Tarrifs, the Markets & Your Portfolio

Blair Brace - Feb 05, 2025

The most common question I get these days is what impact will Trump’s proposed Tariffs have on my investments?

Most clients are concerned, and I certainly understand why. It’s all over the news. It’s everywhere.

I just recorded a client video on this topic. Once it gets approved for distribution I will send it out.

The key message from the video is to turn off the news, especially as it pertains to your portfolio. Do not draw any connections between what the media is saying and the impact it may/will have on the markets.

The role of the media is to sell advertising and get you to tune in. And let’s face it, negativity sells.

History has proven time and time again that listening to the message of the markets is a far more effective strategy then listening to the people on the tv. Price is the only thing that pays.

So what are the markets telling us? Let’s jump in …

Remember, Markets are a Discounting Mechanism

The markets discount, or take into consideration, all available information including present and potential future events. When unexpected developments occur, the markets discount this new information very rapidly.

Markets are forward looking. The prices investors pay are reflective of where they think companies will be in 9-12 months from now. Not next week, next month or next quarter.

News of Trump’s proposed tariffs has been public information for months now. As a discounting mechanism, the markets have already absorbed this information.

So what prices have investors been paying for stocks in Canada, the U.S. and other impacted countries since news of his proposed tariffs were announced? Let’s see …

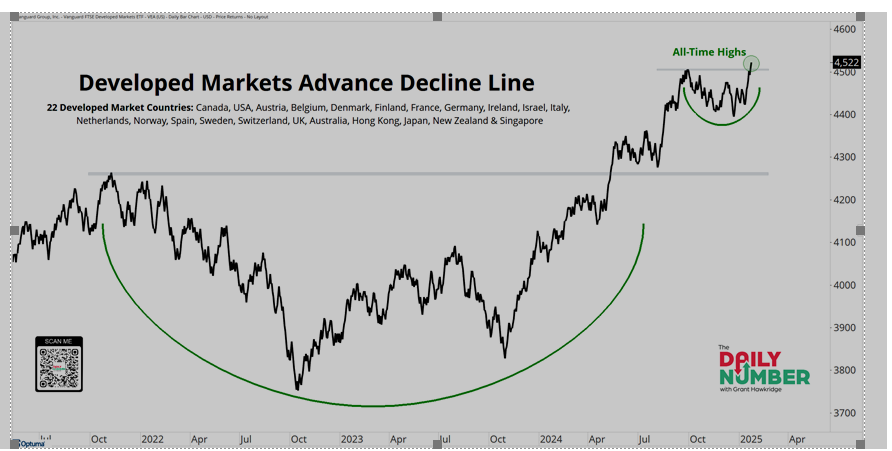

Index of 22 Developed Markets (including Canada) Just Printed an All Time High

Advance-Decline lines are one of my favourite ways to assess market participation. Unlike market cap weighted indexes – where the biggest companies have the largest impact - every constituent in an Advance-Decline line has an equal weight. For example,

- Apple, the largest company in the U.S. by market cap, has the same weight as Campbells Soup.

- Royal Bank, the largest company in Canada by market cap, has the same weight as Jamieson Wellness.

If the Advance-Decline line for a particular market is going up then the price is rising for the majority of its participants, indicating broad based participation.

The following Advance-Decline line, consisting of 22 Developed Markets including Canada, just closed at an All Time High.

Source: All Star Charts, January 2025

Let's break down what it shows:

- The black line represents the Developed Markets Advance-Decline line, which includes the following countries' ETFs: Canada, USA, Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Israel, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, UK, Australia, Hong Kong, Japan, New Zealand, and Singapore.

- The Takeaway: I like using this AD Line as it is a valuable indicator for assessing overall market strength. It measures the number of Developed Markets participating or not, providing us with insights into the health of the market move. So, when more markets are advancing than declining, the AD Line rises; in contrast, it falls when there are more declining markets than advancing ones.

Currently, this AD line is at its highest level ever, which means that the strong market internals are not limited to just the U.S. It includes Canada.

This widespread confirmation from global market internals is what Bulls want to see. More markets around the world are advancing than declining, including Canada.

It's pretty difficult to enter a Bear Market or experience a significant correction when this trend occurs.

What are your thoughts?

Let us know!

If you would like to set up a phone call or meeting to discuss this further please contact the office. We are here to help.