Creating your Personalized Roadmap

Creating your Personalized Roadmap

Through our consultative meetings with you, we will be listening to your plans for the future and building a financial model in and around your needs and capabilities. This model is not static and will be updated yearly to make sure we’re staying on track with your financial plan. Most importantly, this will help us populate investments that meet your individual objectives, creating your personalized roadmap to financial success.

Client Risk Evaluation

Client Risk Evaluation

Retirement & Capital Return Analysis

When assessing your appropriate level of investment risk, a formal retirement and capital analysis is critical in understanding your needs versus goals. Using sophisticated planning tools we create a clear and cogent picture of your finances including retirement and financial planning.

Legacy Analysis

Many assets are a legacy to clients’ future family members. This may lead to complex estate and tax planning requirements. We can evaluate these needs and draw upon our in-house tax, legal and estate experts to provide you with the optimal solution for your family legacy needs. It is a great benefit to have these experts working together with us to build your family’s tax and wealth plan.

Goals

Every investor has unique goals. Our job is to understand your needs and customize a portfolio based on your specific objectives.

Asset Allocation

Asset Allocation

1. Proactive Asset Allocation

After we have assessed your investor profile we will employ a proactive approach to asset allocation. We use a sound framework to reduce emotional influences and make changes at appropriate times.

2. Secular Themes

As we see new opportunities arise in various sectors of the market we will be adopting new strategies.

3. Horizons

As your needs evolve or timelines change, we will constantly monitor your strategy to ensure it aligns with your personal or family’s financial needs.

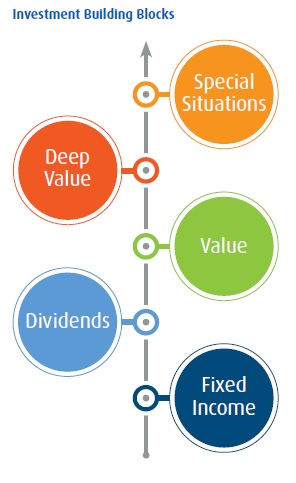

4. Investment Building Blocks

The framework of a portfolio is critical when allocating capital. We will ensure you have the necessary building blocks with the proper focus on your changing goals.

Macroeconomics

Macroeconomics

Backed by BMO Nesbitt Burns’ extensive Economic Research, we review National and International Economics and assess Income and Employment complementing in our Portfolio Analysis.

Assessing Current Global Economic Trends

Growth Money Flow

Unemployment Government policies

Inflation

Business Cycle

Today’s business cycles are widely believed to be irregular, varying in frequency, magnitude and duration. We are constantly evaluating data points to better understand where we are today and where we are headed.

Quantitative Analysis

Quantitative Analysis

Our up to date analysis and dynamic investment strategies are built using the following five guidelines:

- Growing earnings and dividend yield

- Low price to earnings relative to industry

- Low price/book relative to industry

- High return on equity

- Annual cash flow momentum

Your Portfolio

Your Portfolio

Your portfolio will reflect your risk assessment, time horizon, tax needs and cash flow requirements. It is the sum total of your Risk Evaluation, the Macroeconomic Outlook, Quantitative Analysis and appropriate Asset Allocation.

If there is a material change in your needs, the economic picture, a company’s outlook or BMO Nesbitt Burns’ interest rate outlook, Geoff will react dynamically within the market and adapt to the changing environment where required.