag. Vancouver tops the list at $473,000 in required personal savings, after accounting for government benefits. With average home prices exceeding $1.2 million and monthly living expenses around $4,500, it's easy to see why.

Victoria offers a slightly more affordable option at $368,000, but you're still paying a premium for that mild climate and ocean views.

Ontario – Urban Concentration and Cost Gaps

Ontario shows huge variations depending on where you settle. Toronto requires $431,000 in personal savings, driven by housing costs averaging over a million dollars. But here's where it gets interesting – smaller Ontario cities offer way better value.

Ottawa needs $326,000, Hamilton drops to $242,000, and London comes in at just $200,000. That's less than half of what you'd need in Toronto for essentially the same provincial services and healthcare.

Alberta – Tax Advantages and Value

Alberta's looking pretty good for retirees. Calgary requires $263,000 and Edmonton just $221,000. The kicker? No provincial sales tax, which means your dollars stretch further on everything from groceries to entertainment.

Quebec – Affordable Francophone Retirement

Quebec consistently offers some of the best value in the country. Montreal, despite being a world-class city, only requires $200,000 in personal savings. Quebec City? Even less at $158,000. Monthly expenses in these cities run about $3,000-3,200, significantly lower than their anglophone counterparts.

Manitoba – Canada's Most Affordable Province

Here's where things get really interesting. Winnipeg requires just $158,000 in personal savings, with government benefits covering nearly 75% of retirement needs. But Brandon takes the crown as Canada's most affordable retirement destination at just $95,000. Government benefits cover over 83% of expenses there.

Saskatchewan – Tax Efficiency and Regional Gaps

Saskatchewan offers interesting contrasts. Regina and Saskatoon require $158,000 and $179,000 respectively, but tiny Prince Albert needs just $74,000. The province boasts the lowest provincial sales tax at 6%, giving you more bang for your buck on daily expenses.

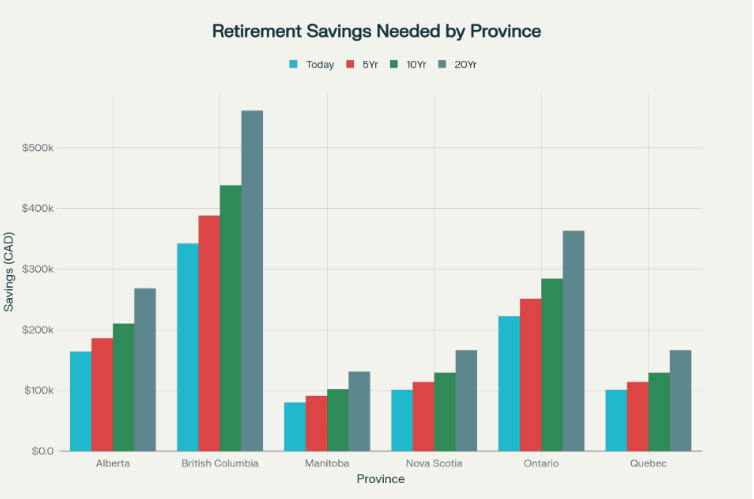

How Much You'll Need If You Retire in 5, 10, or 20 Years

Here's where the rubber meets the road. Inflation is going to change everything, and you need to plan for it. We're using a conservative 2.5% annual inflation rate – right in line with the Bank of Canada's target range.

The math is simple: Future need = Today's need × (1.025)^years.

5-Year Horizon (2030) – "Almost There"

If you're planning to retire in five years, here's what you're looking at:

- BC (Vancouver): $536,000 (up from $473,000)

- Ontario (Toronto): $488,000 (up from $431,000)

- Alberta (Calgary): $298,000 (up from $263,000)

- Saskatchewan (Saskatoon): $202,000 (up from $179,000)

- Manitoba (Winnipeg): $179,000 (up from $158,000)

Even with just five years to go, you've still got time to adjust your savings strategy and optimize when you'll take CPP and OAS.

10-Year Horizon (2035) – "Mid-term Planners"

Got a decade before retirement? The numbers jump significantly:

- BC (Vancouver): $606,000

- Ontario (Toronto): $551,000

- Alberta (Calgary): $337,000

- Saskatchewan (Saskatoon): $229,000

- Manitoba (Winnipeg): $203,000

Notice how the gap between expensive and affordable cities grows? Your location choice now could mean a six-figure difference in what you need to save.

20-Year Horizon (2045) – "Long Runway"

For those with 20 years to plan, the numbers get serious:

- BC (Vancouver): $776,000

- Ontario (Toronto): $707,000

- Alberta (Calgary): $432,000

- Saskatchewan (Saskatoon): $293,000

- Manitoba (Winnipeg): $259,000

Even "affordable" Manitoba sees savings requirements jump to over a quarter-million dollars. The lesson? Start early and invest deliberately, because time is either your best friend or worst enemy when it comes to retirement planning.

Strategic Recommendations for Canadian Retirees

So what should you actually do with all this information?

First, think strategically about location. If you're flexible about where to retire, choosing Manitoba, Quebec, or Saskatchewan over BC or Ontario could literally save you hundreds of thousands of dollars.

Second, remember that universal healthcare doesn't cover everything. Budget for supplementary health insurance, dental care, and potential long-term care needs.

Finally, protect yourself against inflation. Keep some equity exposure in your portfolio, consider inflation-protected bonds, and be realistic about future costs when planning. Those inflation projections we talked about? They're conservative estimates. Reality could be worse.

Conclusion – Retirement in Canada is Achievable with Smart Planning

Ready to create a personalized retirement plan that accounts for your specific location and lifestyle goals? Contact Surcon Mahoney Wealth Management today and book a free consultation and discover how our tailored strategies can help you achieve the retirement you deserve, whether you're planning for Vancouver or Winnipeg.