Portfolio Construction Process

Our approach is different. Because our clients are different.

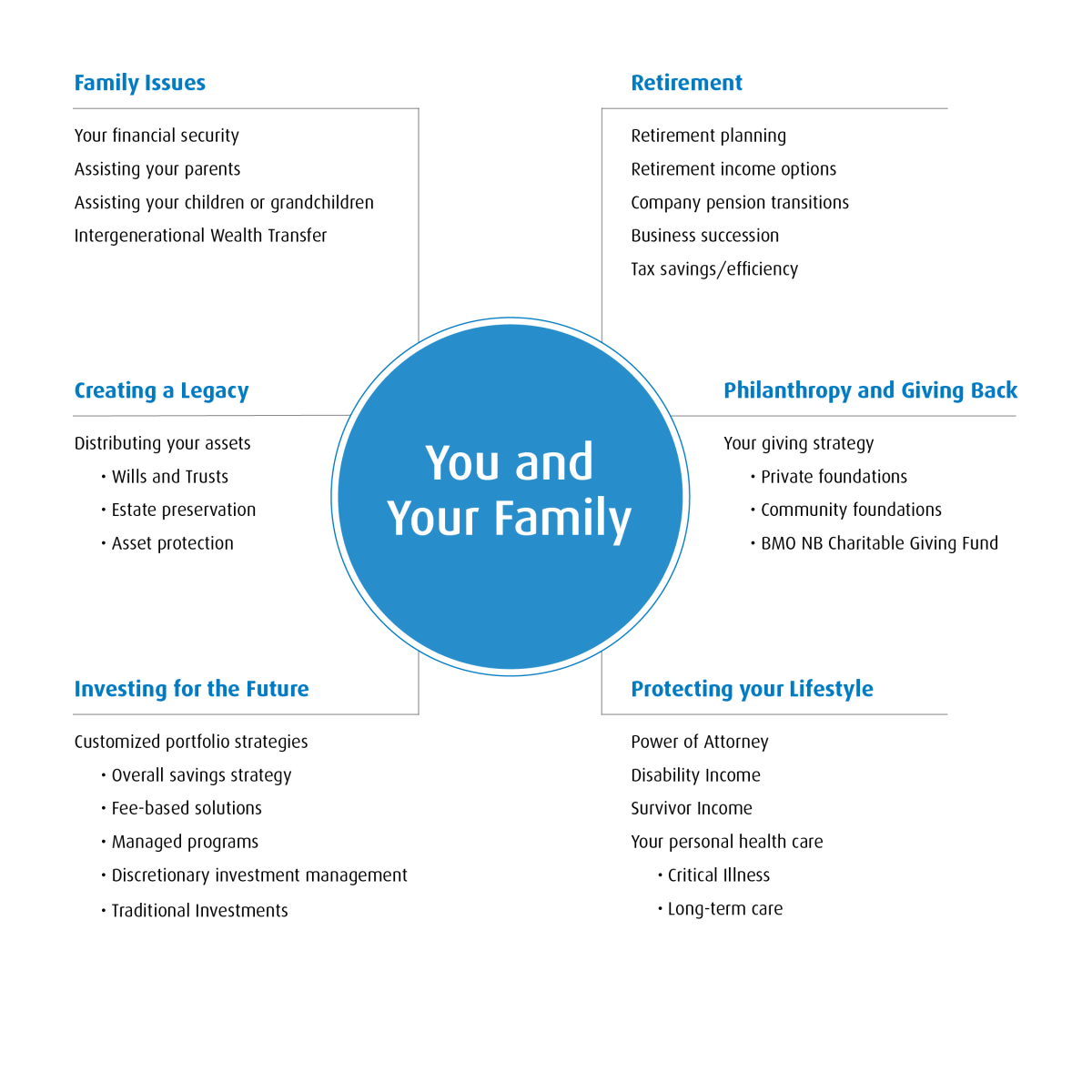

What is most important to you? We will tailor a solution specifically for you, to maximize opportunities and mitigate potential challenges down the road. We apply disciplined, holistic, transparent and independent guidance, maintaining open and regular collaborative lines of communication, listening to you, and keeping you informed.

Defining Your Investor Profile

Defining Your Investor Profile

I start building a personalized portfolio by understanding your risk tolerance, investment time horizon, tax needs, cash flow requirements and expected return.

Creating an asset allocation strategy that meets your changing needs.

1. Proactive Asset Allocation

After I have assessed your needs and risk tolerance I will employ a proactive approach to asset allocation. I use a sound framework to reduce emotional influences and make changes at appropriate times.

2. Secular Themes

As I see new opportunities arise in attractive sectors of the market I will be implementing new strategies.

3. Horizons

I will constantly monitor your strategy to ensure it aligns with your personal or family’s financial needs in keeping with your changing needs.

4. Investment Building Blocks

The framework of a portfolio is critical when allocating capital. I will ensure you have the necessary building blocks with the proper focus on your changing goals.

Macroeconomics and Quantitative analysis

Macroeconomics and Quantitative analysis

Macroeconomics: Backed by BMO Nesbitt Burns’ extensive Economic Research, we review National and International Economics and assess Income and Employment complementing in our Portfolio Analysis.

Assessing Current Global Economic Trends

- Trade imbalances

- Inflation

- Market Liquidity

- Credit Spreads

- Economic Growth

Your Portfolio

Your Portfolio

Your portfolio will reflect your risk assessment, time horizon, tax needs and cash flow requirements. It is the sum total of your RiskEvaluation, the Macroeconomic Outlook, Quantitative Analysis and appropriate Asset Allocation. The portfolio is dynamic, if there is a material change in your needs, the economic picture, a company’s outlook or BMO Nesbitt Burns’ interest rate outlook, I will react dynamically within the market and adapt to the changing environment where required. I also have regular meetings to review the portfolio with you to make sure it always fits your financial needs.

Business Cycle

Today’s business cycles are widely believed to be irregular, varying in frequency, magnitude and duration.

I am constantly evaluating data points to better understand where we are today and where we are headed.

My up to date analysis and dynamic investment strategies are built using the following five guidelines:

- Growing earnings and dividend yield

- Low price to earnings relative to industry

- Low price/book relative to industry

- High return on equity

- Annual cash flow momentum