Compte d’épargne libre d’impôt pour l’achat d’une première propriété

BMO Gestion privée - 27 octobre 2023

Le Compte d’épargne libre d’impôt pour l’achat d’une première propriété (CELIAPP) est un nouveau régime enregistré qui permet aux futurs acheteurs d’une première maison de cotiser jusqu’à 40 000 $ de manière non imposable afin d’épargner pour...

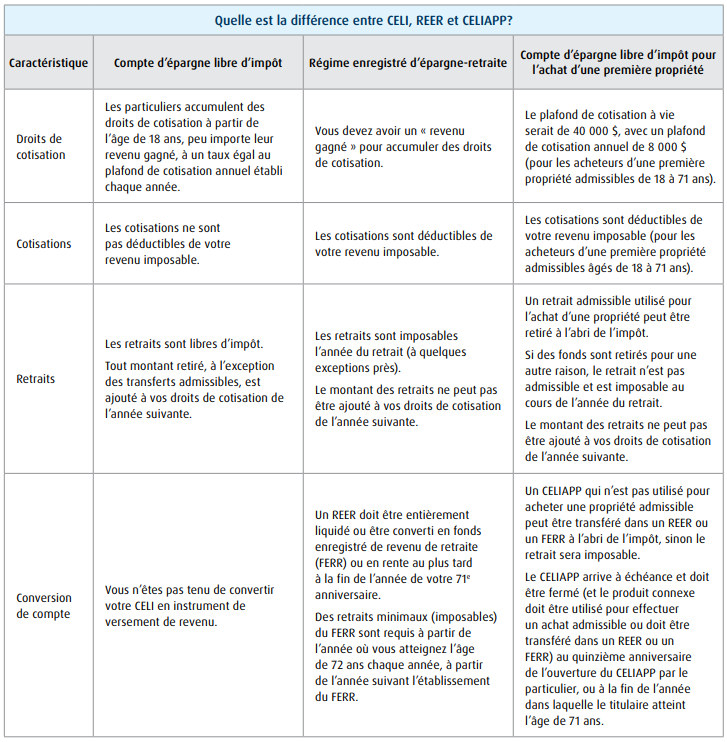

Le Compte d’épargne libre d’impôt pour l’achat d’une première propriété (CELIAPP) est un nouveau régime enregistré qui permet aux futurs acheteurs d’une première maison de cotiser jusqu’à 40 000 $ de manière non imposable afin d’épargner pour l’achat de leur première maison. Comme dans le cas d’un régime enregistré d’épargne-retraite (REER), les cotisations à un CELIAPP sont déductibles d’impôt et les retraits pour acheter une première maison, y compris à partir d’un revenu de placement, ne sont pas imposables, comme dans le cas d’un compte d’épargne libre d’impôt (CELI).

Proposé pour la première fois dans le budget fédéral de 2022, le projet de loi présentant le CELIAPP a reçu la sanction royale à la fin de l’année 2022, ce qui lui a donné force de loi. Cet article fournit des renseignements sur le CELIAPP et fournit des conseils de planification utiles à prendre en considération.

Caractéristiques du CELIAPP

Ouverture et fermeture du compte

Pour ouvrir un CELIAPP, la personne doit être résidente du Canada et avoir au moins 18 ans. De plus, la personne doit être un acheteur d’une première maison, ce qui signifie qu’elle n’a jamais vécu dans une maison qui lui appartenait, seul ou conjointement, à elle-même ou à son conjoint ou conjoint de fait, à tout moment au cours de la partie de l’année civile précédant l’ouverture du compte ou au cours des quatre années civiles précédentes.

Le CELIAPP arrive à échéance et doit être fermé (et le produit connexe doit être utilisé pour effectuer un achat admissible ou doit être transféré, de manière non imposable, dans un REER ou un FERR ou être retiré sur une base imposable) au quinzième anniversaire de l’ouverture du CELIAPP par le particulier, ou à la fin de l’année dans laquelle le titulaire atteint l’âge de 71 ans.

Placements admissibles

Le CELIAPP peut détenir les mêmes placements admissibles que ceux qui sont actuellement admissibles pour un CELI. Le contribuable peut détenir un large éventail de placements, notamment des fonds d’investissement, des titres cotés en bourse, des obligations d’État et de sociétés, ainsi que des certificats de placement garanti.

Les règles concernant les placements interdits et les règles concernant les placements non admissibles qui s’appliquent aux autres régimes enregistrés s’appliquent également aux CELIAPP, y compris les conséquences fiscales potentielles décrites dans cet article. Ces règles visent à interdire les placements dans des entités avec lesquelles le titulaire du compte a un lien de dépendance, ainsi que les placements dans certains actifs, comme des terrains, des actions de sociétés privées et des parts de société en nom collectif.

Cotisations

Le plafond cumulatif des cotisations est fixé à 40 000 $, avec un plafond de cotisation annuel de 8 000 $. Autrement dit, les particuliers peuvent cotiser le montant le moins élevé entre leur plafond annuel et leur plafond à vie.

Le plafond de cotisation annuel s’applique aux cotisations effectuées au cours de l’année civile. Les particuliers peuvent demander une déduction fiscale pour les cotisations effectuées au cours de l’année d’imposition. Contrairement au cas du REER, les cotisations versées dans les 60 premiers jours d’une année civile donnée ne peuvent pas être attribuées à l’année d’imposition précédente.

Le particulier peut reporter la partie inutilisée de son plafond de cotisation annuel, jusqu’à concurrence de 8 000 $. Cela signifie que s’il cotise moins de 8 000 $ au cours d’une année donnée, il pourrait cotiser le montant non utilisé (c.-à-d., 8 000 $ moins ses cotisations au cours de cette année) au cours d’une année subséquente, en plus de son plafond de cotisation annuel de 8 000 $, sous réserve du plafond de cotisation à vie. Par exemple, un particulier qui effectue une cotisation de 5 000 $ dans son CELIAPP en 2023 est autorisé à effectuer une cotisation de 11 000 $ en 2024 (c’est-à-dire 8 000 $ plus le montant restant de 2023, 3 000 $). Toutefois, les montants reportés ne commencent à s’accumuler qu’une fois que le titulaire a ouvert un CELIAPP pour la première fois.

Un particulier est autorisé à détenir plus d’un CELIAPP, mais le montant total qu’il cotise à tous ses CELIAPP ne peut pas dépasser ses plafonds de cotisation annuel et à vie. Il incombe au contribuable de s’assurer qu’il ne dépasse pas sa limite au cours d’une année donnée. L’Agence du revenu du Canada (ARC) a l’intention de fournir des renseignements de base sur le CELIAPP afin d’aider le contribuable à déterminer le montant qu’il peut cotiser au cours d’une année donnée.

Les cotisations versées à un CELIAPP à la suite d’un retrait admissible en vue de l’achat d’une première maison ne sont pas déductibles du revenu aux fins de l’impôt.

Cotisations non utilisées

Un particulier n’est pas tenu de demander une déduction du revenu pour l’année d’imposition au cours de laquelle une cotisation est effectuée. Comme dans le cas des déductions au titre du REER, le montant des cotisations peut être reporté indéfiniment et déduit au cours d’années d’imposition ultérieures (p. ex., si vous prévoyez vous trouver dans une tranche d’imposition plus élevée à l’avenir).

Imposition du CELIAPP

Les revenus, les pertes et les gains à l’égard des placements détenus dans un CELIAPP, ainsi que les retraits admissibles, ne sont pas inclus (ni déduits) dans le calcul du revenu aux fins de l’impôt ni pris en considération dans la détermination des prestations ou crédits fondés sur le revenu fournis dans le cadre du système d’impôt sur le revenu (par exemple, l’Allocation canadienne pour enfants et le crédit pour taxe sur les produits et services).

Retraits admissibles

Pour qu’un retrait CELIAPP soit admissible (c.-à-d., non imposable), certaines conditions doivent être respectées :

- Le contribuable doit être un acheteur d’une première maison au moment du retrait. Plus précisément, le contribuable ne peut pas avoir vécu à un moment au cours de la partie de l’année civile précédant le retrait ou à un moment au cours des quatre années civiles précédentes dans une maison que lui ou son conjoint ou conjoint de fait, seuls ou avec d’autres propriétaires, possédaient. Une exception permet aux particuliers de faire des retraits admissibles dans les 30 jours suivant leur déménagement dans leur première maison.

- Le contribuable doit également avoir conclu une entente écrite en vue d’acheter ou de construire une habitation admissible avant le 1er octobre de l’année suivant l’année du retrait et avoir l’intention d’occuper l’habitation admissible à titre de résidence principale dans l’année suivant l’achat ou la construction de celle-ci.

- Une habitation admissible est un logement situé au Canada. Une part dans une coopérative d’habitation qui donne au contribuable le droit de posséder un logement situé au Canada serait également admissible. Cependant, une part dans une coopérative d’habitation qui vous donne seulement le droit d’habiter le logement ne serait pas admissible.

Dans la mesure où le contribuable respecte les conditions de retrait admissibles, la totalité des fonds disponibles dans le CELIAPP peut être retirée à l’abri de l’impôt sous la forme d’un retrait unique ou d’une série de retraits.

Retraits non admissibles

Les retraits non admissibles sont inclus dans le revenu du particulier qui les effectue, aux fins de l’impôt sur le revenu. Les institutions financières sont tenues d’effectuer une retenue et de verser l’impôt sur les retraits non admissibles, conformément au traitement qui s’applique aux retraits imposables d’un REER.

Les retraits non admissibles ne rétablissent ni le plafond de cotisation annuel ni le plafond à vie.

Transferts

Il est possible de transférer les fonds d’un CELIAPP à un autre CELIAPP, à un REER ou à un FERR à l’abri de l’impôt.

Les fonds transférés dans un REER ou un FERR seront assujettis aux règles habituelles applicables à ces comptes, y compris l’imposition au moment du retrait. Ces transferts ne réduiraient pas ou ne seraient pas limités par les droits de cotisation inutilisés à un REER du particulier. Ces transferts ne rétablissent pas le plafond de cotisation à vie au CELIAPP du particulier.

Les particuliers sont également autorisés à transférer des fonds d’un REER à un CELIAPP à l’abri de l’impôt, sous réserve des plafonds de cotisation annuel et à vie du CELIAPP et des règles de placement admissibles. Bien que ces transferts soient assujettis aux limites de cotisation du CELIAPP, ils ne sont pas déductibles du revenu et ne rétablissent pas les droits de cotisation à un REER du particulier.

Lien avec le Régime d’accession à la propriété (RAP)

Le RAP est encore offert, conformément aux règles en vigueur. Le particulier est autorisé à effectuer à la fois un retrait de son CELIAPP et un retrait dans le cadre du RAP à l’égard du même achat d’une propriété admissible.

Cotisations à un compte de conjoint et règles d’attribution

Le titulaire du CELIAPP est le seul contribuable autorisé à demander une déduction pour les cotisations versées à son CELIAPP. Les particuliers n’ont pas la possibilité de cotiser au CELIAPP de leur conjoint ou de leur conjoint de fait et de demander une déduction.

Cela dit, un particulier pourrait cotiser à son CELIAPP avec des fonds qui lui ont été fournis par son conjoint. En règle générale, si un particulier transfère des biens à son conjoint ou conjoint de fait, les règles fiscales traitent tout revenu gagné grâce à ces biens comme un revenu du particulier. Une exception à ces règles d’attribution permettra aux particuliers d’utiliser les droits de cotisation au CELIAPP qui sont à leur disposition au moyen de fonds fournis par leur conjoint. Plus précisément, ces règles d’attribution ne s’appliqueront pas au revenu tiré du CELIAPP qui provient de ces cotisations. De même, il n’y aura aucune attribution du revenu gagné dans le cadre d’un CELIAPP si un parent donne des fonds à un enfant adulte pour qu’il puisse cotiser à son propre CELIAPP.

Rupture conjugale

En cas de rupture d’un mariage ou d’une union de fait, un montant peut être transféré directement du CELIAPP de l’une des parties à la relation au CELIAPP, au REER ou au FERR de l’autre partie. Dans de telles circonstances, le transfert ne rétablirait aucun droit de cotisation du cédant et il ne serait pas comptabilisé dans les droits de cotisation du cessionnaire.

Cotisations excédentaires, placements non admissibles, placements interdits et impôts sur les avantages

Comme pour les CELI, un impôt de 1 % sur les cotisations excédentaires versées dans un CELIAPP s’applique pour chaque mois (ou partie de mois) au montant le plus élevé de cet excédent durant ce mois.

Lorsque le plafond de cotisation annuel du contribuable est rétabli au début de chaque année civile, les cotisations excédentaires d’une année précédente pourraient cesser d’être des cotisations excédentaires. Le contribuable est autorisé à déduire un montant de cotisation excédentaire pour une année donnée au cours de l’année d’imposition où ce montant cesse d’être une cotisation excédentaire, mais pas avant. Toutefois, si un retrait admissible est effectué avant qu’une cotisation excédentaire cesse d’être une cotisation excédentaire, aucune déduction ne sera accordée pour le montant de la cotisation excédentaire.

Example :

Alyssa cotise 10 000 $ le 15 novembre 2023 et n’effectue pas de retrait. Cette cotisation dépasse de 2 000 $ le plafond de cotisation annuel au CELIAPP d’Alyssa.

Alyssa est assujettie à un impôt sur les cotisations excédentaires de 40 $ (1 % x 2 000 $ x 2 mois) lorsqu’elle produit sa déclaration de revenus de 2023 en 2024. Le montant de 2 000 $ cesserait d’être une cotisation excédentaire le 1er janvier 2024, car un nouveau plafond annuel de 8 000 $ est disponible.

Alyssa sera autorisée à déduire 8 000 $ de son revenu net de 2023. En supposant qu’Alyssa n’a pas effectué de retrait admissible entre le 15 novembre 2023 et le 1er janvier 2024, elle serait autorisée à déduire les 2 000 $ supplémentaires de son revenu net de 2024.

La Loi de l’impôt sur le revenu prévoit d’autres impôts dans certaines circonstances concernant des placements non admissibles, des placements interdits et des avantages involontaires à l’égard d’autres régimes enregistrés. Ces règles s’appliquent également au CELIAPP.

Le ministre du Revenu national a le pouvoir d’annuler ou de supprimer la totalité ou une partie de ces impôts dans les circonstances appropriées. Divers facteurs sont pris en considération, notamment le caractère raisonnable de l’erreur, la mesure dans laquelle les transactions qui donnent lieu à l’impôt donnent également lieu à un autre impôt et la mesure dans laquelle les paiements ont été effectués à partir du régime enregistré du contribuable.

Traitement au décès

À l’instar des CELI, les particuliers sont autorisés à désigner leur conjoint ou conjoint de fait comme titulaire remplaçant du compte, auquel cas le compte pourrait conserver son statut d’exonération d’impôt. S’il est nommé titulaire remplaçant, le conjoint survivant devient le nouveau titulaire du CELIAPP dès le décès du titulaire initial, à condition qu’il réponde aux critères d’admissibilité requis pour ouvrir un CELIAPP (voir le texte ci-dessus sous Ouverture et fermeture du compte). Le fait d’hériter d’un CELIAPP de cette façon n’a aucune incidence sur les plafonds de cotisation du conjoint survivant. Les CELIAPP hérités adoptent les échéances de fermeture du conjoint survivant. Si le conjoint survivant n’est pas admissible à ouvrir un CELIAPP, les montants qui s’y trouvent pourraient plutôt être transférés dans un REER ou un FERR du conjoint survivant, ou être retirés sur une base imposable.

Si le bénéficiaire d’un CELIAPP n’est pas le conjoint ou le conjoint de fait du titulaire décédé, les fonds doivent être retirés et versés au bénéficiaire. Les montants versés au bénéficiaire à partir d’un CELIAPP sont inclus dans le revenu du bénéficiaire aux fins de l’impôt, contrairement aux montants versés au bénéficiaire désigné d’un REER ou d’un FERR au décès du rentier. Lorsque de tels paiements sont effectués, ils sont assujettis à une retenue d’impôt.

Non-résidents

Les contribuables peuvent cotiser à leur CELIAPP après avoir quitté le Canada, mais ils ne sont pas en mesure de faire un retrait admissible à titre de non-résidents. Plus précisément, un contribuable qui retire des fonds d’un CELIAPP doit être un résident du Canada au moment du retrait et jusqu’à ce qu’il achète ou construise une propriété admissible. Les retraits effectués par des non-résidents sont assujettis à une retenue d’impôt.

Déductibilité des intérêts

Comme pour les REER et les CELI, les intérêts sur l’argent emprunté pour investir dans un CELIAPP ne sont pas déductibles du revenu imposable.

Garantie

Les contribuables doivent inclure dans leur revenu la valeur totale de tout actif détenu dans un CELIAPP et donné en garantie d’un prêt.

Faillite

Le CELIAPP ne serait pas protégé contre les créanciers en vertu de la Loi sur la faillite et l’insolvabilité.

Considérations relatives à la planification

- Les montants reportés du CELIAPP ne commenceront à s’accumuler qu’à partir du moment où le particulier ouvre un CELIAPP pour la première fois. Par conséquent, il peut être préférable d’ouvrir un CELIAPP plus tôt que prévu, afin de pouvoir bénéficier des montants reportés et d’atteindre un plafond de cotisation plus élevé. Cependant, n’oubliez pas qu’un CELIAPP a une durée de vie limitée (jusqu’à 15 ans, et seulement jusqu’à l’âge de 71 ans).

- Si vous êtes admissible à ouvrir un CELIAPP et qu’il est probable que vous allez acheter une propriété admissible dans les 15 années suivantes (et avant l’âge de 71 ans), mais que vos liquidités sont limitées, cotisez maintenant à votre CELIAPP (plutôt qu’à votre REER). Ainsi, vous pourrez tirer parti de la croissance des placements dans votre CELIAPP pour financer l’achat de votre maison au lieu de transférer jusqu’à 40 000 $ de votre REER vers un CELIAPP avant d’acheter une propriété. De plus, cette stratégie visant à cotiser à un CELIAPP n’aura aucune incidence sur vos droits de cotisation au REER (qui demeureront en place pour vos cotisations futures).

- Toutefois, vous pouvez transférer les actifs de votre CELIAPP à votre REER ou à votre FERR à l’abri de l’impôt, sans incidence sur vos droits de cotisation au REER, ce qui vous donne une certaine liberté d’action si vous n’avez pas utilisé votre CELIAPP pour acheter une propriété au cours de sa durée de vie de 15 ans (ou à l’âge de 71 ans). Cela donne un coup de pouce supplémentaire à votre épargne REER.

- Si vous n’êtes pas admissible à ouvrir un CELIAPP, mais que vous avez un enfant adulte (âgé d’au moins 18 ans) qui est admissible à ouvrir un CELIAPP et que vous souhaitez l’aider à acheter sa première maison, vous pouvez envisager de donner des fonds à votre enfant pour qu’il cotise à son CELIAPP. Ainsi, vous l’aiderez à épargner en vue de l’achat de sa première propriété admissible.

- Comme nous l’avons déjà vu, comme dans le cas des cotisations au REER, vous n’êtes pas tenu de demander une déduction pour l’année d’imposition au cours de laquelle vous cotisez à votre CELIAPP; vous pourriez préférer reporter votre déduction jusqu’à ce que vous vous trouviez dans une tranche d’imposition plus élevée afin de profiter d’économies d’impôt plus importantes.

- Étant donné que vous pouvez uniquement demander une déduction d’impôt sur le revenu pour les cotisations versées au titre du CELIAPP au cours d’une année civile donnée, il sera donc important de faire (ou d’envisager) des cotisations au CELIAPP avant la fin de chaque année civile (31 décembre) pour être en mesure de demander la déduction pour cette année civile. Contrairement au cas des REER, les cotisations au CELIAPP effectuées au cours des 60 premiers jours d’une année civile donnée ne peuvent pas être attribuées à l’année d’imposition précédente.

- Les types de placement admissibles à un CELIAPP sont très semblables aux types de placements qui peuvent être détenus dans un REER ou un CELI. Toutefois, en raison de la durée de vie limitée et de l’objectif très précis du CELIAPP, il sera essentiel de tenir compte du délai pour l’achat d’une propriété admissible afin de déterminer les placements appropriés pour votre CELIAPP. Comme dans le cas du REEE, où la répartition de votre actif peut changer au fil du temps à mesure que votre enfant approche des études postsecondaires (p. ex., passer d’un portefeuille axé sur la croissance pendant que votre enfant est jeune à une approche plus prudente axée sur la préservation et la liquidité à mesure que votre enfant avance en âge). il sera important de tenir compte du moment prévu de l’achat de votre propriété pour déterminer votre horizon de placement et la répartition de l’actif dans le cadre de votre CELIAPP.

BMO Gestion privée est un nom de marque du groupe d’exploitation qui comprend la Banque de Montréal et certaines de ses sociétés affiliées qui offrent des produits et des services de gestion privée. Les produits et les services ne sont pas tous offerts par toutes les entités juridiques au sein de BMO Gestion privée. Les services bancaires sont offerts par l’entremise de la Banque de Montréal. Les services de gestion de placements, de planification de patrimoine, de planification fiscale et de planification philanthropique sont offerts par BMO Nesbitt Burns Inc. et BMO Gestion privée de placements inc. Si vous êtes déjà un client de BMO Nesbitt Burns Inc., veuillez communiquer avec votre conseiller en placement pour obtenir plus de précisions. Les services de garde de valeurs ainsi que les services successoraux et fiduciaires sont offerts par la Société de fiducie BMO. Les entités juridiques de BMO Gestion privée n’offrent pas de conseils fiscaux. La Société de fiducie BMO et BMO Banque de Montréal sont membres de la Société d’assurance-dépôts du Canada.

MD Marque de commerce déposée de la Banque de Montréal, utilisée sous licence