Responsible Investing

Investing in our future

" Responsible investing is an investment approach that aims to integrate environmental, social and governance (ESG) factors into investment decisions to better manage risks and generate sustainable long-term returns. "

- United Nations Principles for Responsible Investment

All members of The Tetreault Group have strong social and environmental convictions. We firmly believe that socially responsible investing is the future of investing, when people quickly realize that these businesses are good for their wallets and for the planet.

Which is why, in 2018, we developed our own responsible investing model according to the standards and criteria of the Responsible Investment Association of Canada (RIA).

Our approach is based on several strategies used in responsible investing:

Thematic investment

Investment in ESG themes such as women in leadership, clean technologies, alternative energy, cybersecurity, etc.

Negative filtering

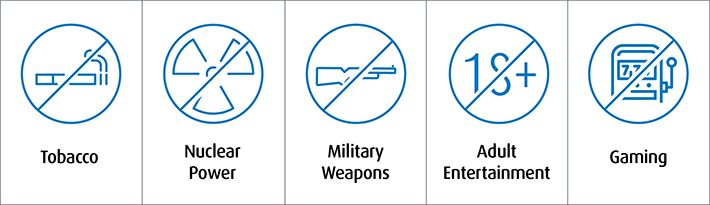

This approach focuses on the exclusion of certain industries or companies from a portfolio, generally based on ethical or moral criteria. For example, many SRI mutual funds exclude manufacturers of tobacco and weapons.

Our main exclusion filters are:

In addition, most of the investments included in our SRI portfolio are free of fossil fuels.

Positive filtering

This approach is based on the inclusion of certain companies in portfolios based on their excellent ESG performance compared to industry peers. For example, there are usually leaders and laggards in all industries. A positive screening approach would include leaders in sustainability, while a negative screening approach would exclude laggards.

These approaches are therefore used simultaneously.

Although the investment criteria are different for each of our investment product suppliers, they are all approved by RIA.

Should you need more information about Socially Responsible Investment, please read the following document "Decoding Responsible Investing".