Our Team

Caracciolo Kemper Wealth Management is a group of nine investment professionals with over 60 years of financial experience. We are driven to help our clients create, grow, and preserve their wealth through a highly disciplined and structured approach.

We focus on creating solutions for all your wealth management needs, including:

- Investment Products

- Customized Financial Plans

- Multi-Generational Estate and Tax Planning

- Banking Solutions

Our team is backed by BMO Nesbitt Burns, one of Canada’s leading full-service investment firms. We have access to some of the world’s top portfolio managers, allowing us to create portfolios tailored to our client’s individual circumstances and investment preferences. BMO Nesbitt Burns also offers top ranked investment research. Our team assesses the vast amount of market information and research to provide you with the relevant background information to make informed investment decisions that you feel comfortable with.

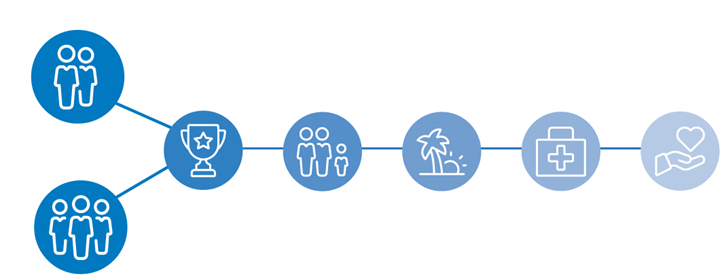

Together with you on your journey

Wherever life takes you, through continuous discovery rooted in planning, we will be there to provide industry-leading solutions, while bringing the full breadth of BMO Private Wealth’s resources to keep you on track to your goals, and focused on what matters most: you.