Dividend Growth Investment Strategy

Dividend Growth Investment Strategy

The Bottom Line

When it comes to income investing, it pays to go with Dividend Growth. This strategy has withstood the test of time by providing steady growth even during periods of volatility. By analyzing the trends throughout the decades, it’s clear that dividend growers provide superior valuations and returns, not to mention persistent payouts during the ups and downs of the market.

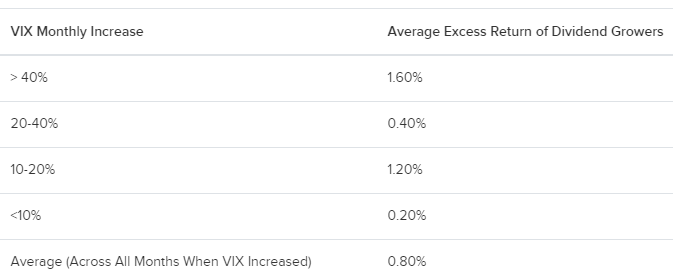

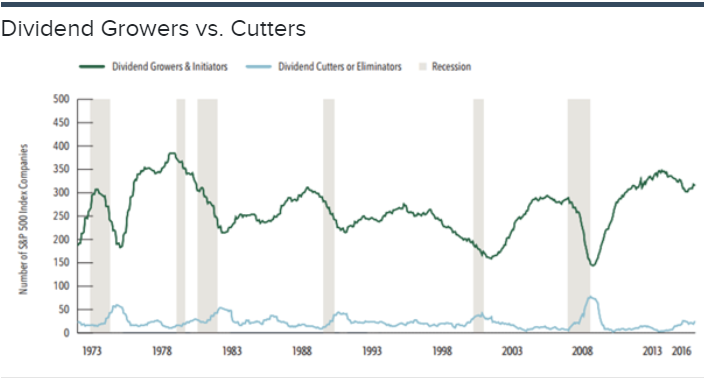

Historically, dividend-growing stocks have performed better than companies that cut their dividends or did not pay them at all. Dividend growers have not only enjoyed higher total returns but have done so with lower risks. Companies that have steadily increased their payouts have provided excess returns during periods of market volatility. Whether cyclical downturns or full-blown recessions, dividend payers have routinely outperformed other non-yielding assetss. The following chart illustrates how companies with persistent dividend growth have provided excess returns during periods of increased volatility.

The average excess return of dividend growers is 0.8% across all months where the CBOE VIX increased. In fact, excess returns increased the most (1.6%) during months when the VIX spiked more than 40%.

Companies with persistent dividend growth have also exhibited strong fundamentals when compared with companies that do not pay dividends. This is true of earnings, revenu, free cash flow (FCF), margins and return on equity (ROE). Historically, all these variables have been higher for the dividend growers.The valuations of dividend growers are generally very attractive. Dividend growers have traded at a 23% premium to high dividend yielders over the past three decades.