2022 Spring/Summer Newsletter

Christine Fortin - Jun 08, 2022

The "R" Word (recession shhhhh)

“Our analysis of historical G10 episodes suggests that although strong economic momentum limits the risk in the near term, the policy tightening we expect raises the odds of a recession. As a result, we now see the odds of a recession as roughly 15% in the next 12 months and 35% in the next 24 months.”

—Jan Hatzius, Goldman Sachs chief economist, in a mid-April note to clients

Financial Journalism only has one headline issue. AND, it always has to be presented as a catastrophe.

Right now, the headline that has usurped everything from stagflation, the GDP growth to Supply Chain issues from Covid, to the War in Ukraine is, you guessed it: Recession.

We don’t even discuss the depth or the length of it or how it will affect the equity markets, if at all. How will it affect bonds? None of this is exciting enough to emit a panic running to the exits. So, I’m going to talk about it. But, I will talk about it in a pragmatic manner, not the crazy grenade dropping sensationalism that presents itself in daily financial journalism.

What I want to yell from the rooftops is “Can’t we all see that this is just another current events crisis and our best policy is to ignore it as you have an excellent long term plan that is entirely tied to your specific personalized goals?”

But, let me expand with some facts. If you want the non-coles notes here is the link: https://en.wikipedia.org/wiki/List_of_recessions_in_the_United_States

And one more thing.. why 1980 you may ask? Well, for those that recall, 1980 was the year that we started a recession after the roaring hyperinflation of the 70s.

-

Since 1980, there have been six recessions, an average of one every seven years.

-

The longest was that surrounding the Global Financial Crisis. It ran for a year and a half from December 2007 to June 2009; GDP declined 5.1% from peak to trough.

-

The shortest was the COVID-19 shock recession. It ran from February to April 2020, and took GDP down 19.2%.

-

The average duration of the six recessions was 10 months, and the average GDP decline was about five percent. (Without the Corona Crash, the average GDP decline was a little over two percent.)

-

The total number of months from January 1980 through April 2022 was 508. The total number of months of decline in the six recessions was 58. That is to say that during this period the U.S. economy was expanding 88% of the time.

-

On January 2, 1980—the first trading day of the analysis we're performing here—the S&P 500 closed at 106. As I write it is around 4,200. The dividend in 1980 was $6.44; in 2021 it was $60.40. The average annual compound rate of total return of the S&P 500 in this period was 11.8%—quite significantly higher than the long-term (95-year) average of 10.5%.

FACT – recessions are a major distractor but their effect on your long-term plan are no more than a blip.

FACT – a recession is coming or its not coming. Making a rash decision meaning you have changed the probability from 50/50 to 100%. However, you still haven’t gauged the severity or length.

FACT – there is no reliable correlation between equity market tops and the start of recessions

FACT – there is no reliable correlation between the end of a recession and a market trough

FACT – the equity market tends to trough around 6 months prior to an economy, because of course the equity market is efficient and forward looking (but usually overplaying the hand – providing great buying opportunities for smart investors like our clients)

FACT – no one can effectively and consistently forecast the economy nor time the market

SO, Where are we at now?

The Federal Reserve may have made a mistake. They expanded money supply too much and for far too long. You have heard the term “too low for too long”? This may not have been as bad on its own, but add in exogenous factors like a war, and massive supply chain challenges with punitive Covid restrictions in China and now it is a bit of a scramble to raise rates quickly, but not too quick.

Raise quickly in order to withdraw the excess by shrinking the balance sheet AND raising rates so this large inflation can get back under control. This is what we want them to do. When they do not do this, well, then we have the late 70s which is when it became a mandate of central banks to maintain inflation in a controllable manner.

We must embrace this. If it takes recession to break the back of inflation and the equity market temporarily sells off further and longer… well it is something that we must not only endure, but embrace. The alternative is much more painful. Think interest rates in the teens, housing prices even more unaffordable, wages not keeping up. Yes, it is ugly if we don’t allow for the natural ebbs and flows of the economy.

This is the process that Paul Volcker used to kill the crazy hyperinflation some 40 years ago. Once the economy had its reset – do you know what happened to the equities market? It has the greatest bull market of all time which took place from August 1982 to March 2000.

There is no reason to be spooked. We have had three years of very large market returns with the S&P500 at 26% annualized*. There is going to be a selloff at some point.

And, we have seen this movie before… it has been a while, but it is not new.

*moneychimp CAGR

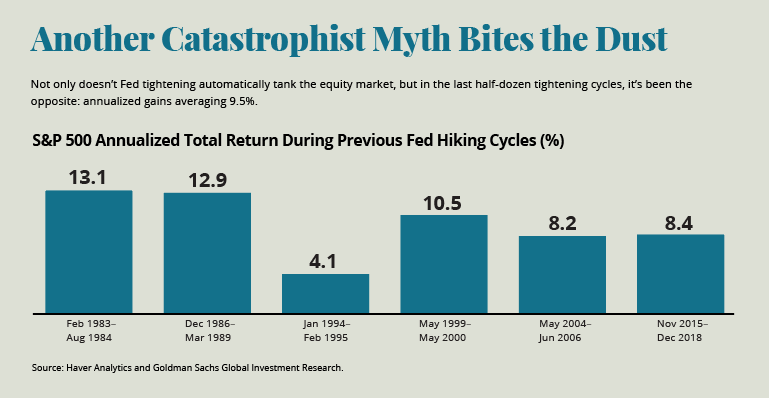

Another Catastrophist Myth Bites the Dust

Planning for a Buffer in Your Financial Plan

When we say we use Industrial Grade solutions for our clients, we are not kidding. Every one receives a Goals Based Report. It advises if they are over or underfunded against their personalized goals. If they are underfunded, it indicates what they need to go to be fully funded. If overfunded, they know what their surplus is as a lump sum and also as an annual maximum spend.

We also encourage clients to work toward 130% of goal – providing for a 30% buffer. Think of this as your emergency reserve that you keep set aside for that “rainy day”. This 30% buffer ensures that nothing, meaning no market event, will ever disrupt their plan rendering their goals as bullet proof.

Despite sometimes being challenged by clients that their spend decreases over time as they travel less and dine out less with age, we stand firm with a solid lifestyle expense that increases annually with inflation as here is what we know: medical expenses have inflated 26x faster than other expenses and “you never know”.

Christine recently had a family event arise that unfortunately has tested our theory of planning for extraordinary expenses. Her 81 year old dad was up on the roof doing some spring cleaning and the ladder slipped. He took a tremendous fall and broke his neck, both C1 and C2. It has been true tragedy for her family. Firstly, know that he miraculously survived and doesn’t have any neurological damage which is almost unheard of. With that out of the way, they had to quickly look at what the next 6 weeks and beyond would look like. Arranging for medical beds and other devices to be delivered and paid for privately, what about private in home care? Not to mention the emotional stressors on the family and time required for Christine away from the practise. However, during all of those stressors and disappointments, never once did they have to worry about the finances as there was always a buffer built in.

When Christine had time to de-brief mentally, she realized that she will be far more adamant about having a surplus built in to plans. Most of our clients expect a slow demise and health care in bits and pieces and increasing over time. Very few expect that large costs can occur immediately. But now we know and they will too.

A Note From Ryan

Investing for Generations to Come, A Personal Experience

As I embark on the journey of fatherhood my natural instinct is to begin planning and investing for my Daughter. Throughout this process I have personally taken time to reflect on my life, and the generations that have come before me. I come from a family of entrepreneurs that stems 3 generations here is Canada, and while each generation was highly successful in their independent business lines they didn’t fully take advantage of the ability to push wealth through to next generation by prudently planning in the early years. While educated in the fields of financial planning and wealth management, I begin to see that the planning was more reactive then pre planned. Personally, we have learned from this as my Brother (an entrepreneur in his field of work) and I have begun our financial planning at a young age, allowing us to benefit from our long runways while also organizing parts of our investments to help benefit the next generation. The 100 year financial plan is one that is utilized by the wealthiest families in the world, and we look to implement that process with the clients we work with. As I meet with clients I look forward to engaging in detailed conversations, and more importantly learning about your families and legacy wishes.

Team Updates

As mentioned in our last newsletter, Ryan and his wife Amm were expecting their baby any day. Baby Aanya Kaur Lidder was born on March 13 2022. She is so adorable as you can see!

We had a wildly successful “Bucket List Travel Event” whereby we hosted Robin Esrock, renowned global travel writer, to share his Canadian Bucket List to inspire us all to get out and explore little known places in Canada.

Let us know if you would like a copy of the video link. Grab a tea/coffee/beer and get inspired!

Christine and Kent and Kase finally broke the COVID Travel Quarantine by heading away to the Mayan Riviera for Spring Break. Although it wasn’t their dream vacation, it was so nice to unplug for a bit. As you can see, Kase quickly learned about swim up bars.