Les changements proposés à l’IMR pourraient compliquer les dons de bienfaisance

BMO Gestion privée - 2 novembre 2023

Les changements récemment proposés à l’impôt minimum de remplacement (IMR) pourraient inciter les Canadiens qui sont en mesure de faire des dons conséquents à être un peu plus charitables cette année. Mais en 2024, les organismes de bienfaisance crai

Les changements récemment proposés à l’impôt minimum de remplacement (IMR) pourraient inciter les Canadiens qui sont en mesure de faire des dons conséquents à être un peu plus charitables cette année. Mais en 2024, les organismes de bienfaisance craignent que les changements de nature fiscale n’atténuent ces dons à un moment difficile.

L’IMR est un calcul d’impôt sur le revenu parallèle qu’Ottawa a initialement mis en place en 1986 pour veiller à ce que les personnes à revenu élevé ne puissent combiner certains incitatifs fiscaux qui leur permettraient de réduire considérablement leurs impôts à payer. Dans le budget fédéral de 2023, le gouvernement canadien s’est engagé à modifier la façon dont l’IMR est calculé. « Il s’agit d’un suivi de la promesse électorale du Parti libéral de s’assurer que tout le monde paie sa juste part », explique Phil Haines, directeur général, Planification fiscale, BMO Gestion privée.

Le changement ne convient pas aux personnes à revenu élevé et aux organismes de bienfaisance, car il pourrait réduire considérablement les incitatifs fiscaux liés au don de titres à ces derniers. À la fin du mois de septembre, Donald K. Johnson, un administrateur de la UHN Foundation qui siège également à d’autres conseils d’administration d’organismes de bienfaisance, a écrit une lettre ouverte à l’intention du premier ministre. Dans celle-ci, il a souligné en gras que les changements proposés « […] décourageront de nombreux dons potentiels conséquents, ce qui aura pour effet de compromettre les activités de nombreux organismes de bienfaisance ». La lettre, parue dans l'édition imprimée du Toronto Star du 22 septembre, et signée par 30 autres grandes œuvres caritatives canadiennes, prévient que le changement déstabilisera une importante source de revenus qui a généré plus d’un milliard de dollars en dons depuis 1997.

Les changements proposés à l’IMR

Parmi les changements proposés, le gouvernement fédéral prévoit d’élargir la base de l’IMR, d’augmenter son taux à 20,5 % (par rapport au taux actuel de 15 %), de faire passer le niveau de l’exemption de base d’un montant fixe de 40 000 $ à un montant estimé de 173 000 $ (indexé à l’inflation) et de limiter davantage les avantages fiscaux. (c.-à-d., les exonérations, les déductions et les crédits, comme le crédit d’impôt pour don de bienfaisance) dans le calcul de l’IMR.

« L’une des répercussions les plus importantes devrait être sur les dons de bienfaisance, en particulier lorsque des particuliers font don d’actions de sociétés cotées en bourse », explique John Waters, vice-président et directeur général, Services-conseils en fiscalité à BMO Gestion privée. Puisque le gouvernement semble avoir les dons dans son rétroviseur, certains Canadiens à revenu élevé pourraient se sentir incités à faire d’autres dons cette année, avant l’entrée en vigueur des nouvelles règles en janvier.

En vertu des règles actuelles, la totalité du crédit d’impôt pour don de bienfaisance sera appliquée dans le cadre de l’IMR, mais l’un des changements proposés consiste à réduire ce pourcentage à 50 %. De plus, il est proposé d’inclure 30 % (par rapport à 0 % à l’heure actuelle) des gains en capital réalisés lors du don de titres cotés en bourse dans le calcul de l’IMR en 2024.

M. Waters décrit les changements comme un double coup dur pour les personnes à revenu élevé qui font des dons de titres à des organismes de bienfaisance. « Vous êtes touché par l’inclusion accrue des gains en capital et par la modification à l’impôt sur les dons, explique-t-il. Par conséquent, ceux qui font un don à un organisme de bienfaisance pourraient devoir payer plus d’impôts. »

Bien que certaines personnes à revenu élevé puissent avoir des préoccupations, M. Haines les invite à faire preuve de prudence et à ne pas modifier précipitamment leurs plans caritatifs, car les changements ne sont pas encore en vigueur et ne toucheront qu’un petit segment de la population. « La grande majorité des gens n’ont rien à craindre », explique-t-il. Grâce à l’augmentation de l’exemption de l’IMR de base à 173 000 $ par personne, les nouvelles règles devraient principalement toucher les personnes à revenu plus élevé. Ceux qui gagnent un revenu de classe moyenne et qui font des dons généreux à des organismes de bienfaisance ne seront pas visés par l’IMR, explique M. Haines.

Dons de titres en vertu du nouvel IMR

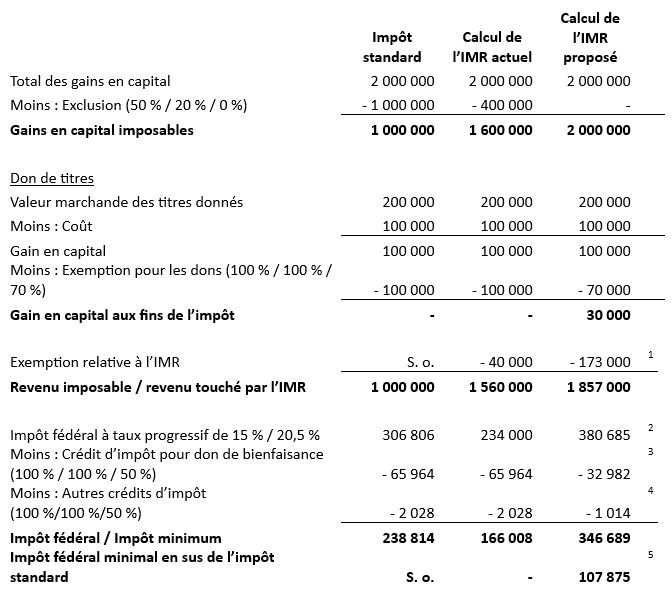

Néanmoins, pour ceux qui sont touchés par le changement proposé, la facture fiscale pourrait être salée. Voici comment l’IMR pourrait avoir une incidence sur une personne qui réalise un gain en capital important (p. ex., vente d’une entreprise ou d’un bien) et qui fait également un don important de titres cotés en bourse pour compenser une partie de l’impôt découlant de cette vente.

Scénario 1 : Le particulier réalise 2 000 000 $ de gains en capital et fait don de 200 000 $ de titres ayant pris de la valeur (pour un coût de 100 000 $).

1 L’exemption de base de l’IMR passe de 40 000 $ en 2023 au début de la deuxième tranche d’imposition fédérale la plus élevée, qui devrait être d’environ 173 000 $ en 2024.

2 Taux d’imposition marginal fédéral et tranches d’imposition pour 2023 utilisés pour calculer l’impôt standard.

3 Les crédits d’impôt fédéraux pour dons de bienfaisance sont évalués à 15 % de la première tranche de 200 $ des dons et à 33 % du reste lorsque le revenu imposable dépasse la tranche d’imposition marginale supérieure. À noter que la limite annuelle pour les crédits d’impôt de dons de bienfaisance est établie à 75 % du revenu net (100 % l’année du décès).

4 Les autres crédits d’impôt comprennent uniquement le montant personnel de base dans ce scénario.

5 Seul l’IMR fédéral est présenté à titre indicatif. Toutes les provinces et tous les territoires ont en place un impôt minimum et, dans la plupart des provinces, la composante provinciale de l’IMR est représentée en pourcentage de l’IMR fédéral.

Dans ce scénario, les changements proposés à l’IMR entraîneraient un impôt supplémentaire de plus de 100 000 $. Par le passé, l’IMR n’aurait entraîné aucun impôt supplémentaire en sus de l’impôt standard.

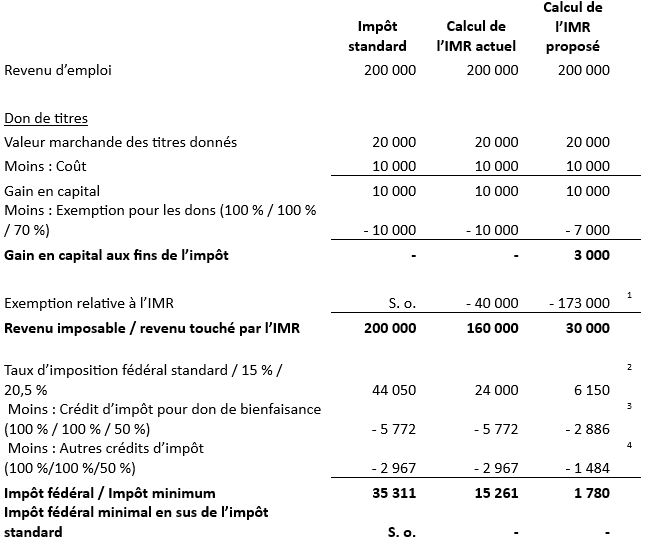

Les personnes à revenu plus modeste qui font de petits dons de titres ne feront pas face au même risque en vertu de la nouvelle formule de l’IMR.

Scénario 2 : Personne ayant un revenu d’emploi de 200 000 $ et faisant don de 20 000 $ de titres ayant pris de la valeur (pour un coût de 10 000 $)

1 L’exemption de base de l’IMR passe de 40 000 $ en 2023 au début de la deuxième tranche d’imposition fédérale la plus élevée, qui devrait être d’environ 173 000 $ en 2024.

2 Taux d’imposition marginal fédéral et tranches d’imposition pour 2023 utilisés pour calculer l’impôt standard.

3 Les crédits d’impôt fédéraux pour dons de bienfaisance sont évalués à 15 % de la première tranche de 200 $ des dons et à 29 % du reste lorsque le revenu imposable ne dépasse pas la tranche d’imposition marginale supérieure. À noter que la limite annuelle pour les crédits d’impôt de dons de bienfaisance est établie à 75 % du revenu net (100 % l’année du décès).

4 Les autres crédits d’impôt comprennent uniquement le montant personnel de base, ainsi que les montants liés au Régime de pensions du Canada (RPC), à l’assurance-emploi (AE) et à l’emploi au Canada dans ce scénario.

Ces deux scénarios soulignent les préoccupations des organismes de bienfaisance et des personnes à revenu élevé à l’égard des changements proposés.

Autres répercussions des changements proposés à l’IMR

Les propriétaires d’entreprise qui souhaitent quitter leur entreprise ou toute personne qui vend un bien immobilier secondaire, comme un chalet familial ou une propriété à revenu, devraient également porter une attention particulière aux changements à l’IMR. « Parfois, sur une année, les gens ont un revenu plus élevé en ce qui a trait à l’impôt, mais ils ne gagnent pas nécessairement un revenu élevé au sens traditionnel du terme, explique M. Haines. Maintenant, toute personne qui tire une proportion importante de son revenu de gains en capital au cours d’une année donnée pourrait être touchée par cette modification apportée à l’IMR. »

Tout travailleur à revenu élevé qui est en mesure de demander des déductions ou des crédits importants peut également être touché par le nouvel IMR. Les Canadiens qui tirent une partie importante de leur revenu de gains en capital (comme il est indiqué ci-dessus) ou de dividendes sont particulièrement visés, puisque le crédit d’impôt pour dividendes est retiré du calcul de l’IMR, explique M. Waters.

Gestion de votre facture d’impôt

Bien que les modifications à l’IMR n’aient pas encore été officiellement mises en œuvre, M. Waters affirme que l’établissement d’un fonds à vocation arrêtée par le donateur cette année pourrait être un moyen pour les personnes à revenu élevé d’opérer un certain contrôle sur leurs impôts, surtout si elles n’ont pas décidé de la façon dont elles veulent faire don de leurs fonds. Votre conseiller de BMO Gestion privée peut vous aider à établir un fonds à vocation arrêtée par le donateur dans le cadre du Programme de dons de bienfaisance de BMO. Vous pourrez ainsi obtenir immédiatement une déduction d’impôts sur le revenu au cours de l’année du don et distribuer les fonds pour l’octroi de subventions sur une longue période.

Un fonds de dons de bienfaisance, ou un fonds à vocation arrêtée par le donateur, est une solution clés en main qui vous permet, à vous et à votre famille, de collaborer pour faire du don une expérience mémorable. Un fonds à vocation arrêtée par le donateur vous offre une solution philanthropique hautement souple et personnalisable qui vous permettra d’avoir une incidence durable sur les causes qui vous tiennent à cœur.

Pour ceux qui s’attendent à une augmentation ponctuelle de leur revenu, ce qui aurait pour effet de les assujettir à l’IMR, M. Haines leur offre une lueur d’espoir. Ces personnes pourraient être en mesure d’obtenir le remboursement d’une partie ou de la totalité de leurs paiements d’IMR au fil du temps, explique-t-il, en soulignant qu’elles ont sept ans pour recouvrer l’IMR qu’elles ont payé au cours d’une année donnée. Il convient également de noter que l’IMR ne s’applique qu’aux particuliers et aux fiducies et ne s’applique pas aux sociétés ni à l’année du décès, ajoute-t-il.

« De toute évidence, les gens continueront d’être philanthropiques, indépendamment des avantages fiscaux qui en découlent », explique M. Waters, mais il croit que cela pourrait décourager ceux qui sont motivés par le côté fiscal du don. Il s’attend à ce que la plupart donnent toujours, mais peut-être moins ou plus stratégiquement que ce qu’ils auraient donné en vertu des anciennes règles.

BMO Gestion privée est un nom de marque du groupe d’exploitation qui comprend la Banque de Montréal et certaines de ses sociétés affiliées qui offrent des produits et des services de gestion privée. Les produits et les services ne sont pas tous offerts par toutes les entités juridiques au sein de BMO Gestion privée. Les services bancaires sont offerts par l’entremise de la Banque de Montréal. Les services de gestion de placements, de planification de patrimoine, de planification fiscale et de planification philanthropique sont offerts par BMO Nesbitt Burns Inc. et BMO Gestion privée de placements inc. Si vous êtes déjà un client de BMO Nesbitt Burns Inc., veuillez communiquer avec votre conseiller en placement pour obtenir plus de précisions. Les services de garde de valeurs ainsi que les services successoraux et fiduciaires sont offerts par la Société de fiducie BMO. Les entités juridiques de BMO Gestion privée n’offrent pas de conseils fiscaux. La Société de fiducie BMO et BMO Banque de Montréal sont membres de la Société d’assurance-dépôts du Canada.

MD Marque de commerce déposée de la Banque de Montréal, utilisée sous licence