2023 Winter Newsletter

Fortin Wealth Advisory Group - Feb 01, 2023

Our 2023 Annual Letter to Our Clients

Part One: General Principles

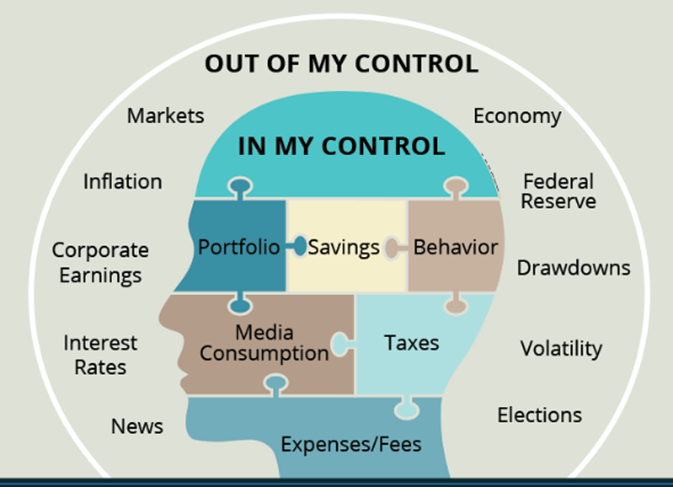

- It will be worth restating, even in the context of a letter primarily focused on the year just past, our overall philosophy of investment advice. It is goal-focused and planning-driven, as sharply distinguished from an approach that is market-focused and current-events-driven. Long-term investment success comes from continuously acting on a plan. Every successful investor I've ever known was acting continuously on a plan; failed investors, in my experience, get that way by continually reacting to current events in the economy and the markets.

- We and our clients are long-term, goal-focused, plan-driven investors. We believe that the key to lifetime success in equity (private or public) investing is to act continuously on a specific, written plan. Likewise, we believe substandard returns and even investment failure proceed inevitably from reacting to (let alone trying to anticipate) current economic/market events.

- We're convinced that the economy cannot be consistently forecast, nor the markets consistently timed. Therefore we believe that the only reliable way to capture the full long-term return of equities is to ride out their frequent but historically always temporary declines.

- Just in the last four decades or so, the average annual price decline from a peak to a trough in the S&P 500 exceeded 14%. One year in five, the decline has averaged at least twice that. And on two occasions (in 2000-02 and 2007-09), the Index has actually halved. Yet the S&P 500 came into 1980 at 106, and went out of 2022 at 3839.50; over those 43 years, its average annual compound rate of total return (that is, with dividends reinvested) was more than 12%.

- These data underscore our conviction that the essential challenge to long-term successful equity investing is neither intellectual nor financial, but temperamental: it is how one reacts, or chooses not to react, to market declines. We mostly feel that as advisors we would have been well served with a Psychology degree v. an Economic one.

- As long as your long-term goals haven't changed, as a general statement, we, The Fortin Wealth Advisory Group, have found that the more often investors change their portfolios (in response to the market fears or fads of the moment – just look at the recent bitcoin and tech cos with lack of earnings fad), the worse their long-term results.

- In sum, our essential principles of portfolio management remain unchanged. (1) The performance of a portfolio relative to a benchmark is largely irrelevant to the long-term financial success. (2) The only benchmark we should care about is the one that indicates whether you are on track to accomplish your financial goals. (3) Risk should be measured as the probability that you won't achieve your goals. (4) Investing should have the exclusive goal of minimizing that risk.

- These principles are not only our bedrock convictions but will continue to govern the essentially behavioral nature of our advice to you in the coming year…and beyond.

* Sources: Standard & Poor's; Yahoo Finance; J.P. Morgan Asset Management “Guide to the Markets” (p. 16); S&P 500 Return Calculator with Dividend Reinvestment, DQYDJ.com.

Part Two: Current Observations

- Unrelieved chaos continued in 2022. The central drama of the year—and, it seems likely, of the coming year—was the Federal Reserve's belated but very aggressive efforts to bring inflation under control.

- After rising seven times in the nearly 13 years between the trough of the Global Financial Crisis (March 9, 2009) and this past January 3, the U.S. equity market sold off sharply; at its most recent trough in October, the S&P 500 was down 27%. (Bond prices also swooned in response to sharply higher interest rates.)

- It seems to me more than a little ironic that, after the serial nightmares through which it's suffered since the onset of the pandemic early in 2020, the mainstream equity market managed to close out 2022 somewhat higher than it was at the end of 2019 (3839.50 versus 3,221, a gain of 19.25%). Not great, but not at all bad for three years during which our entire economic, financial, political and geopolitical world blew up.

- If anything, this tends to validate our core investment strategy over these three years, which—simply stated—has been: stand fast, tune out the noise and continue to work your long-term plan. Needless to say, that continues to be our recommendation, and in the strongest possible terms.

- The burning question of the hour seems to be whether and to what extent the Fed, in its inflation-fighting zeal, might tip the economy into recession at some point—if it hasn't already done so. Over the coming year, the way this plays out may determine the near-term trend of equity prices. My position continues to be that this outcome is simply unknowable, and that one cannot make rational investment policy out of an unknowable.

- That said, I continue to believe strongly that whatever it takes to put out the inflationary fire will be well worth it. Inflation is a cancer that affects everyone in our society; if recession proves to be the painful chemotherapy required to destroy that cancer, then so be it.

- Although this may be hard to remember every time the market gyrates (and financial journalism shrieks) over some meaningless monthly economic datum or other, you and I are not investing in the macroeconomy. Our portfolios largely consist of the ownership of enduringly successful companies—businesses that are even now refining their strategies opportunistically to meet the needs and wants of an eight billion person world. I like what we own.

As I always say—but can never say enough—thank you for being my clients. It is a genuine privilege to serve you.

Family Office – Wealth Planning for Generations and Lessons from the Past

By Ryan

As I celebrate my 10th year in the Wealth Management industry, I spend time reflecting on the relationships built along the way. One of the most satisfying feelings is seeing the growth of our clients, from personal milestones to business and career growth as we tirelessly strive to ensure we are providing valuable strategies and support along the way. One question we get asked is “how can we ensure our estate is structured for generational growth and success”. While family net worth’s continue to grow, as do the complexities. Our goal is to ensure we have the answers and strategies available to our clients as we walk along side them through their personal journey as a valuable member of their Family Office.

Canada has seen a rapid rise in UHNW (ultra high net worth) households (defined by 50 million + in investable assets and 100 million + in total net worth), and the utilization of Family Offices has become more prevalent as families become more dynamic and find themselves with numerous moving pieces, and increasing levels of complexity in their daily lives. The implementation of a Family Office allows clients to set clear goals not only for today but for multiple generations. With the implementation of the right structures and support networks, a strong Family Office network allows for your team to strategize collectively as one entity rather then operating in silo’s creating more costs and inefficiencies. Over time this eventually leads to estate breakdowns as we look to pass assets and business through to the following generations.

As Mark Twain once said “history never repeats itself, but it does often rhyme” provides us with an important note to reference the past, as strategies and advice we seek may have already been tested by those before us. When one thinks Wealth Management we quickly turn to the likes of Warren Buffet, John Paulson and Ray Dalio for guidance on historical strategies for investment management. One lesson from history that holds true today highlights the value of holistic family planning as seen through the estates of the Rockefellers and Vanderbilts. The story is a fascinating one. Two of the wealthiest families in the 20th century, quite similar in wealth profiles, took very different approaches to generational wealth transfer and the outcome was vastly different. Articles below.

Nasdaq research suggests that 70% of families lose their wealth in the second generation and 90% lose their wealth by the third. The Vanderbilt family estate shared a similar early growth cycle to that of the Rockefellers as the family network grew to be one of the wealthiest families in America during the late 1800’s. Unlike the Rockefellers the Vanderbilts made no effort to implement strategies and safe guards to help preserve the family estate. By the mid-20th century majority of the estate had been lost with none of the original family business remaining in the family name today.

The Rockefeller approach to wealth management fell into a similar approach to today’s Family Office structure as they focused on growing their family support team of professionals as their businesses and family net worth grew. The estate which grew to be in the billions, still stands in the billions today after 100’s of years due to the use of effective tax, estate & insurance planning, coupled with an investment management network in place to ensure assets were preserved and managed for subsequent generations.2

Whether you are an UHNW family or not, the approach you take with respect to your Financial Roadmap can greatly influence your outcome. Further, the choice of which Wealth Advisor you select is often the single greatest influence on your wealth growth. This is supportive of our own unique approach of focusing on Goals Based Strategies in order to clearly visualize options and outcome.

1Lessons From Vanderbilt And Rockefeller: Know Your 'One Big Thing' (forbes.com)

2Rockefellers v. Vanderbilts: Estate Planning Lessons | Trust & Will (trustandwill.com)

Why Women Make Better Investors

Submitted by Christine (obviously)

Did you know that Women investors *consistently* outperform their male peers? (according to Fidelity).

Earlier in my career I believed that women's decisions around capital markets were underestimated. More bluntly, they were incorrectly labeled. They would be labeled as "risk averse". Nothing much has changed with the stereotype.

I believed that a more correct term would actually be that women are more comprehensive. Thus, what may come across as being risk averse, is more appropriately described as “implementing a more robust due diligence approach to investing: weighing all the options, pontificating, reviewing trade-offs, and only then, make the decision.”

Personally, I hope that every investor out there has a woman in their corner helping marshall the best direction with respect to their Financial Roadmap and subsequent investment, tax, and estate strategies to get them there.

https://www.forbes.com/advisor/investing/woman-better-investors/

Robin Esrock’s Bucket List

Travel Blog – Contribution by Renowned Travel Writer Robin Esrock

You may recall we hosted a Virtual “Fill your Canadian Travel Bucket” with Robin Esrock in February of 2022 as we all got set to ramp up our travel again. The response was terrific. Places not yet having been considered were being booked by clients, as well as Christine.

Robin is a bestselling author and travel personality who has reported from over 100 countries on 7 continents. We’ve invited him to share some travel inspiration.

This is our first time engaging Robin. PLEASE reach out and let us know if you value this information. If we have enough interest, we will continue to engage him on behalf of our clients.

International Dream of the Season:

Winter is icing the north, so the bucket list tips south. We’ll head to Australia to board The Ghan, one of the world’s great rail journeys. Named after 19th century Afghan cameleers who carved a route through Australia’s desolate red centre, this luxury train traverses almost 3000 kilometres from Adelaide through Alice Springs to Darwin, or vice-versa. A 3-day, 2-night crossing caters to a range of budgets, from sleeper chairs to luxe ensuite cabins with double beds. Enjoy gourmet dining, fine wine, and sensational, non-stop views. Daily off-rail excursions are included with the package, including the croc-infested Katherine Gorge, iconic Uluru, and eccentric Coober Pedy, a remote desert opal mining town where people still live in underground caves. Click here to learn about different Ghan itineraries. Here's a short video from when I ticked The Ghan off my Great Australian Bucket List.

Canadian Dream of the Season:

Quebec City is freezing in February, but you can’t do Canada if you can’t do cold, and you certainly can’t do the world’s largest winter carnival. The famous Ice Hotel is also open for business, although I recommend visiting during the day when you can tour all the rooms, warm up in the ice-vodka bar, visit the ice chapel, and enjoy the winter wonderland (exit through the gift shop). As for spending the night, think less romance, and more frost-tips on your nose. The carnival itself runs day and night, with ice-carvings, live performances, sub-zero street parades, snow palaces and contests, climaxing with the wild ice-canoe race across the icy St Lawrence River. I recommend booking into the castle-like Fairmont Chateau-Frontenac, the iconic, grand railway hotel that dominates the old city’s skyline. If you’re with the kids, Valcartier Village hosts the ice hotel and Bora Parc, an impressive (blessedly heated) indoor waterpark connected to family-friendly hotel.

Leaving the Pandemic Behind:

Destination Canada recently shortened their projections for tourism’s post-pandemic recovery. By 2024, they expect domestic tourism revenue to exceed 2019 levels. Tourism added $45.2 billion to Canada’s GDP in 2019, a contribution that was on par with the GDP from agriculture, forestry, fishing and hunting combined.

Pro Tips:

Even pros end up packing too much. The culprit often comes down to toiletries. Rather than squeezing Shoppers Drugmart into your luggage, consider picking up what you need if and when you actually need it. Unless you’re going backcountry, it’s not difficult to find a pharmacy, even on a cruise ship. The same principle applies to bulky clothing, although pack those layers if you’re heading to Quebec City in February! Ladies, consider different scarves as a light, dashing way to change-up your evening-ware. The Great Luggage Crisis of 2022 taught us to travel with carry-on only, which in turn taught us we don’t need to pack nearly as much stuff as we think.

Starting at the Top:

As a volunteer Canadian Geographic Travel Ambassador, join me on a 4-day luxury heli-hiking adventure in the stunning Cariboo Mountains. Incredible views, wildlife, mountains, food, stories…we’ll have it all. Click above for more info.

Don’t Quote Me:

“Once a year, go somewhere you have never been before.” – Dalai Lama

“Travel is never a matter of money, but of courage.” – Paulo Coelho

And a classic:

“My favourite childhood memory is my parents paying for my holidays.” – Anon

Happenings

~ A quick note from our team

2022 will go down as the year of amazing changes on the team that resulted in an Award Winning Team who was selected for Top in the Province award by the Globe and Mail. It also involved getting Covid, my mom being diagnosed with stage 3 breast cancer, my dad falling off a ladder and breaking C1 and C2 vertebrates, and Kase becoming a force in American Football.

As a Professional Woman in Wealth I have different challenges than my male colleagues as women we are typically called on more to carry responsibilities with the family - holiday planning, health care, social calendar etc... So, when it is time for down time - I really enjoy the small and special moments in creating memories with my husband and son. After our annual President’s Council Conference in Miami, (for the top Advisory Professionals at the firm) I was able to sneak down to Mexico for a few days and meet up with my husband and son.

A really special moment is that Kase would awake early and communicate with locals to have them use their machetes to crack coconuts for him for breakfast each day. Not a day goes by that I don't look at this picture. My hope is that for 2023 you find those special moments that will remain in your mind and heart.

Christine recently attended the TEDxSurrey conference with her husband. They are both documentary junkies who are constantly thirsting for new philosophies, contemplations, approaches and discoveries. The day contained 12 talks and 4 fantastic musical performances.

This year’s theme was : A SHIFT IN THINKING

Standouts were Dr. Stephanie Green’s talk “This is Assisted Dying”, Finn Liu “Transgender in the Asian Culture”, and Muhaddisa Sarwari “The unspoken discrimination culture towards Refugees”. The content can be accessed on TED’s You tube channel. The agenda is also posted on our social site to specifically access topics.

Joanna and her husband, Paul, joined their daughter, Elizabeth in becoming a full Canadian Citizen just before the Christmas Holidays! They moved here 5 years ago from South Africa to provide for a safer upbringing for their family. Congratulations Joanna!

If you are speaking with Jordan in the coming months, wish him some luck! He is tackling some pretty tough designations this year as he becomes more involved in helping Christine and Ryan execute on the team’s Wealth Management model portfolios.

As usual Christine and Family were at their Ski Chalet reconnecting over the holidays. Lots of skiing, baking, board games, walks, tobogganing, and reading!