| Once in a very great while, there comes a year in the economy and the markets that may serve as a tutorial—in effect, a master class in the principles of successful long-term, goal-focused investing. Two thousand twenty was just such a year. On December 31, 2019, the Standard & Poor's 500- Equal Weighted Stock index closed at 8485.96. This past New Year's Eve, it closed at 9574.87 according to the S&P Dow Jones website. This is some 11% higher in CAD$ terms. From these bare facts, you might infer that the equity market had, in 2020, quite a good year. As indeed it did. What should be so phenomenally instructive to the long-term investor is how it got there.

From a new all-time high on February 19, the market reacted to the onset of the greatest public health crisis in a century by going down roughly a third in five weeks. The Federal Reserve and Congress responded with massive intervention, the economy learned to work around the lockdowns—and the result was that the S&P 500 regained its February high by mid-August. And the TSX just regained its latest high – taking twice as long (due to the structure of the sectors of the TSX).

The lifetime lesson here: At their most dramatic turning points, the economy can't be forecast, and the market cannot be timed. Instead, having a long-term plan and sticking to it—acting as opposed to reacting, which is your and my investment policy in a nutshell—once again demonstrated its enduring value.

(Two corollary lessons are worth noting in this regard. (1) The velocity and trajectory of the equity market recovery essentially mirrored the violence of the February/March decline. (2) The market went into new high ground in midsummer, even as the pandemic and its economic devastations were still raging. Both outcomes were consistent with historical norms. “Waiting for the pullback” once a market recovery gets under way, and/or waiting for the economic picture to clear before investing, turned out to be formulas for significant underperformance, as is most often the case.)

The North American economy—and its leading companies—continued to demonstrate their fundamental resilience through the balance of the year, such that all four major stock indexes made multiple new highs. Even cash dividends appear on track to exceed those paid in 2019, which was the previous record year.

Meanwhile, at least two vaccines were developed and approved in record time, and were going into distribution as the year ended. There seems to be good hope that the most vulnerable segments of the population could get the vaccines by spring, and that everyone who wants to be vaccinated can do so by the end of the year, if not sooner.

The second great lifetime lesson of this hugely educational year had to do with the presidential election cycle. To say that it was the most hyper-partisan in living memory wouldn't adequately express it: adherents to both candidates were genuinely convinced that the other would, if elected/re-elected, precipitate the end of American democracy.

In the event, everyone who exited the market in anticipation of the election got thoroughly (and almost immediately) skunked. The enduring historical lesson: never get your politics mixed up with your investment policy.

But perhaps the greatest irony of this plague year is that the most hated industry in the world delivered a miracle – indeed, a brace of miracles – in record time.

Still, as we look ahead to 2021, there remains far more than enough uncertainty to go around. Is it possible that the economic recovery—and that of corporate earnings—have been largely discounted in soaring stock prices, particularly those of the largest growth companies? If so, might the coming year be a lackluster or even a somewhat declining year for the equity market, even as earnings surge?

Yes, of course it's possible. Now, how do you and we—as long-term, goal-focused investors—make investment policy out of that possibility? Our answer: we don't, because one can't. Our strategy, as 2021 dawns, is entirely driven by the same steadfast principles as it was a year ago—and will be a year from now.

We have been assured by the Federal Reserve that it is prepared to hold interest rates near current levels until such time as the economy is functioning at something close to full capacity—perhaps as long as two or three more years.

For investors like us, this makes it difficult to see how we can pursue our long-term goals with fixed income investments. Equities, with their potential for long-term growth of capital—and especially their long-term growth of dividends—seem to us the more rational approach.

Setting aside its human tragedy, perhaps the ultimate financial/psychological irony of the bizarre year just past is that last January/February, one felt that the equity market was too hot not to cool down, and pined rather wistfully for a bit of a correction. As the year turns, one finds investor psychology back where it started: we seem to have gone through a virtually complete euphoria/terror/euphoria cycle. Investors are focusing on specific sectors, often without earnings. And, in the hot new idea. These same investors were concerned about sections of their well-diversified portfolio earlier in the year however have no all but abandoned clarity. So, the Tortoise, the Hare and the Unicorn, sent out the 1st week of January from our team, was written to re-direct those that are chasing certain sectors in unorganized euphoria.

We therefore tune out “volatility.” We act; we do not react. This was the most effective approach to the vicissitudes of 2020. We believe it always will be.

To our clients, we look forward to discussing again your long term goals and how the investments fit into them during our review. Until then, let us thank you again for being our clients. It is a sincere privilege to serve you.

The term “gig” is something that we all know from past norms as in “I got a gig”. However, this is a very real economy now and it impacts our young people mostly. Finding long term dependable employment is largely a think of the past.

Depending on the industry, temporary employees may be called contingent workers, virtual or remote workers, independent contractors, consultants or freelance workers. In the last two decades, from the dot.com bubble in

1999-2000 to the 2008-09 financial crisis, and most recently, with the COVID-19 pandemic, finding work to earn a steady income has become increasingly more difficult for everyone. However, it has become even more problematic for younger generations to find work in the fields in which they have been trained or

educated to work. It should therefore come as no surprise that there has been a corresponding increase in the number of Gig workers during the same time. This article addresses some of the challenges faced by Gig workers, estate and tax considerations, along with tips to manage finances and navigate employment

in the Gig economy. Click here to view article. Our team continues to work from home and we obviously don’t have any photographs of far away places that we have visited.

We are each in the office one day a week to access items needed or print documents or send cards but other than that we, as are most, fully functional remotely. We have re-created our offices with multiples screens and fast hardware and Christine is going to be piloting Softphones starting February 2021 for the firm.

Sofia is writing her Conduct and Practises Handbook exam in March and will become fully licenced.

Spencer and Christine completed the final course and exams and have both earned the Certified Investment Manager Designation. Sounds great but what does this mean? It means that they have now earned: -

The ability to conduct discretionary portfolio management services on behalf of their clients. Look for more on this starting in the Spring. -

They are now specialized in investment strategies tailored to affluent clients. -

credibility in the eyes of investors and other institutional investment management firms as this is a higher professional standard. Spencer has completed all of the educational requirements, exams and case studies as well as professional experience and has earned his Certified Financial Planner (CFP) designation. And he is just finishing his insurance piece to be able to support Christine and Jamie in the tax planning with respect to insurance trusts.

Christine and Kent and Kase will continue to get as much skiing in at Sun Peaks as they can over the coming months. After Kase taking a tumble off a jump and breaking his collarbone last January, he is back in the saddle and easily hitting his 180s off the big jumps and working solidly on his 360s – much to his mom’s horror.

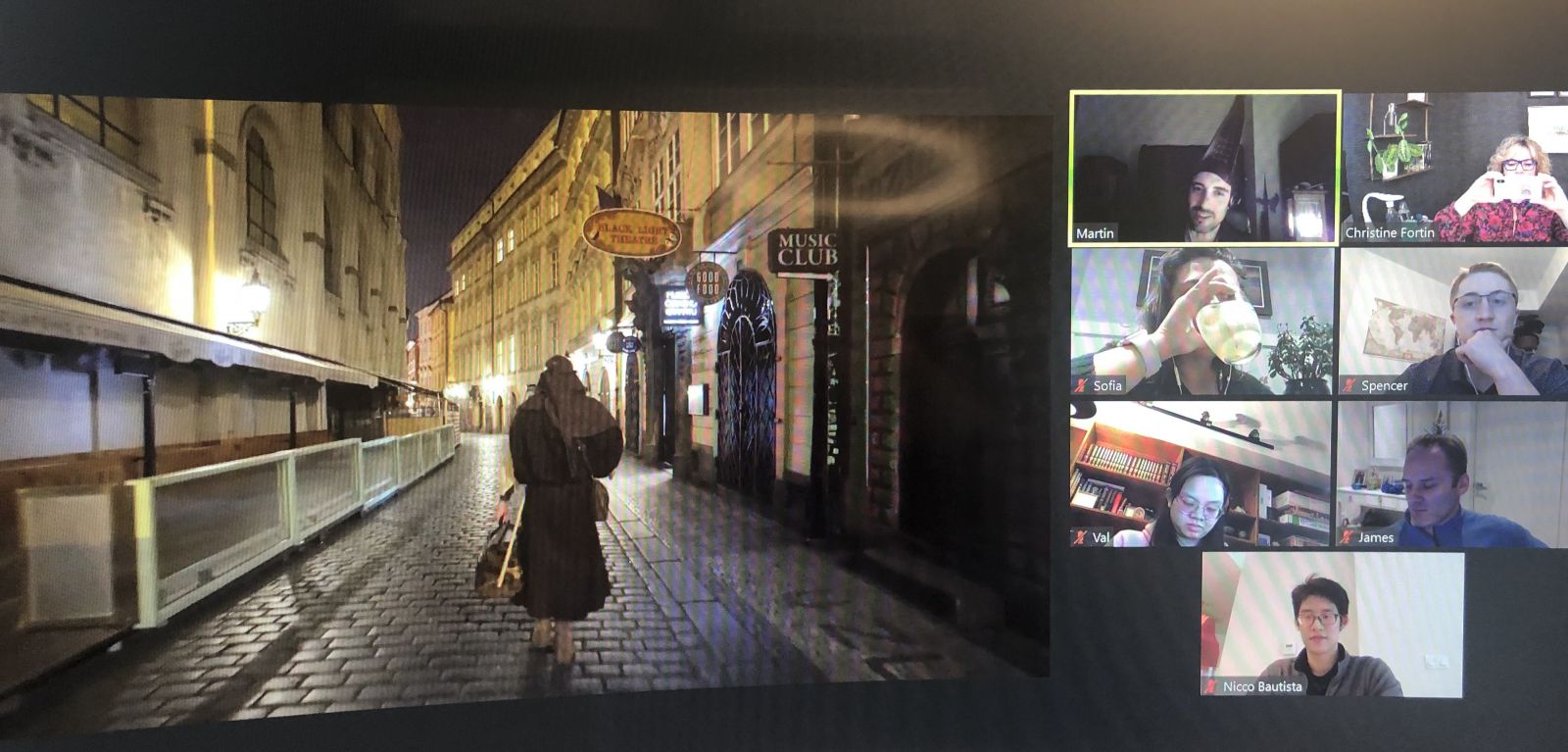

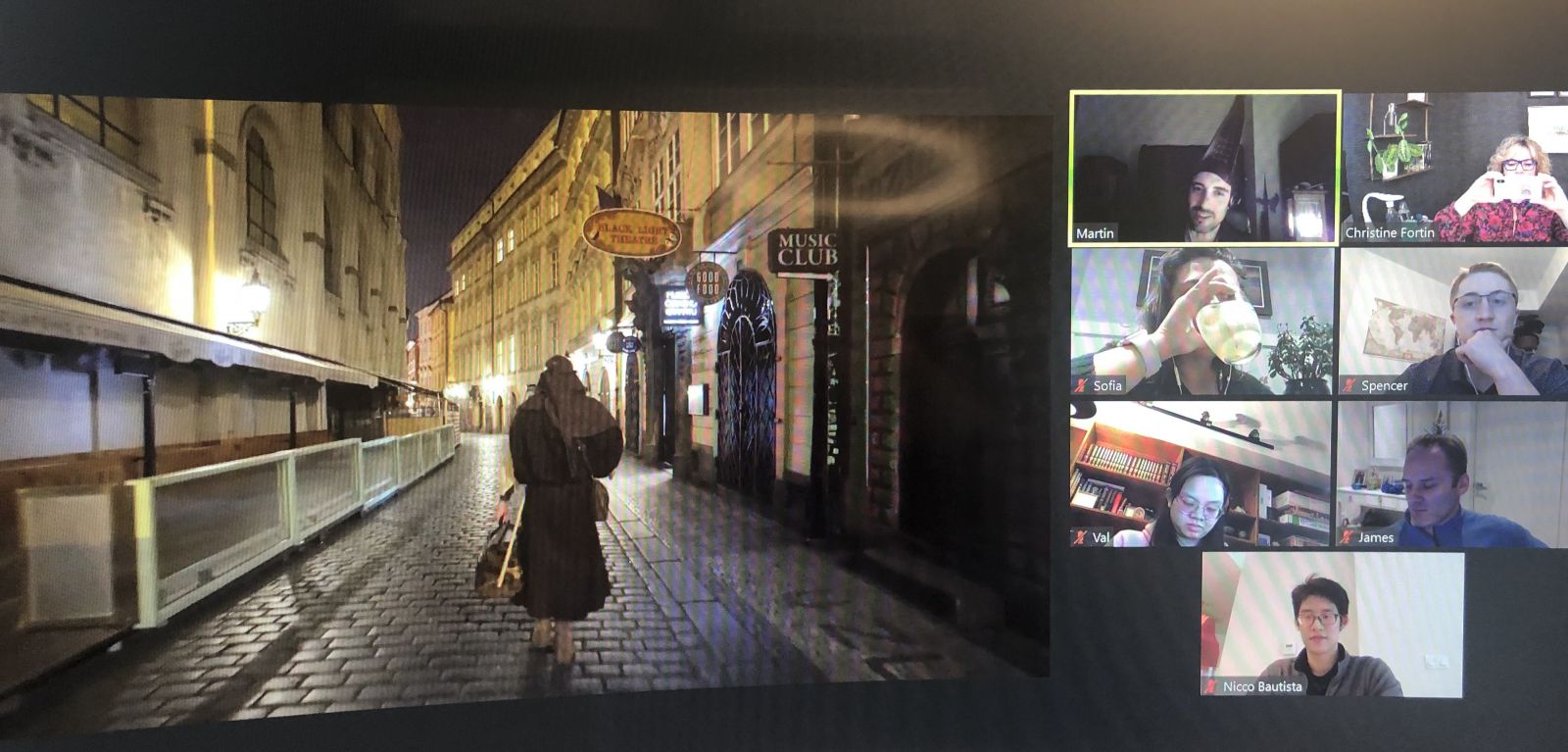

We thought you would get a kick out of this year’s annual holiday party with our full team which includes Valerie, Nicco and Jamie. We toured Prague through the eyes of a plague doctor from the black plague days, were treated to a cocktail box to fix ourselves a cocktail while we toured and then enjoyed a 3 course meal with wine pairing – all virtually of course!

*Source

“S&P500 at your fingertaps” tab of www.politicalcalculations.com. The data are Nobel laureate Robert Shiller’s.

|