2025 Fall Newsletter

The Fortin Wealth Advisory Group - Oct 07, 2025

The Biggest Risk is The One That You Don’t Know About Yet | Christine

That title seems obvious right? Of course it is a risk if you can’t plan for it. As I write, it is the day after 9/11. A day that is my Generation X version of the Kennedy Assassination. This is to say that I remember exactly where I was, what I was doing and what my thoughts were in slow motion. Getting everyone in the house up to watch the TV as this was going to be history. And then the pit in my stomach when the 2nd plane hit, knowing this wasn’t an accident and the world would never be the same. And then the panic to call all of my friends in NYC.

For those that remember, the world literally shut down. War happened on North American soil. The investment markets fell out of bed.

Anyone who tells me that they planned for that sell off is lying. Full stop. There is going to be an approximate 20% selloff annually, so maybe you can plan for that, but you cannot with confidence say “I knew that was coming” because the risks that cause the jitters are ones that you didn’t know would happen. Remember Covid? We were in February of 2020 and the market was up about 14%, no one knew that the world would shut down a few weeks later and remain shuttered for months.

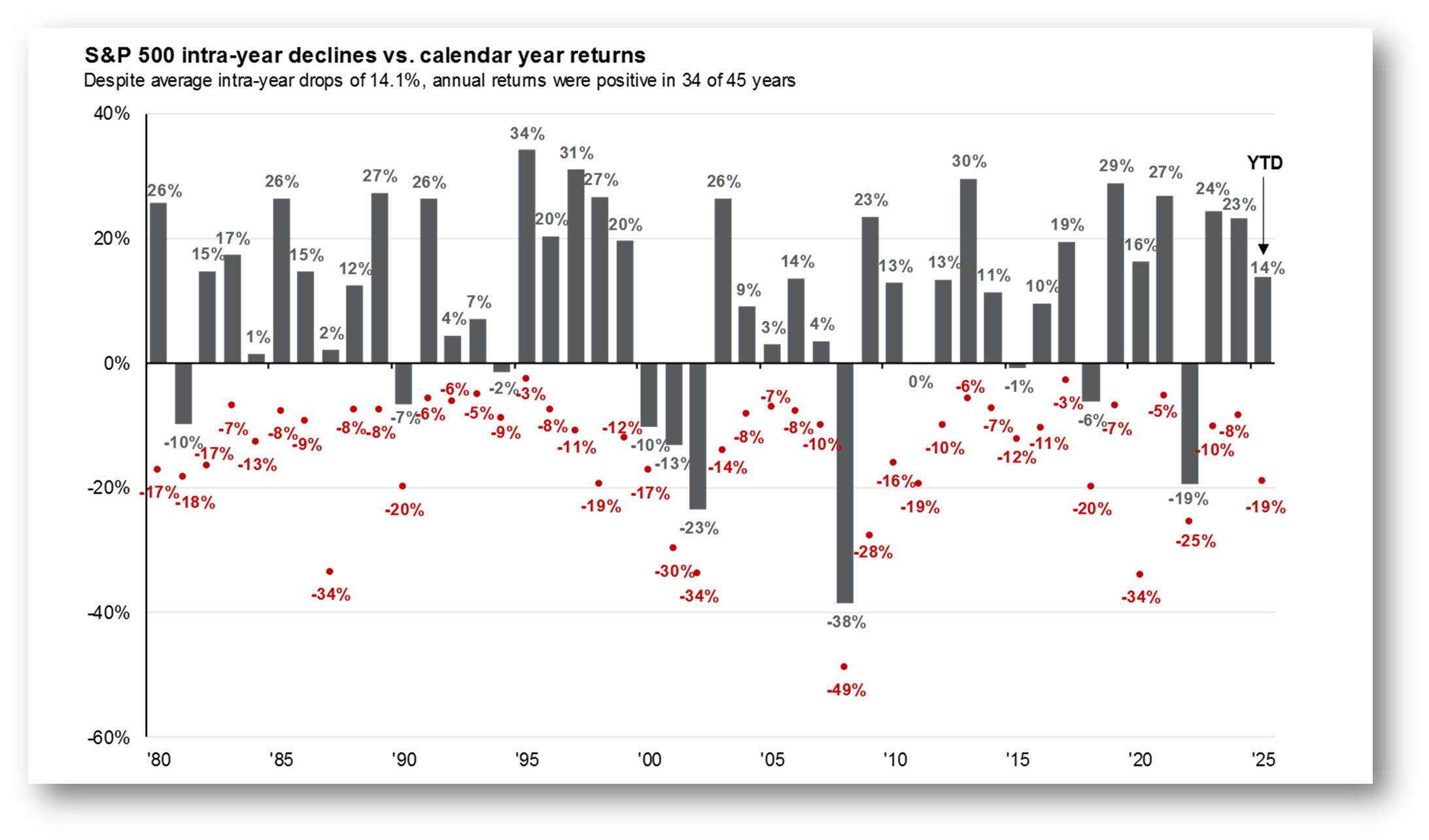

Take a look at the chart below.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Year-to-Date = May 14th, 2025

The grey bars represent the rate of the return for the S&P500 as of December 31 of each year depicted over the last 45 years. The red dots represent the lowest point that the S&P500 was at during the year.

I am on week 2 of fall reviews with clients and there is plenty of robust and grand debate around many political goings on. There is ALWAYS a political going on. Some clients have commented – what is going to happen with the markets given all of the tariffs and lack of agreements. Ok, let’s take a look than shall we? You see the red dot on the chart for 2025. -19%. I remember exactly where I was at that time. Having dinner with Sr. Economist at a conference for our top advisors nationally. In the US. And the market was falling out of bed. Why? Because a year ago we never thought that Trump would run for office. And then we certainly never thought he would get in, and then the risk that we didn’t see coming was the attack on the world with tariffs (we pretty much had prepared for Canada in some way… but the world? The Penguins?). And boom. The risk we never saw coming = -19%.

Had one panicked and said, we are never going to survive, and sat on the sidelines, missed the ensuing 29% return (what happened to sell in May and go away?) taking us to 10% on May 14th, 2025.

I expect I have made my point.

This reminds me of a VLOG that I recorded a number of years ago about Houdini. If you care to watch me talk for 5 minutes, please click on the following link The Fortin Wealth Advisory Group - Videos and Vlogs. For those who prefer to read on, here is the story.

Let’s talk about risk in investment portfolios.

There’s a story about Harry Houdini that really illustrates how risk works. We all know Houdini, he was famous for his daring stunts: escaping from chains, being buried alive, submerged underwater in locked boxes. But one of his most popular tricks was surprisingly simple. He’d stand on stage, call up the biggest man in the audience, brace his core, and let the man punch him repeatedly in the stomach. The crowd loved it, watching little Harry take hit after hit and stand strong.

But one day after a show, Houdini invited a group of college students backstage. One of them walked in and, without warning, started punching him in the stomach. Houdini wasn’t prepared. He doubled over in pain and asked, “What are you doing?” The student replied, “I thought this was the stunt you always do.” Houdini said, “Yes, but I wasn’t ready.”

The next day, Houdini woke up in agony. It turned out he had a ruptured appendix, likely caused by those unexpected blows. He died shortly after.

The lesson? Houdini could endure anything, if he was prepared. What ultimately killed him was the thing he didn’t see coming.

So when we talk about risk, it’s not just about how risky something is, it’s about whether you’re prepared for it.

Over the past decade, people have debated the risks of various economic policies, Obama’s tax reforms, Bernanke’s money printing, Trump’s unpredictability. But in hindsight, none of those were the real threat. The biggest risk was a virus no one saw coming. COVID-19 crippled the global economy, and it wasn’t on anyone’s radar.

This pattern repeats throughout history. The biggest disruptions are rarely the ones we’re talking about. We focus on trade deficits, quarterly earnings, elections, interesting topics, but not surprises. The true shocks come from events like Pearl Harbor, 9/11, or the collapse of Lehman Brothers. They hit hard because they’re unexpected.

So how do we protect ourselves from the unknown? How do we manage risk in our portfolios?

There are two key ideas:

Expectations vs. Forecasts

Getting Rich vs. Staying Rich

Let’s start with expectations vs. forecasts. Forecasts are guesses, about interest rates, tax policies, currency fluctuations. They’re rarely accurate and never perfectly timed. Expectations, on the other hand, are about knowing that something will happen eventually, even if we don’t know when.

Think of California and earthquakes. If you live there, you expect earthquakes. You don’t know when they’ll hit, but you prepare anyway. That mindset, expecting the unexpected, is a much better way to think about risk.

Now, getting rich vs. staying rich. These are two very different strategies. Getting rich means being optimistic, taking big risks, swinging for the fences. Staying rich means being cautious, conservative, and resilient, weathering recessions, pandemics, and market crashes. It’s about patience and preparation. And by the way, staying rich is exactly what Warren Buffett focuses on.

So when we evaluate risk in our portfolios, we need to ask: are we prepared for the things we don’t expect? Were we ready in 2020 when the world shut down? Could our investments withstand that kind of shock?

Because risk isn’t just about what might happen, it’s about what we’re not ready for. And that’s what can do the most damage.

Looking under the hood of the S&P 500 – additions, deletions and long-term growth | Ryan

With the S&P 500 index leading the way as the most recognized and referenced indexes globally it is important to review the companies that make up the index and how it has evolved over time. When looking at the long-term growth of the index over time many are astonished and amazed at its ability to continue to growth and compound at a strong rate.

As the global economy evolved and innovated so has the index and the companies within it. Since 1969, industrials went from a weighting of 33% down to 14% as technology companies moved up in representation from only 16 companies in 1969 to over 68 companies by 2010.

Below we highlight the changes in the 10 largest S&P500 holding from 1985 to 2024 to show the changes in the companies leading the market. It is important to note that during that period the S&P500 index as a whole experienced 12 corrections of 19% or more. As we can see below the leaders of the past in most cases are not the leaders of the future.

Source: Goldman Sachs, American Enterprise Institute

As Advisors our goal is to cut through the noise and help clients to invest in great companies across all stages of the business cycle from early expansion (small cap) to growth acceleration (Mid-cap) to mature companies (large-cap). As we can see from the chart above as the economy moved through many expansion and recession cycles not all companies recovered to take part in the next growth cycle. Some of the leaders from the past have now been removed from the index all together as new growth names enter to provide growth for the coming decades. By diversifying across difference asset class and investing globally we allow clients to experience lower volatility and focus on income generation to ensure cash-flow remains strong during down markets. As reviewed in our meetings we look to every market correction as an opportunity to identify the laggers and to look for opportunities in strong long term growth names that have been unfairly punished by the most recent media or economic headline dragging down the indexes.

Sources: Fisher Investments

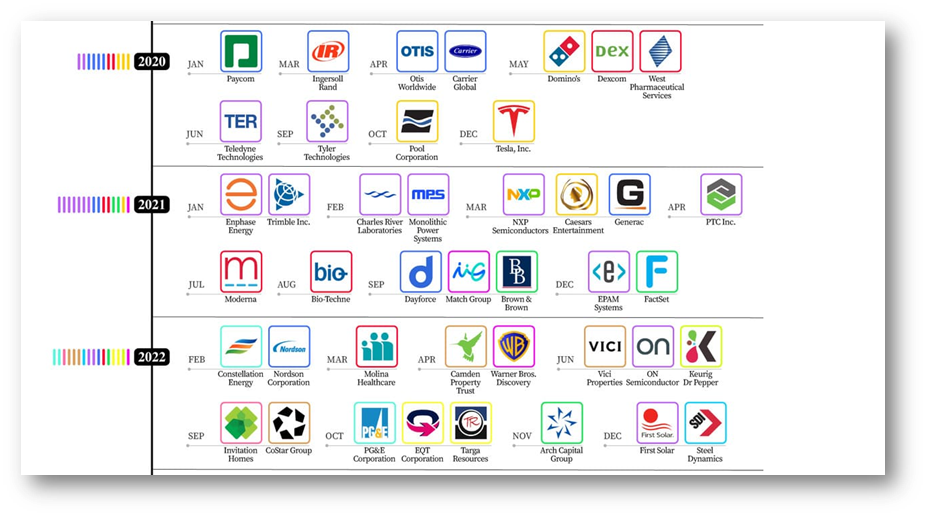

In March 2020, with the world shuttered due to Covid-19 in we saw the S&P500 sink -34% over the coming months. After time had passed and calmer heads prevailed, we saw the market rally back 50% to finish the year up 16%. During that rally we saw many new additions (below) and removals to the index as the economy and the way we conducted business changed and as part of portfolio management, so did the business we invest in.

Source: Madison Trust Company

Our key messaging to clients remains the same. Continue to invest in great companies that grow earning and income greater than inflation to help achieve long term success. Volatility and market correction are the price of admission to building wealth. We will continue to provide guidance in helping to ensure our clients are prepared for the economy today, tomorrow and decades to come.

Article Sources: A Timeline of the S&P 500 Companies by Date Added, Ranked: The Largest S&P 500 Companies Over Time (1985-2024), History of Companies and Industries Listed on the S&P 500 | QAD Blog, S&P 500 Stocks: List Of Additions And Removals In 2025 | Bankrate

EARN - Uncertainty to Opportunity: Navigating Volatility with Smart Strategies | Jordan

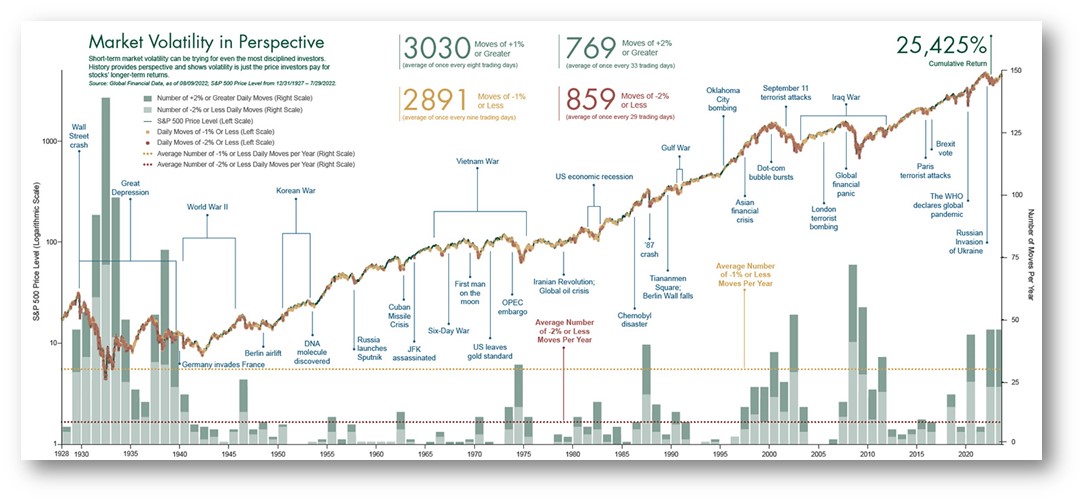

Throughout this newsletter we explore how the biggest risks are often the ones we never see coming. For this edition of our EARN series I want to touch on market volatility and explain how unexpected events can shake markets and challenge even the most seasoned investors. While we can’t always predict the next shock to the system, we can prepare for uncertainty by understanding market volatility itself: what it is, why it matters, and how to build a resilient investment strategy.

What Is Market Volatility?

Market volatility measures the rate at which the price of securities increases or decreases for a given set of returns. High volatility means prices move sharply in either direction, while low volatility indicates steadier, smaller changes. Volatility is influenced by economic news, geopolitical events, and investor sentiment.

Why Does Volatility Matter?

Volatility can create both risks and opportunities. For investors, it means the potential for higher returns, but also bigger losses. Navigating volatility is a core part of successful investing.

Proven Strategies to Mitigate Volatility

1. Stay Calm and Keep Perspective

Volatility is normal. Markets have always bounced back over time. Reacting emotionally—selling in a panic or chasing quick gains—can hurt long-term results.

2. Diversify Your Portfolio

Diversification means spreading investments across different asset classes and sectors. The more diversified your portfolio, the less likely you are to be severely affected by volatility in any one area.

3. Asset Allocation: Your Volatility Buffer

Asset Allocation is the process of choosing the right mix of investments for your goals and risk tolerance. It’s widely recognized as the primary driver of portfolio performance over time—more so than picking individual stocks or timing the market. I talked more extensively about Asset allocation in my previous EARN article and have a video posted to our EARN Videos page if this is something that sounds interesting. But here are some way that Asset Allocation is beneficial in times of uncertainty:

- Reduces Volatility: By investing in assets that react differently to market events, you can smooth out the ups and downs in your portfolio.

- Aligns with Goals: The right asset mix ensures your investments match your financial objectives and risk tolerance.

- Encourages Consistency: In volatile periods, a well-defined asset allocation helps you stay on course and avoid impulsive decisions.

4. Stick to Your Long-Term Plan

Short-term market movements shouldn’t derail your long-term strategy. Younger investors, especially, have time on their side and can afford to ride out volatility. For those closer to retirement, adjusting asset allocation toward more stable investments (like fixed income) can help preserve capital.

5. Review and Adjust as Life Changes

Your financial goals and risk tolerance evolve as you move through different life stages. Regularly reviewing your portfolio and making adjustments ensures you’re prepared for both opportunities and challenges that volatility brings.

Conclusion

Market volatility is an unavoidable part of investing, but it doesn’t have to derail your financial goals. By staying calm, diversifying, focusing on asset allocation, and sticking to your long-term plan, you can mitigate the risks and take advantage of the opportunities that volatility presents.

For more insights, I have attached one of my videos which summarizes this article. For more videos/articles on topics just like this one make sure to check out the earn series on our knowledge centre here.

What Nobody Discusses When Investing: Behavioral Risks | Dylan

Many investors prefer to time the stock market. They do this for two reasons: first, to minimize monetary losses when the market falls, and second, to maximize monetary gains when the market rises. This is a gamble that many investors take, but is it worth the risk?

What are Behavioral Risks?

Often, when individuals discuss the risks involved with investing, they tend to focus on three major topics: market volatility, inflation, and economic uncertainty. However, there is a fourth topic that is often overlooked – the ways our emotions can impact our investments. Pulling out of an investment due to fear of economic losses can cause more damage than simply leaving the investments alone. This is what a Behavioral Risk is. It is the tendency to allow one's emotions to influence investment decisions.

Investing, in theory, can be quite simple. Many people wrongly assume that a prerequisite to managing a profitable portfolio is to perfectly time the market. However, it is far more important to have a plan and remain committed to it. This gives investors, such as yourselves, the best chance at successfully growing your portfolio. This is because diligently following a plan eliminates the risk of investors accidentally timing the market incorrectly. A strategic investment plan alleviates the stress of "second-guessing" every trade made based on emotional decisions due to market volatility.

In sum, do not underestimate the power of one’s emotions when it comes to investing, especially excitement or fear.

The Risk of Timing the Market

Timing the market is the process of predicting the best times to buy or sell based on news or trends, with the goal of capturing market highs and avoiding market lows.

While many investors enjoy doing this because it gives them the illusion of having control over a market that appears to be beyond their control, the reality is that the consequences of timing the market almost always outweighs the benefits.

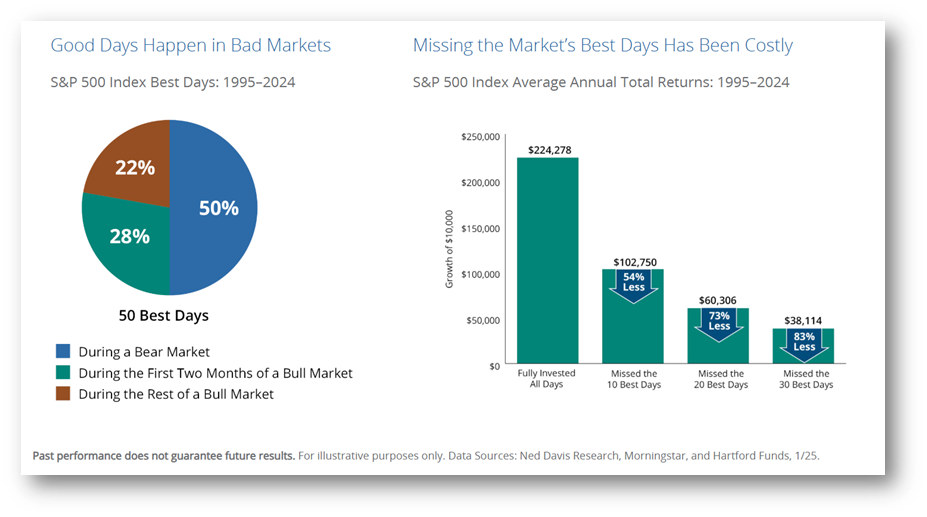

The two charts below explains why:

Source: Ned Davis Research, Morningstar, Hartford Funds

If someone tries to time the market and only misses 10 Best Days in a year, their return may be 54% lower than if they had left their money invested. Missing the 20 Best Days would reduce their growth by 73%.

To further illustrate the difficulties of "successfully timing the market," this graph shows that nearly half of the Best Days in the last 30 years occurred during bear markets. This is when fear and uncertainty are at their highest, and investors who time the market are typically too afraid to invest due to their emotions. As a result, they frequently miss out on the rare opportunities of when it is beneficial to time the market.

Furthermore, even professional investors struggle to time the market “correctly.” Reacting to headlines or economic forecasts can result in emotional decisions and missed opportunities. As the infographic above demonstrates, this will, in turn, eventually lead to poor long-term performance. Hence, this explains why a successful investor should focus on consistency rather than "perfect timing."

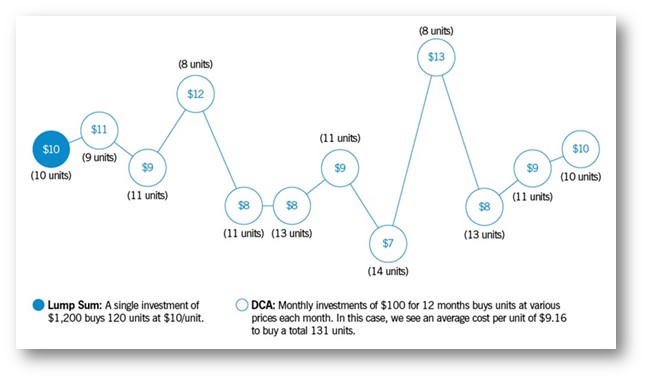

Hidden Strength of Dollar Cost Averaging

Dollar Cost Averaging (DCA) is investing a fixed amount on a regular schedule, regardless of market conditions. This keeps investors consistent and focused on their long-term investment goals. An example of DCA is a person who invests $1,000 bi-weekly regardless of market fluctuations.

Although investing large sums of money at once can result in higher returns in theory, this technique is not reliable in practice. The advantage of DCA is that it allows individuals to invest their money with confidence. It provides a reliable investment plan that is immune to emotional error.

Consider the dot-com bubble that occurred in the early 2000s. Individuals who made large investments during the bubble's peak had to recover for years after it burst. However, those who used DCA had an easier time recovering because they invested thorough this turbulent period rather than just at its peak. The chart below illustrates how consistent monthly investments of $100 accumulate over a year, in contrast to a one-time $1,200 investment made at the start.

Source: Co-operators®

DCA does not automatically protect you from losses, but it does help investors avoid the stress of investing large sums of money at the "wrong" time. This peace of mind is valuable because remaining consistent is integral for ensuring long-term investment success.

Instead of worrying about whether it is the "right" time to invest, DCA provides a consistent rhythm. When markets inevitably dip, DCA investors do not panic; instead, they buy at a discount. This shift in mindset transforms short-term losses into long-term opportunities.

Article Source: Timing the Market Is Impossible, Investing when markets fall

Robin Esrock’s Bucket List

Fall 2025

Travel personality and bestselling author Robin Esrock has reported from over 120 countries on 7 continents. We’ve invited him to share his latest travel inspiration.

GLOBAL DREAM FOR THE FALL: CRUISING ON THE DANUBE

The Danube River has flowed from the Black Forest to the Black Sea for millennia, carrying the dreams of empires, traders, pilgrims, and tourists too. River cruising is big business in Europe, and with over 80 vessels, Viking operates the continent’s largest and most modern fleet. Offering high-end dining, a lounge bar, sundeck, putting green and walking track, river cruises dispense with the logistical stress of Europe, so you spend less time navigating hotels, restaurants and transport, and more time visiting multiple destinations in comfort. You’ll find shoulder season is less crowded in the fall months, both on and off the boat. Cruising on the Danube between Germany’s historic Regensburg through Passau, Vienna, Budapest and other attractions, keep an eye out for the castles, monasteries and fortresses that dot the hills. Sign up for the tours or just explore each stop on your own, free from the hordes of high-season summer visitors.

CANADIAN DREAM FOR THE FALL: THE LAURENTIANS

Every autumn, the Laurentian Mountains explode in a riot of crimson, amber, and gold. The quintessential Canadian autumn postcard come to life across the mountains, lakes and forests, and there are various ways to take it all in. From the car, on a road trip from Montreal which is just an hour’s drive away. From above, with a scenic helicopter flight over the region. On the panoramic gondola at Mont Tremblant, cresting over the trees. For the more adventurous, you can fly between the trees attached to Quebec’s longest zipline. Bonjour Quebec, the province’s tourism agency, offer real-time updated Fall Foliage map to track the colours. If you miss the colours, wait a couple months for snow to blanket the region, and the Laurentian winter opens for business.

TIPS: Rise of the Sober Traveller

The low and non-alcoholic sector has exploded into a $13-billion-dollar industry, recording staggering year-over-year growth, with Canadians among its top international consumers. According to NielsenIQ, the overall market grew by over 35% in 2023, and 120% over the past three years. Much of this has to do with increased awareness for our physical and mental health. With demand comes the supply in the form of de-alcoholised spirits, mixes, wines and beer that – compared to products of the past – actually taste great. Better distillation and brewing techniques, sophisticated food science, and elegant bottling are creating a new world of beverages - light on calories, high on taste, with no or low alcohol, and zero hangovers. As a wine, whiskey and craft beer enthusiast, I don’t plan to quit the real stuff, but definitely see the healthy benefits of moderation, and alternating with non-alcoholic drinks to enjoy a long night without getting inebriated. My go-to non-alc craft beer: Phillips Brewing’s Iota.

DON’T QUOTE ME:

“There’s nothing wrong with the younger generation that becoming taxpayers won’t cure.” – Dan Bennett

Team Updates and Happenings

Christine

It was a busy summer at Christine’s home. The first stage of renovations are complete and now she turning to the yard over the winter.

As many know, Kase is heavily involved in Football, whereby practises start in June, so there is not much travel but we did get away to our Chalet and our favourite lake… and we seem to always now have a full vehicle bringing other kids.

Gordie, the resident Cavalier King Charles Spaniel X Poodle, at Christine’s became a big brother. Christine’s family adopted, Walter, from a puppy mill in northern BC. Walter is very timid and nervous and trusts his family now, but will likely have some lifelong trauma. Gordie isn’t so sure about losing the solo status given that Walter is glued to him.

Kase, has started fall tackle Football, as well as deciding to become a goalie with hockey. So what was 6 days a week is now 7 days with some days multiple sports. Also, Kase was invited to join a USA Football Travel Team for 7v7 football, North West Elite. Christine hopes the US/CAD FX improves.

Ryan

Summer involved lots of family time as Aanya and Reyna continue to explore the world. Aanya now 3 and a half continues to ramp up the activities as she embarked on Pre-k 3 times a week in Sept and has taken up ice skates and basketball along with her weekly music class. It is now the running joke as some days she carries a busier schedule than Ryan.

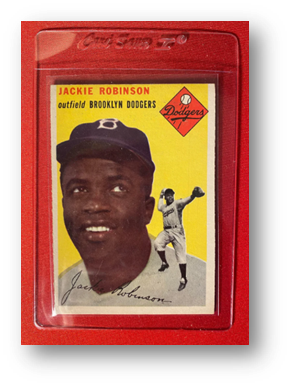

Ryan continues to stay busy with his weekly hockey team out in Burnaby and has continues to build on his hobby of investing and collecting high end sports cards. Ryan was able to get his hands on a 1954 Jackie Robinson and recently added some vintage baseball cards from 1888 and 1912, truly a piece of history.

Jordan

Jordan has reached an exciting milestone this season, he officially completed his CIM designation, and the team couldn’t be prouder of his achievement. It’s a testament to his dedication and hard work, and we’re thrilled to see him take this next step in his professional journey.

Outside of work, Jordan moved into his very own apartment. It’s his first time living solo, and we wish him all the best as he settles into his new place in Langley.

Dylan

Dylan had the opportunity to travel to Southeast Asia this summer, with his first stop being the stunning countryside of Vietnam.

One highlight was the famous Ha Giang Loop, a scenic motorcycle route located about six hours north of Hanoi. Dylan described the three-day bike tour as “like riding the Sea-to-Sky Highway, but stretched out over three days of nonstop beauty.”

Dylan had the chance to try authentic Japanese Sashimi while visiting Tokyo. His biggest take away? Vancouver truly holds its own and he didn't notice a significant difference in the quality. Vancouver definitely has some of the best food in the world. When asked which destination he preferred, he said the cultures are so distinct it’s like comparing apples to oranges and simply can’t choose. Both countries offered such a own unique charm that he would return in heartbeat. If anyone’s looking for travel inspiration, Dylan highly recommends Kyoto and Ho Chi Minh City as his top picks.