Do you have a succession plan for your business?

Kyle Grenier - Sep 26, 2022

| A succession plan would detail the business owner’s desires with respect to the management of the business and the disposition of their shares. This is very important because business owners devote a significant amount of time, energy and, in most cases, their own money to building their business. If you’re contemplating a sale to a third party or a transition to family or employees, setting goals, having a vision and developing a formalized business succession plan are critical for success. A succession plan would also be useful as a contingency plan in the event of premature death, divorce, disability, disenchantment. Under some of these events the business owner is not able to manage the affairs of the business or lead the process for transitioning. |

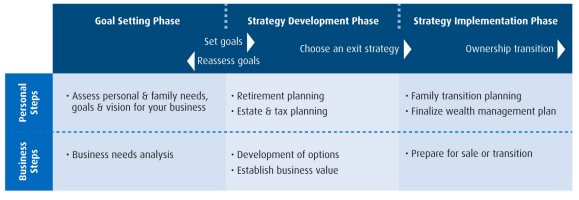

BMO’s Succession Planning Roadmap

|

| Value will drive the asking price, the income tax plan, any corporate reorganization plan, and the estate plan. Knowing the value will help with option development and choosing the right option. |

For business owners, the company is their most important asset, requiring thoughtful consideration and planning with respect to the next generation who, may or may not, carry on the family business. Whether the company is retained within the family, expanded by acquisition or sold to a third party, proper planning will ensure that the family’s goals and objectives can be met.

What to ask yourself?

• Where do I see myself, the family, the business in 5 or 10 years?

• How am I going to be able to have more time away from the business?

• How much is the business worth? What are the value drivers for the business?

• Can the next generation grow the business or is it best to sell the business?

• What would happen if I couldn’t get into the business for 12 weeks?

Assess personal and family needs, goals and vision for the business. The business owner and their family would review/establish all of their objectives in terms of retirement, working, business ownership, wealth transfer, etc. By establishing clear objectives, decisions become much clearer.

Assess personal and family needs, goals and vision for the business. The business owner and their family would review/establish all of their objectives in terms of retirement, working, business ownership, wealth transfer, etc. By establishing clear objectives, decisions become much clearer.  Business needs analysis. The business will have objectives also. What is the 5 or 10 year plan for business? What are the needs of the business in order to achieve its business plan? What are the obstacles confronting the business. As noted above, a clear business needs analysis will making decision making easier, such as family succession or third party sale.

Business needs analysis. The business will have objectives also. What is the 5 or 10 year plan for business? What are the needs of the business in order to achieve its business plan? What are the obstacles confronting the business. As noted above, a clear business needs analysis will making decision making easier, such as family succession or third party sale.  Development of options. This step reviews the current resources available and the goals of the client and business. Options are developed that can achieve the objectives given the available resources. The options could then be reviewed to ascertain which achieve the client’s objectives in the more efficient and effective manner. This step requires a team be assembled. The team must represent the various types of knowledge required for the situation. The team must work together to analyze the situation and develop appropriate strategies. Only by working together will the final plan address all aspects of the situation and best achieve the client’s objectives.

Development of options. This step reviews the current resources available and the goals of the client and business. Options are developed that can achieve the objectives given the available resources. The options could then be reviewed to ascertain which achieve the client’s objectives in the more efficient and effective manner. This step requires a team be assembled. The team must represent the various types of knowledge required for the situation. The team must work together to analyze the situation and develop appropriate strategies. Only by working together will the final plan address all aspects of the situation and best achieve the client’s objectives.  Establish business value. Completing a business valuation is an important step in succession planning.

Establish business value. Completing a business valuation is an important step in succession planning.  Retirement planning. A plan will ensure that the appropriate level of assets are segmented for retirement, which could free up other assets for succession planning or estate planning.

Retirement planning. A plan will ensure that the appropriate level of assets are segmented for retirement, which could free up other assets for succession planning or estate planning.  Estate and tax planning. Tax minimization and asset conversation are common objectives of estate planning. The family’s intergenerational wealth plan will develop from the estate plan.

Estate and tax planning. Tax minimization and asset conversation are common objectives of estate planning. The family’s intergenerational wealth plan will develop from the estate plan. Prepare for sale or transition. The phases in completing a third party sale are; review of information systems, review of management structure, review of financial statements, general corporate housekeeping and operational analysis.

Prepare for sale or transition. The phases in completing a third party sale are; review of information systems, review of management structure, review of financial statements, general corporate housekeeping and operational analysis.  Family transition planning preparation. The phases for a family succession are roughly the same as a third party sale but would also include a systematic review of the skill required to succeed and the skills in the next generation.

Family transition planning preparation. The phases for a family succession are roughly the same as a third party sale but would also include a systematic review of the skill required to succeed and the skills in the next generation.  Finalize wealth management plan. The wealth plan pulls all of the pieces together. By carefully reviewing the wealth plan the family can see the financial results of their decisions and will be able to gain confirmation that they are on the right track.

Finalize wealth management plan. The wealth plan pulls all of the pieces together. By carefully reviewing the wealth plan the family can see the financial results of their decisions and will be able to gain confirmation that they are on the right track.