2024 Spring/Summer Newsletter

Fortin Wealth Advisory Group - Jun 27, 2024

How Psychological Safety Drives Our Daily Successes

My article for our Newsletter is typically inspired by conversations that I have been engaged in recently. It seems like Team Dynamics is at the forefront of many interactions that I am having. As we onboard new team members, it is my responsibility to ensure that we have psychological safety. Our overarching firm needs to ensure that the leadership team is dialed into the needs of us as entrepreneurs. My in-laws need to have the dysfunctions addressed. Our enterprise families that we serve struggle with team dynamics AND affluent families have dynamics that are emotionally driven by years of relationships and REALLY need to ensure that they have psychological safety locked down.

Effective teams and families are so incredibly rare, however there are recommendations to eliminate barriers that lead to the dysfunction.

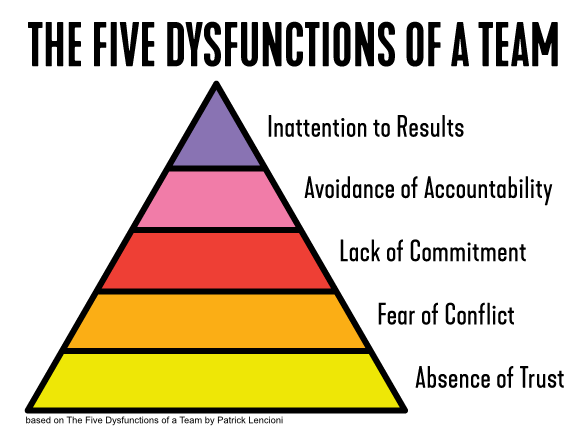

What is Lencioni’s Five Dysfunctions of a Team/Family

As pictured below, similar to the eating it right pyramid, all these areas need to be dialed in for the team to have proper dynamics. Starting from the bottom. Each level on the pyramid is influenced by the dysfunction in the lower level. You cannot address Avoidance of Accountability if you haven’t addressed Absence of Trust.

So, how do we define each of these and what are their impacts. For the purposes of this article, I am going to interchange family and team but understand they have the same applications.

- Absence of Trust. Families who lack trust conceal weaknesses and mistakes, hesitate to ask for help, jump to conclusions about the intentions of others, hold grudges and dread meetings.

- Fear of Conflict. A lack of trust leads to the fear of conflict. In these companies and families, employees and family members worry more about politics and personal risk management than solving problems. Meetings are often boring because controversial topics are avoided.

- Lack of Commitment. When families become conflict-avoidant, a fear of failure develops. These teams have difficulty making decisions and second guess themselves.

- Avoidance of Accountability. Second-guessing and a lack of common objectives then leads to an inability to develop standard for performance. Families miss deadlines and delivery mediocre work.

- Inattention to results. When teams lack focus and clear objectives, team members stagnate, become distracted and focus on themselves.

How did I come to learn of Lencioni’s Five Dysfunctions of a Team?

A number of years ago Google was disjointed. Filled with ultra brilliant MIT and MIT type employees who were bred to be fiercely competitive with each other in school. They brought that attitude to the workplace and you can imagine without effective leadership what would have ensued. There was a complete lack of trust and the teams filled with the most brilliant individuals in the world were producing sub par results. Once the leadership of Google were able to effectively address and implement strategies to overcome dysfunction – their productivity and intellectual prowness of creativity flourished. It was years and not without a lot of effort and cost.

Strategies for Overcoming the Five Dysfunctions

While Fortin Wealth is no Google, I still read the book annually just to ensure that I am not getting lazy around ensuring our meetings allow for a flat boardroom table where everybody’s input matters AND no one is signaled out for their input. Further, I find that most of my skills gained as a leader for the last 27 years have allowed me to become effective in identifying and trying to accommodate family dynamics where I see that these dysfunctions exist.

So, I will leave you with a number of strategies that you can implement either in your Family Enterprise, or your Family Dining Room Table to overcome these dysfunctions. The one caveat – is that they must be led by the head of the household… or more conflicts will ensue.

- Creating a culture of trust. The head of the family must create an environment where family members feel safe to be vulnerable and share their honest thoughts and feelings. This can be done by being transparent, demonstrating vulnerability, and encouraging open communication.

- Encouraging healthy conflict. So often family heads shy away from conflict. They try to interfere and mediate behind closed doors. This leads to further lack of trust. Instead, they must encourage healthy debates and ideological disagreements within the team. This can help to ensure that all perspectives are considered and that the best possible decisions are made.

- Getting buy-in for decisions. Leaders and family heads must ensure that all team members have a clear understanding of the team’s goals and objectives, and that they are committed to making decisions that are in the best interests of the team. This can be done by involving team members in the decision-making process and by getting their buy-in before moving forward.

- Holding Family members accountable. Family heads must create a culture of accountability where team members feel comfortable speaking up when they see something that is not right, and where there are clear consequences for poor performance/behaviour. This can be done by setting clear expectations, providing regular feedback, and taking corrective action when necessary.

- Focus on the results. The family head must keep the family’s goals top of mind and ensure that everyone is working towards the same objective. Celebrate successes as various family members contribute to the greater good of the overall family! Provide guidance when one family member is struggling and get them back on side.

Building a strong family culture is not easy, but it is essential for the success of the family and their legacy, not to mention to ensure that the relationships are strong and deep.

*Source: The Five Dysfunctions of a Team. Patrick Lencioni.

Indexing/Passive Vs. Direct/Active Wealth Management

In the world of investing there are different styles that investors can utilize from Indexing/passive to direct and active wealth management. Different styles can play different roles in the construction of a client’s overall portfolio, and it is important to note the benefits and draw backs, and how each can play a part in helping to achieve the ideal portfolio solution.

Diversification

Indexing/Passive Investing is effective style for those starting out or accounts with smaller investment balances as it allows individuals the ability to diversify across many different markets such at the S&P 500, TSX and International markets through a small basket of ETF (exchange traded fund) or Mutual Fund. While some of the main advantages is the ease of use and access, we need to determine when this style and approach is beneficial to a client’s overall wealth profile, and when additional strategies should be utilized.

Direct Investing and active management not only allows for diversification but give investors the ability to customize their portfolio right down to an individual company or bond position. This allows for the addition of equity or fixed income positions that may not be captured in an index fund and can allow for tactical changes to be made when necessary. The ability to rebalance and tactically change positions within a certain sector or geography also helps to reduce the overall volatility in a portfolio which we will discuss next.

Market Volatility

Market volatility can be defined by the frequency and magnitude of price movements both to the upside and downside1. With indexing approach you are exposed to the full effects of the markets movement, which when to the upside bares minimal impact to ones emotions. When taking into consideration the effects of negative volatility though periods of market corrections we risk feeling personal and emotional discomfort which can potentially lead to irrational investment decisions. For example, during the height of the Covid-19 market correction in March 2020, we saw the S&P 500 and Nasdaq correct 32% and 27% respectively over a 6 week period2. For most this level of volatility is unsettling. Active management and direct investment allow for investor to tactical buy and sell individual holdings through these periods in an attempt to help reduce the overall volatility in ones portfolio. By reducing the amount of downside capture during these period of market corrections, one can look to achieve stronger risk adjusted returns while also creating a smoother ride further reducing the risk of emotional interference.

Tax Planning

For HNW/UHNW clients the ability to control your taxable income is a powerful tool as incomes can fluctuate on an annualize basis. By utilizing only an indexing/passive investment style there is an inability to fully control the funds holdings which removes the ability to tax loss harvest on a personal or corporate level. Tax loss harvesting is the process of managing one’s individual capital gains taxes by allowing the Manager the ability to sell off certain holdings in order to trigger a loss and reduce a clients overall realized capital gain. This became even more important most recently with the proposed changes to capital gains inclusion rates. Active/Direct investment portfolio managers were able to strategize and review each individual’s portfolio and review area of opportunity for triggering gains at the lower inclusion rate prior to the June 25th deadline. We will talk more about the tax changes later in this newsletter.

Market Access

Indexing while a viable investment strategy does require an index or benchmark of publicly traded equities and fixed income in order to allow the product to be aligned too. With the rise of Private market portfolios targeted at helping HNW/UHNW clients further diversify their portfolios we are forced to utilize Private Equity and Fixed Income mangers as access and construction of Private Market portfolios requires intensive research and high level of manager involvement to help drive strong returns for investors. As a result, access to these types of private markets would require the use of Active and Direct investment as each fund/vintage is custom built from the ground up.

Conclusion

While there are different styles to investing the key messaging is that there is no one size fits all model. Investment portfolios should be built and constructed based on the goals and wealth plan of an individual. Indexing works well in small accounts such as RESP, TFSA, FHSA and small LIRA’s. As portfolios become large in asset base they may start to require more handling in order to customize and tailor the holding for liquidity, cash flow and tax planning conditions. When entering more unique investment vehicles such as Private Equity and Debt we look to sophisticated asset managers in the active management space as indexing and passive investment just don’t exist. In summary, most investors should feel comfortable blending different investment styles as each can play a role in driving success to the overall portfolio and Wealth Plan.

1: What Is Stock Market Volatility? – Forbes Advisor

2: Google Finance Performance Chart History

Proposed Changes to Capital Gains Inclusion Rates

In the 2024 Federal Budget tabled April 16, the government announced changes to the capital gains inclusion rate from one-half to two-thirds. On June 10, 2024, the government tabled legislation that brings these changes to Parliament on a stand-alone basis and not part of any other budget legislation.

Summary:

- An increase in the capital gains inclusion rate from one-half of the capital gain to two-thirds of the capital gain effective for gains realized on or after June 25, 2024.

- The change in rate is applicable to capital gains realized by all taxpayers, except that individuals will have an annual threshold of $250,000 of capital gains that will be taxed at the one-half inclusion rate. The June 10 proposals extend this threshold to graduated rate estates and qualified disability trusts.

- For tax years that begin before and end on or after June 25, 2024, two different inclusion rates would apply and therefore transitional rules will be required to separately identify capital gains and losses realized before June 25, 2024, and those realized on or after June 25, 2024.

- Net capital losses of prior years will continue to be deductible against taxable capital gains realized by adjusting their value to reflect the inclusion rate of the capital gains being offset. This means that a capital loss realized prior to the rate change would fully offset an equivalent capital gain realized after the rate change.

Special rules for individuals:

- In this context, individuals include a reference to graduated rate estates and qualified disability trusts, but not any other type of trust.

- The $250,000 threshold will apply to capital gains realized by an individual, either directly or indirectly through a partnership or trust.

- The annual capital gain threshold applies net of:

- Current year capital losses;

- Capital losses from prior years applied to reduce current year capital gains; and

- Capital gains in respect of which the lifetime capital gains exemption, the proposed employee ownership trust exemption, or the proposed Canadian entrepreneurs’ incentive (CEI) is claimed. (See 2024 Federal budget insights).

- If an employee stock option benefit is realized, and the employee is entitled to an employee stock option deduction, the deduction will be one-third to reflect this new capital gains inclusion rate. However, employees will be entitled to a deduction of one half the taxable benefit up to a combined limit of $250,000 for both employee stock options and capital gains.

Source: BDO Canada 2024 Federal Budget | BDO Canada

BMO Article: 2024 Federal Budget Review A Deeper Dive into the Proposed Increase to the Capital Gains Inclusion Rate

Financial Literacy for the Next-Generation

Credit Cards: An Introduction to Debt

Credit cards are a great way to introduce you to the world of debt. The word “debt” will sometimes form a sour taste people’s mouth. However, it is a very powerful tool that, when used in the right way, has many benefits.

So, why should someone use a credit card?

- Nowadays it is much easier to use a credit card in cash. In fact, there are some businesses that won’t accept cash anymore. A credit card is a great way to make purchases without always carrying physical cash on you.

- Secondly, if your card is lost or stolen, you will more than likely be reimbursed for any fraudulent charges. Whereas, if you were carrying cash there would be no option of being reimbursed.

- Thirdly, most credit cards will offer some sort of rewards program and/or cashback option. If you have a high amount of spending, whether it be on dining or flights, you can take advantage of certain cards that will offer higher rewards on these types of purchases.

- Lastly, credit cards are a way to boost your credit score. When you properly use a credit card it shows potential lenders you are a good credit risk. By purchasing and paying off your credit balances monthly you are bolstering your credit reputation which makes it easy for banks to give you money.

Now there aren’t only pros when looking at getting a credit card. We must look at some of the cons in order to decide if this would be right for someone’s current situation.

Cons:

- Some credit cards are known for having fees attached to the card. Some cards will have a monthly fee associated with owning a card, and some yearly. There is no set fee a credit card as some cards range from $0 to upwards of $5,000 a year.

- If you do end up missing a payment, then you will end up paying interest on the balance. On a credit card interest can be high. Say your credit card is 30%, this means if you have an outstanding balance of $1,000 you would be paying roughly $25 of interest each month.

- Lastly, having a credit card means you will need to have self control. Having access much more funds than you potentially have on hand could lead to problems with debt. Making sure you have a plan in place and keeping track of your spending is the best way to stay on top of this.

Below is a visual that shows how credit cards work, the implications of overdue payments, and the difference between them and debit cards.

Credit cards have many useful purposes, although there are cons for many people the pros of using a credit card far outweigh the cons.

Sources:

Government of Canada

How credit cards work - Canada.ca

Choosing a credit card - Canada.ca

Robin Esrock’s Bucket List

Travel personality and bestselling author Robin Esrock has reported from over 100 countries on 7 continents. We’ve invited him to share travel inspiration.

A Dream for the Global Bucket List

Sail a Tall Ship in the Caribbean

Unless you personally know someone with a 16-sail, 62m-high, 15m-wide and 110m-long luxury tall ship, chances are you’d never get to sail one. Fortunately, Swedish-owned Star Clippers has a fleet of them, pampering guests with spectacular sailings around the world. Consider boarding their Star Flyer for a week-long sail around the British Virgin Islands. Among sailing enthusiasts and first-timers, you’ll get to explore stunning coves, beaches and island communities where big cruise ships simply cannot go. Star Flyer accommodates up to 160 passengers and 74 crew, combining luxury (think polished mahogany and brass interiors) with soft adventure (climb the mast and feel that wind!) Best spot on the yacht is the bowsprit, a thick, hammock like netting at the front of the ship where I felt the spray of the ocean, and spotted curious dolphins beneath the waves. Seasoned cruise veterans raved the Star Flyer was their favourite cruise ship of all. Sailing is just a different way to do it, and since it burns just 15% of the fuel of a similar sized ship, it’s an eco-friendly way to cruise as well. You can read my full report here.

A Dream for the Canadian Bucket List

On the trail in Newfoundland

When I travel in Newfoundland, I’m always struck how locals put BC at the top of their Canadian Bucket List, just as locals in BC put Newfoundland at the top of theirs. It’s a different world on ‘The Rock’ - with those accents that fell off the boat somewhere between Ireland and North America. Consider walking it. Great Canadian Trails offer a week-long package that curates highlights of the East Coast Trail, a stunning coastal track overlooking the Atlantic. Carrying just a day pack, your bags are shuttled ahead to homely B&Bs, the meals are sensational, and a local character shuttles you around. It’s all about the people you meet, and in Newfoundland, they’re just as memorable as the sweeping views. You’ll also encounter whales, puffins, historical landmarks, and everything that makes Newfoundland so fascinating. If you’d like to learn more, check out my story for Canadian Geographic. This one was quite personal: my father had recently kicked cancer, and I insisted he join on the bucket list hike of a lifetime. What are you waiting for?

Pro Travel Tips:

I used to always drink tomato juice on flights. It must help in some way, I figured, otherwise why would they serve it? A friendly flight attendant set me straight.

"Do your feet swell up on planes?” she asked me. They do! “Then stay off the salty tomato juice!” Incredibly high in sodium, tomato juice is the worst liquid to put into your body in a pressurized cabin, and coffee, pop or alcohol are not much better. Stay hydrated with water. A pro trip for long-haul flights is to wear a pair of compression socks (nowadays marketed as fashionable energy socks). You’ll notice an immediate difference on arrival, with your legs and feet feeling fresh and ready to take on any new adventure.

Let’s Go:

I’m delighted to recommend quality tour operators and travel agencies I know will look after you and offer exclusive perks. Interested in a luxury or exotic family-friendly holiday to Asia, Africa, Central or South America? You should be! Connect with Gideon at Vancouver-based Quivertree Family Expeditions. Family vacations can be so much more. Just ask Christine! Because she used Quivertree to plan her African and European trip last summer.

Happenings

Christine traveled to Tulum for the annual President’s Council Conference in Tulum. The conference is a way to celebrate the top practices nationally and is a great way for Christine to share best practices and challenges with her fellow advisors.

Christine has been a part of the inaugural program that supported mid-career women advisors. She is so excited that BMO has a program that, promotes the development of woman advisors. It wasn’t all business as Christine and her fellow advisors had a great time attending the Madonna concert.

OLB (outdoor land based) education is 'Indigenous land-based education which has implications for science, culture, politics, language, environmental stewardship, land rights, reconciliation - and the future of the planet" *UNESCO. Christine is very excited that her son Kase will be joining the Surrey School District's first Outdoor Land Based school in the fall of 2024. Click here for a link to an article that provides a better understanding on the intricacies of Indigenous Land-Based Education.

Breitling, a privately owned family organization represents one of the private companies that our clients own in their private equity portfolio. Last week I had the opportunity to spend time up close and personal with drool worthy watches, controlling owners of Breitling, and some of their long standing employees to learn about the history and how they are changing the game internally to become one of the world's top 5 watch companies.

Thrilled that our discerning clients get to financially benefit as owners as well in this extraordinary re-birth of a long standing company that is a chronograph company that happens to build watches.

Ryan and Amm welcomed the birth of their second child in March. Baby Reyna is the newest addition to the Lidder household and Aanya is enjoying her new role as big sister.

May is a busy month for Ryan as its Amm’s Birthday, Mothers Day and their big 5 year Anniversary. They were able to lean on some Family for babysitting and headed on down to Rogers Arena to catch the Canucks vs. Oilers for some playoff hockey. Ryan is a Anaheim Ducks fan for those wondering where his Canucks jersey is…. (fun fact)

Jordan had a great time heading down to Seattle for his first MLB game. He definitely looks forward to traveling down to catch more games in the future.