Prudent, long-term investing

Our team will help you invest in strong, proven companies with track records of consistent growth. Our aim is to build long-term, disciplined, diversified portfolios that have the resiliency to perform in all market conditions.

Our team will:

- Establish your investment objectives

- Develop an asset allocation strategy tailored for you

- Design your portfolio and monitor it regularly

- Provide ongoing investment advice

- Perform periodic portfolio reviews and rebalancing

The benefits of discretionary portfolio management

As our client you will receive discretionary portfolio management, which means that we are qualified to make all your day-to-day investment decisions with a fiduciary duty to act in your best interest. This frees you from stress and empowers us to act quickly when opportunities or risks arise. We will create an Investment Policy Statement – a customized document that sets down unique parameters such as your goals, risk tolerance, time horizon, preferences and interests – which we use as a roadmap. You pay an asset-based fee so that our interests are aligned because we both benefit when your asset base grows.

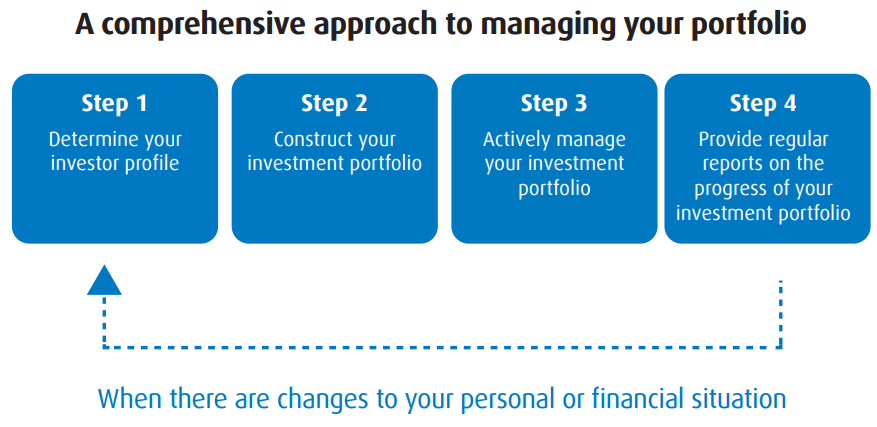

Take your investing to the next level - Managed Portfolio Account Program

The Managed Portfolio Account Program offers unique benefits to individuals wanting to delegate the management of their investments directly to a BMO Nesbitt Burns Portfolio Manager. You’ll establish an ongoing, trusting, one-to-one relationship with the individual directly responsible for making the investment decisions for your portfolio, based on a strong appreciation of your personal goals, needs and preferences. Your Portfolio Manager takes a comprehensive approach and applies a disciplined process to managing your portfolio. Responsible for making informed decisions on your behalf; backed by the extensive expertise, oversight and resources of BMO Private Wealth you’ll have peace of mind knowing your investments are being properly managed.

Benefits of the Architect Program

The Architect Program is a flexible, all-inclusive investment solution with many unique benefits; making this a truly full service investment solution.The BMO Nesbitt Burns Architect Program (“Architect”) gives you the ability to combine professionally managed investment solutions, with the option to include client-directed investments – all within a single portfolio solution, and for a predictable, transparent fee. In conjunction with the expertise of your BMO Nesbitt Burns Investment Advisor, Architect enables you to build an investment portfolio that is tailor-made to your investor profile, preferences and risk tolerance; giving you the latitude you need to achieve your long-term objectives.