January Market Recap - A Good Start to the Year!

Ashley Nichols - Feb 20, 2026

After an extended period of relative calm, volatility has reasserted itself into capital markets. This month we offer a little investor education on risk vs reward, and with RSP season nearing the end, we offer a little more contribution advice.

Money is a tool. It's something that supports your life!

Money is a tool. It's something that supports your life!

Portfolio Management Comment

Here is a article by Carol Schleif, CFA, SASB_FSA, Chief strategist at BMO private Wealth

Risky Business

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

– Robert Kiyosaki

The Through Line: After an extended period of relative calm, volatility has reasserted itself into capital markets. Fluctuating asset prices are nerve wracking – especially when they happen suddenly or with great velocity. Yet price volatility by itself need not be detrimental to long-term financial health if it is short-lived and/or not indicative of more serious underlying fundamental issues. We offer insights into some of the most recently elevated risks and how they may – or may not – apply to your unique situation.

Our highly emotional lizard brains

Anyone hoping for an orderly tiptoe into a post-holiday new year has been sorely rattled. First came a barrage of headlines (Venezuela, oil, Iran, a cap on credit card rates, limitations on housing ownership, criminal investigation of the Fed), which markets in aggregate mostly looked past. Now that earnings season is at hand, the focus has been pretty squarely concentrated on fundamentals.

Then came this week’s sharp break in the “everything rally” that had pushed global stocks of all sizes to record levels. President Donald Trump’s escalating threats to Greenland’s autonomy and the multi-faceted pushback from Denmark and other NATO allies sent equity markets into a tailspin. Fears over a possible trade war – and more – were once again front and center.

For their part, global bonds were roiled this week as well when Japan’s new Prime Minister called a snap general election for February 8. Bond holders jumped to the conclusion that the PM’s popularity could usher in a new wave of politicians more closely aligned with her pro-fiscal stimulus views, thus exacerbating a bloated sovereign debt-to-GDP ratio. Japanese intermediate and long bond yields hit all-time highs on the back of these fears. This, in turn, disrupted another set of trades that global investors had been engaging in: the “carry trade” (borrowing using lower-cost Japanese bonds to invest in higher-yielding assets elsewhere).

Bottom line: round and round the world of interrelated finance went the fear as investors conflated the headlines they had previously ignored. Like lighter fluid on the BBQ, emotion propelled the storyline quickly once the most primitive parts of our brains kicked into self-preservation mode. Now it’s time to take a breath and engage the more rational, logic-denominated portions of our brains to parse what pieces of the “new” news might have lasting import – and what will likely be discounted as noise.

Risk and return go hand in hand

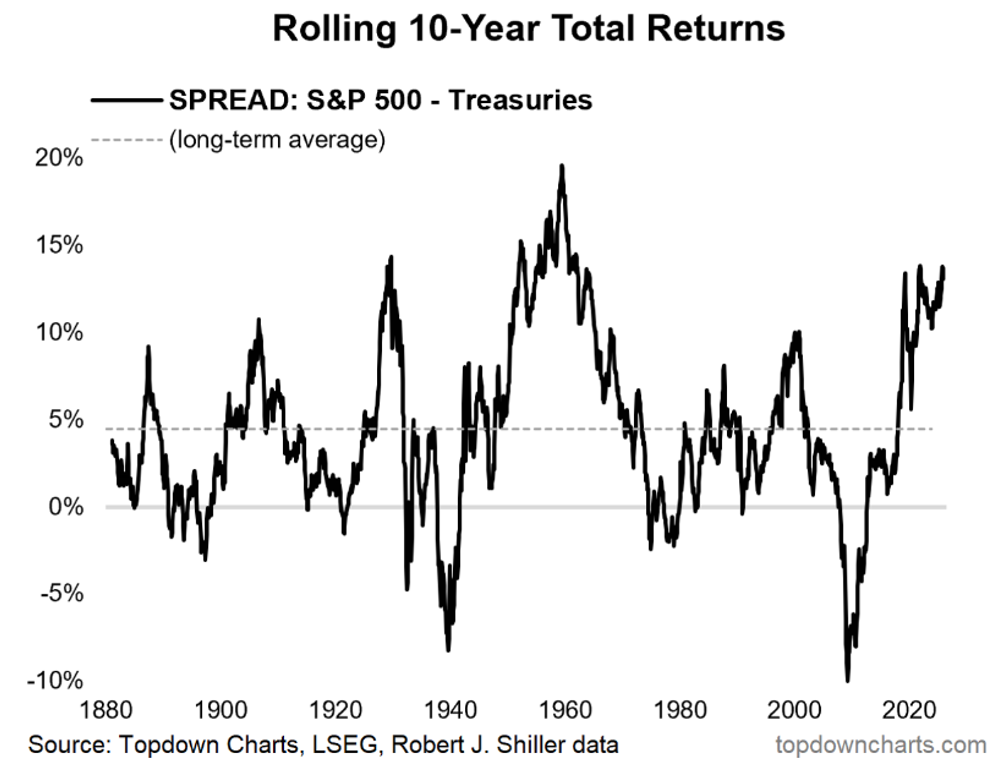

There’s an old adage that you’ll never get rich off a savings account. That saying illustrates the fundamental relationship underpinning markets: risk of some sort is implied if you are seeking a higher return – no free lunches here. The key is understanding the various types of risk and working to insure that your expected return adequately compensates for it.

In equity markets:

Investor lens is that of a part owner, participating in the ongoing cashflows of a business (or group of businesses if buying funds). Focus is therefore on those factors that will juice growth – lower interest rates, healthy and resilient consumers, a supportive regulatory framework, competitive differentiators and reasonable cost inputs.

Potential return comes from share price appreciation and dividends (and, hopefully, growth in those dividends over time). The upside is theoretically unlimited, meaning equities can be a solid hedge against the ravages of long-term inflation. We all relearned over the past five years that inflation is an insidious thief, steadily chipping away at purchasing power, year in and year out.

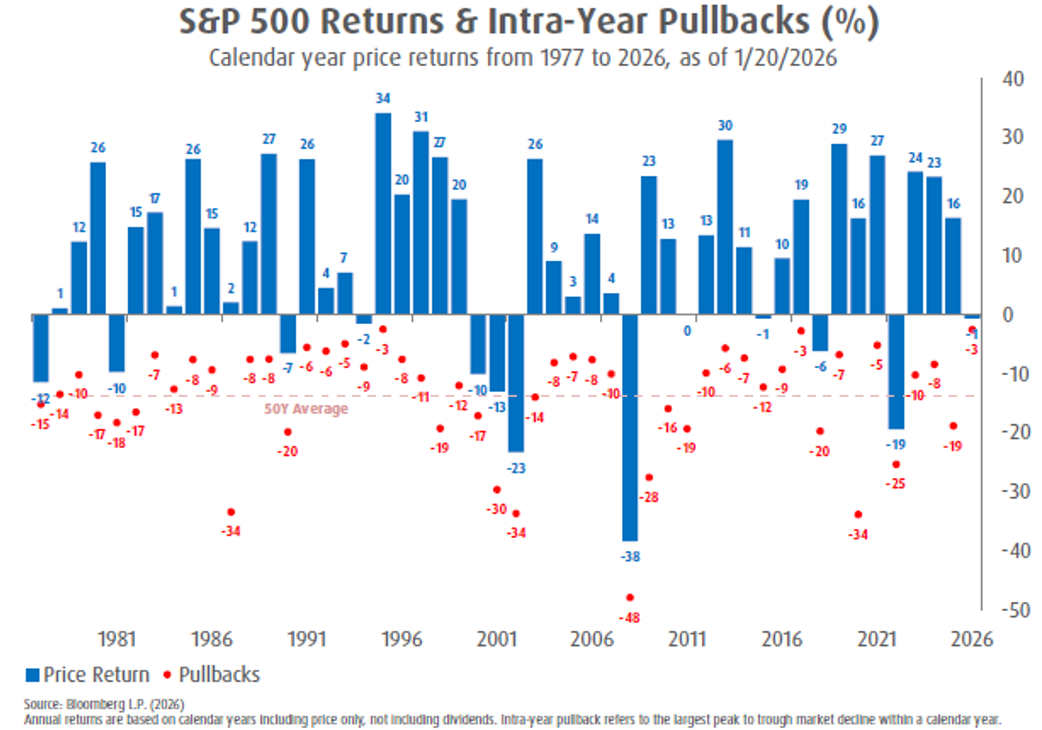

Potential risk comes from the possibility of losing some or all of your investment (permanent loss or decrement of capital) should fundamentals sour. This can be especially true for those forced to sell in a market downturn. Aside from this, equity markets can be – and often are – prone to short-term fluctuations. Such volatility is the rule not the exception even in years featuring strong uptrends (chart).

Though equity investors obsess (a lot) over interim pullbacks, a variety of technical and/or non-fundamental factors can prompt pullbacks too. Disappointing news from a competitor’s earnings release can be transposed onto another company; whole industries can be prone to “right sizing” in institutional portfolios; and broad “risk-off” moods may strike the entire stock market.

In fixed income markets:

Investor lens is that of a creditor. Bonds represent a loan from the investor to the underlying entity, be it a country, company or municipality. The investor is thus concerned about the same things a banker would be: credit worthiness of the borrower and time until the loan is paid in full.

Potential return is the interim interest payments plus the return of principal at the maturation of the bond.

Potential risk relates to how the yield on interim interest payments compares to prevailing interest rates, plus the rate of inflation over the life of the bond. Higher inflation chips away at purchasing power. This “time risk” explains why longer-dated bonds are more sensitive to sudden changes in inflation/economic growth rates.

A delicate balancing act

In the same way that eggs, flour and water or oil can be combined to create pancakes, waffles, popovers or a cake, putting together a personalized investment program is a process that combines the same basic ingredients but in customized ways. The goal of portfolio construction is to balance the risk/return potential offered by different asset classes in order to address risks that individual investors face within their overall financial picture. Employed investors in their 20s are likely to have different constraints, goals and timelines than those in their 40s. When time horizons are longer, compounding can be used to great effect. Assets that have greater near-term volatility (price risk) can be included in the hopes that longer time frames will smooth the interim wobbles and lead to stronger long-term returns. The flip side is that the effects of inflation and loss of purchasing power also compound over time. Simply put, an allocation that is too conservative relative to an investor’s age could lead to erosion of purchasing power.

On the other hand, retired investors in their 60s or 70s often have shorter time horizons and heavier support-of-lifestyle demands on their portfolios. Big drawdowns would be tougher to absorb, necessitating a higher proportion of steadier investments with less volatility, more stability and/or greater capacity to generate income – but lower return potential. While such statements seem obvious, markets (and media headlines) often behave as if the only thing that matters is today’s hot stock or sector – not how it may fit into an overarching plan.

Volatility: will you be my neighbor friend?

Volatility does not necessarily equate to permanent risk. However, it can be problematic for investors who have more limited non-portfolio resources, shorter timeframes or an acute inability to sleep at night when their portfolio balances shift too much. To help mitigate this risk, you can use cash, short-term and/or income-yielding securities sufficient to cover most cash-flow needs. On the other hand, investors with longer time horizons and/or little need to access their funds often take advantage of price fluctuations, using them to rebalance or round up on specific assets at more attractive entry points.

The most recent round of volatility hit after an especially long run (over nine months) of very low intraday price moves. With broader stock markets hitting new highs just last Friday (despite the flurry of high-profile events in the first three weeks of the new year), investor emotions were high, nerves raw and fingers itchy to pull the rip cord. The cognitive dissonance was exacerbated by tight credit spreads and the bond market’s tame (nonexistent) reaction to the extraordinary video released by Federal Reserve Chair Jerome Powell a week ago. Therefore, while the rapid escalation in Greenland tit-for-tat played out in broad social media daylight, markets initially adopted a rapid risk-off response – only to reverse much of the decline the following day as comments re Greenland were softened. In order to sort out which aspects might be lasting after this week’s market-moving issues and which might end up being noise, we offer the following reminders:

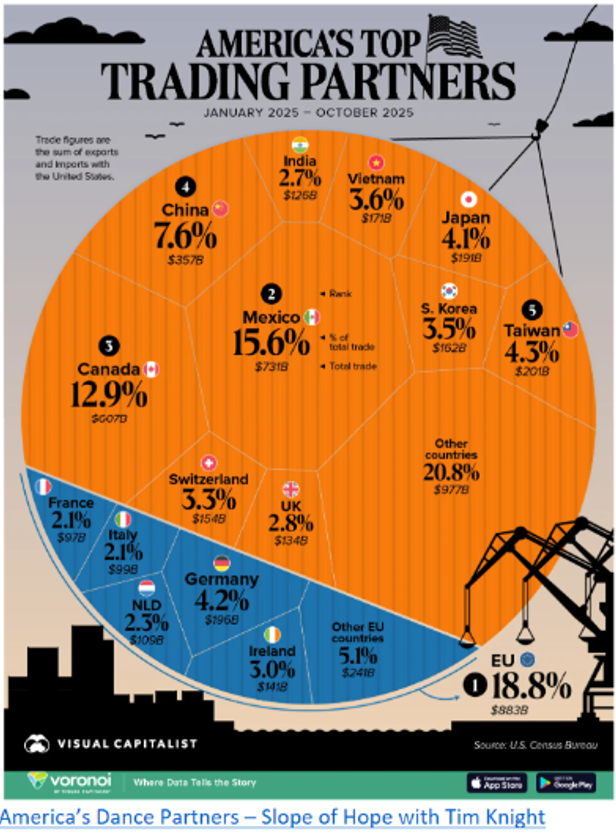

President Trump, everything is a win-lose transaction. His normal operating style is to float a number of ideas on a wide variety of topics – simultaneously – to flood the zone and keep opponents off balance. The opening volley is typically super high to establish a ceiling from which negotiations can work back or be walked back. (This will be an especially important point to keep top of mind entering into USMCA/CUSMA renegotiations over the next few weeks.)

has begun to show signs that members are willing to step in on certain issues. For example, several Senate Republicans questioned the Justice Department’s investigation of Fed Chair Powell. Louisiana Senator John Kennedy noted last week that “even a 9th grader knows it would be weapons-grade stupid to try to invade Greenland.”

Tuesday’s market volatility, Japanese Prime Minister Sanae Takaichi made reassuring statements to the markets about reducing issuance in longer-dated bonds, prompting calmer trading in longer-dated maturities.

underlying U.S. economy remains strong; GDP and productivity are hinting at growth in the 4% range. Now that earnings season is getting underway, we should see plenty of valuable info nuggets that either support or challenge that economic confidence – as well as another quarter of aggregate double digit earnings growth.

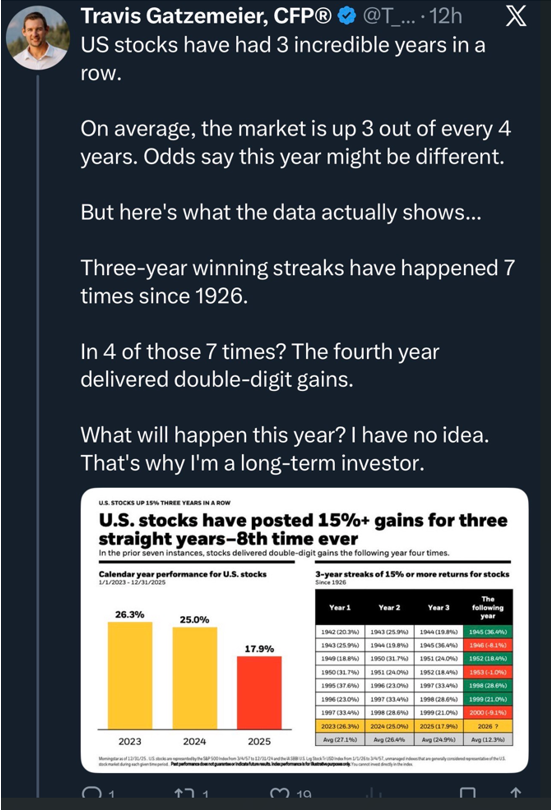

cap indexes closed 2025 up double digits for the third year in a row and at all-time highs. Their growth in 2025 was just a tick or two above earnings growth (through the third quarter), meaning valuations did not expand as much as perceived. A bit of backing and filling near current levels would help to push the valuations a bit lower.

Investors should understand the wisest reaction to a surprising headline is often to take a deep breath and give the situation a bit of time to marinate. Markets of all stripes are playing an important feedback mechanism for global leaders.

Implications for investors

Remind yourself that money is a tool – not an end in itself. It can be tempting to get caught up in chasing the next hot thing (or trying to avoid an interim pullback). Our brains are literally hard-wired for the dopamine hit such activities produce. It’s important to take a step back and assess your cash flow needs (short- and long-term), plus any potential changes to your time horizon or tolerance for price movement. Your BMO team can help you clarify your goals, risk tolerance and the allocation recipe that suits you best.

Our Portfolio Management Approach

We hope you've been able to listen to our Podcasts! A new episode of our Market Commentary is on the way, as well as another episode of Why Do We Do That?

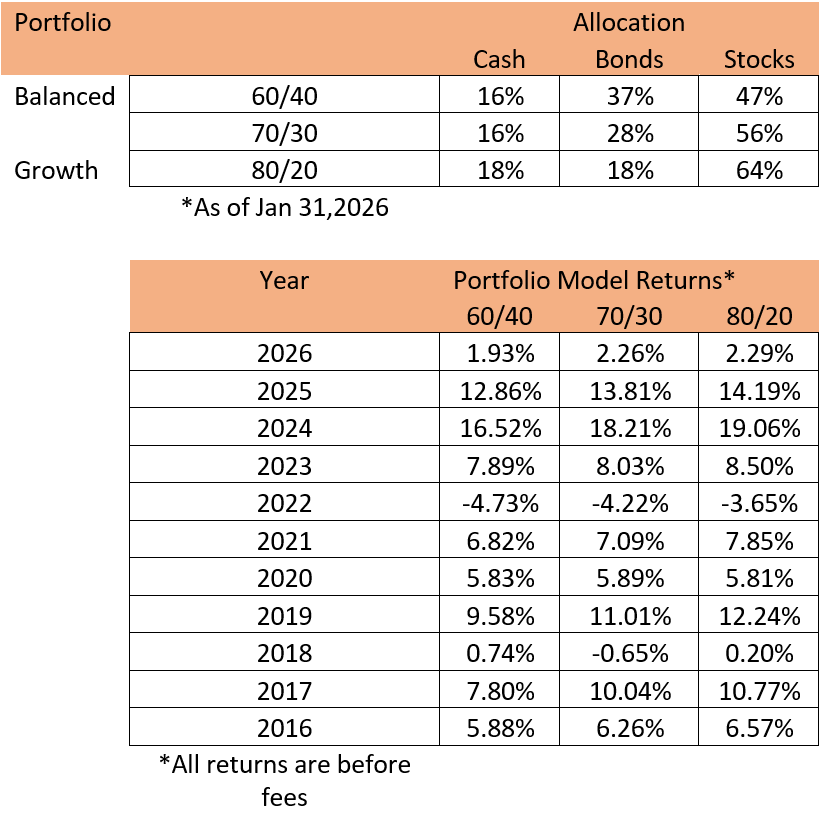

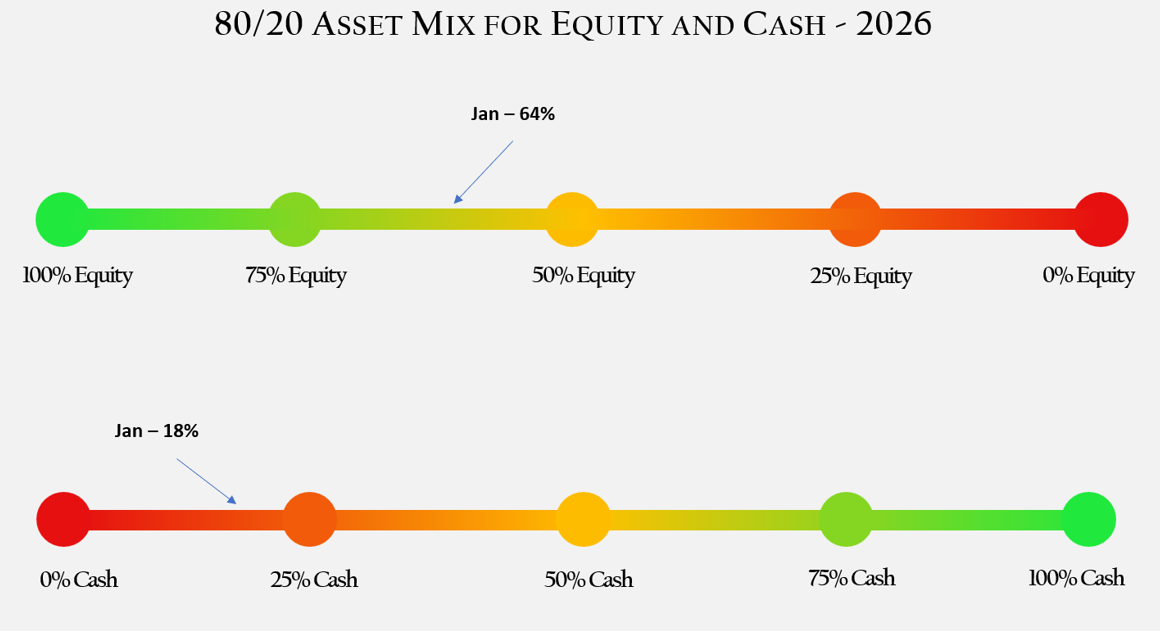

We are fundamental investors that use technical analysis to manage short-term market risks. We believe that risk management is not a choice, but a necessity. While we cannot control how much downside the market provides during a correction, we can control how much of the downside your account receives. We aim to avoid 60% or more of the decline in any significant downturn. Without our process, there is a good chance you will experience 100% of the downside from the market. We will help you navigate the risks and rewards of the market so that you can stop worrying about your money and start living your life.

Transactions

The following is a chronological list of trades:

The tactical trade that was executed on the SPY hit out target and was closed. We bought the SPY it 678.58 and sold it 692.91.

We trimmed three of our winning positions that looked extended.

We sold a bit of Hudbay Minerals, Manulife Financial and Royal Bank.

The respected profits in each position were: 120%, 34% and 40%.

We are currently sitting with around 18% cash. Looking to add to positions during any pullback in February.

Returns on our 60/40, 70/30 & 80/20 Portfolios, before fees:

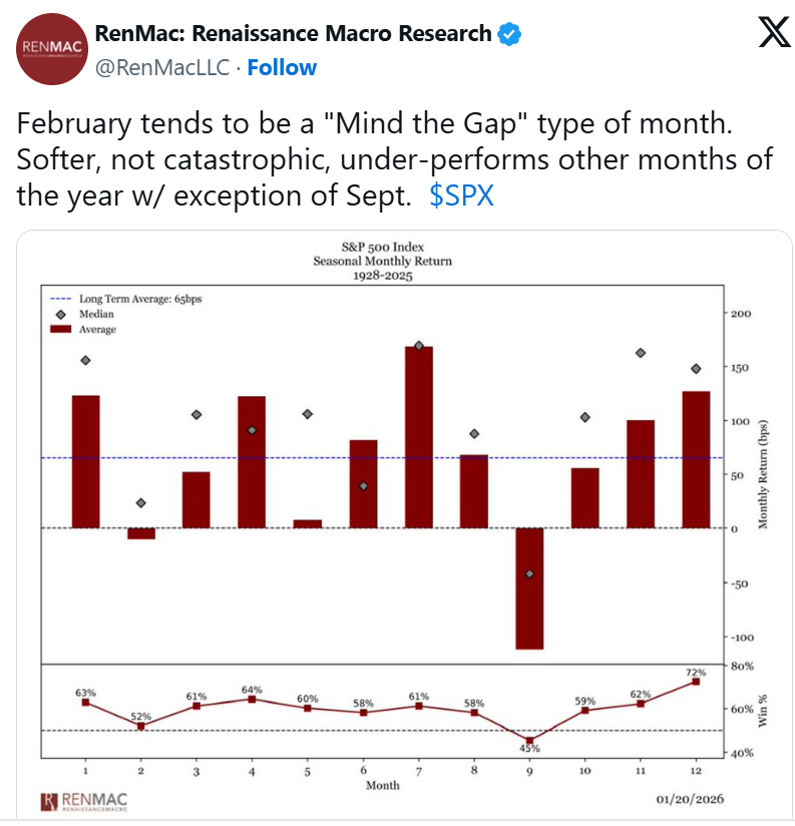

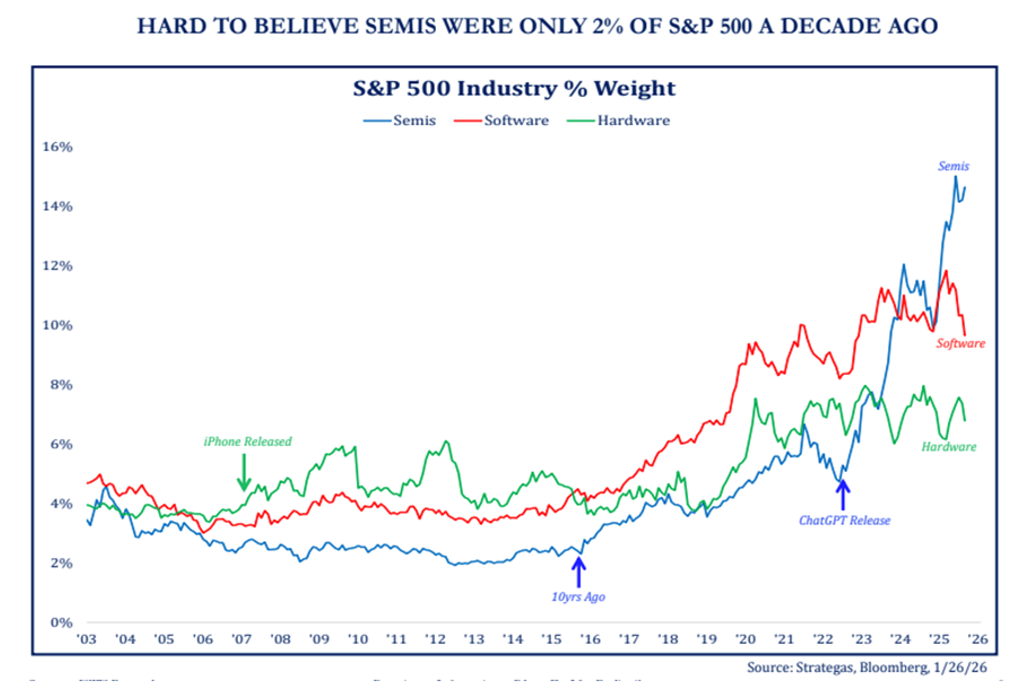

Interesting Charts

Technical Comments

Monthly E-mini Sideways Trading Range | Brooks Trading Course

The market formed a weekly E-mini Low 4 sell setup on the weekly chart. Bears need a strong bear entry bar closing near its low, followed by sustained follow-through selling, to increase the odds of a deeper pullback. The lack of strong bear bars with follow-through selling remains a problem for the bears. Bulls need a strong breakout with sustained follow-through buying above the January 28 high to increase the odds of a trend resumption.

- The January monthly E-mini candlestick was a bull doji closing in the upper half of its range, with a small upper tail and a prominent lower tail.

- Last month, we said traders would watch whether bulls could break above the October 29 high with follow-through buying or whether the market would continue to stall and retest the November low.

- The market barely made a new all-time high and mostly overlapped within December’s range.

- Bulls maintained a tight bull channel from the April 7 low, showing persistent buying pressure.

- Bulls expected at least a small sideways-to-up leg to retest the prior trend extreme high (October 29) after the November pullback, which is underway.

- They want a resumption of the bull trend with a measured move to 7,400 based on the height of the recent trading range.

- Bulls need a strong breakout above the October 29 high with sustained follow-through buying to resume the trend.

- If the market trades lower, bulls want the January or December lows to act as support, forming a higher low and a double bottom bull flag with the November low.

- Bears want a reversal from a large wedge top (July 27, December 6, and October 29) and a small double top (October 29 and January 28).

- Bears see the recent sideways overlapping candlesticks as a possible final flag.

- The lack of strong bear bars with follow-through selling remains a problem for the bears.

- Bears need consecutive strong bear bars closing near their lows to show they are regaining control.

- If the market trades higher, bears want any breakout above the all-time high to be weak and result in a failed breakout.

- The rally from the April 7 low remains in a tight bull channel, indicating persistent buying.

- The market is Always In Long.

- While the rally appears climactic and overbought, traders will only sell aggressively if bears produce strong bars with sustained follow-through that flip the market into Always In Short.

- For now, traders will watch whether bulls can break above the sideways trading range with follow-through buying, or whether the market continues to stall near the all-time high and pull back in the months ahead.

Millennial Minute

We may sound like a broken record, but knowing the limitations RSPs and TFSAs is so important when you’re planning for your retirement and savings.

Check out this month’s article to review why an RSP may not be the best choice for you.

Planning Article

The Smart Investor’s Guide to Reducing Taxes and Growing Wealth

Wealth Planning and Strategy February 10, 2026

A smart tax plan doesn’t just maximize your registered accounts, it structures your finances in a way that optimizes every dollar you earn on the road to retirement – and beyond. It uses a range of financial strategies – from income splitting to trust structures to estate planning – to ensure your wealth grows in the most tax-efficient way possible.

Keeping up with the ever-evolving tax code isn’t easy, but here are a few savvy strategies you may not have considered.

Start with income splitting

One of the first strategies to consider is income splitting, which can help a family lower its overall tax bill by shifting income from the higher-earning individual to someone in a lower tax bracket. There are a few ways to do this:

Spousal RRSPs: One of the most common ways families can split income is through a Spousal Registered Retirement Savings Plan (RRSP). Here, a higher-income earner contributes into a Spousal RRSP for the benefit of their spouse or common-law partner and receives the tax deduction. The account is in the lower-earning partner’s name, so when they withdraw the funds, the income is taxed at their (lower) rate. Careful timing of withdrawals from Spousal RRSPs are required as attribution rules stipulate that if a contribution is made to a Spousal RRSP, any withdrawals within the same calendar year or the following two calendar years are generally taxed in the hands of the contributing spouse, not the spouse who owns the account. The higher earner can still withdraw funds from their own RRSP in retirement, but they may elect not to pull as much out because the lower earner has money to remove, too. If you turn 71 in 2026, your final contribution to your RRSP must be made by December 31, at which point it must be converted into an RRIF or other retirement income option. However, if, after turning age 71, the higher earner is still earning taxable income, has available RRSP contribution room, and their spouse is younger, they can continue making contributions into the Spousal RRSP as long as the account is open, providing continued income-splitting benefits.

TFSA room: If you’re maxing out your Tax-Free Savings Account (TFSA) contributions, but your partner (or child aged 18 or older) still has room, consider providing them with funds to invest. Since the income earned within a TFSA is tax-exempt and is not subject to any attribution rules, this is a simple and effective income-splitting option. Just be aware that it is the TFSA holder that makes the contribution (subject to their available contribution room).

Pension splitting: Those who receive a pension from their workplace(s) or RRIF withdrawals (at age 65 or over) can transfer up to 50% of eligible income to a spouse or common-law partner, which can significantly reduce the family’s tax bill when retirement comes.

Paying for expenses: Another useful strategy is to have the higher-earning partner cover most household expenses, allowing the lower-income earner to save and invest, which will be taxed at a lower rate and reduce the family’s overall tax burden.

Loan: A higher-income-earning spouse can also lend money to a lower-income-earning spouse or family member to invest through a “prescribed rate loan”. This can be helpful if all registered accounts are maxed out, as the lower earner can then invest those funds into a non-registered account and pay tax on the income generated from the invested securities at their lower marginal rate. You have to loan the money since a gift to your spouse would invoke the attribution rules. This means, though, that the borrower must pay interest on the loan each year by January 30 – although if the money is being used to invest in a non-registered account, the interest should be tax deductible for the borrower. The minimum prescribed interest rate set quarterly by the Canada Revenue Agency which must be charged on the loan to avoid the attribution rules. The current CRA prescribed rate is 3% (from January 1, 2026, to March 31, 2026).

Make your portfolio tax-efficient

With investing, market returns matter but so does minimizing the taxes that could eat into those gains. That’s why most experts suggest investing in a tax-deferred or tax-exempt registered account first. If you can invest in both registered and non-registered accounts, though, consider allocating your higher-taxed securities, such as bonds, where interest is fully taxable at your marginal rate, into a registered account. Next, you can allocate more-tax-advantageous investments, such as ones that could generate capital gains, where you would only pay tax on 50% of the gain, or dividend-paying stocks, which come with a preferential tax rate, into a non-registered account.

Donate appreciated securities

Charitable donations can be a great way to support a cause you care about while reaping tax benefits. Donating publicly traded securities that have appreciated in value, instead of cash, can be especially advantageous because you can avoid the capital gains tax that would otherwise be realized on the disposition resulting from that donation, and receive a tax receipt for the full amount of the donation. High-income donors can receive a federal tax credit of 33% on amounts over $200, with total savings approximating 50% when combined with provincial credits.

Use borrowed funds to invest

If you borrow money to invest in income-generating assets outside of a tax-sheltered account like an RRSP or TFSA, the interest is tax-deductible, provided the borrowed funds are used to generate investment income, such as interest or dividends (and not purely for capital gains). However, only borrow within your means, as you don’t want that debt to linger for too long.

Reduce tax for your estate

Naming a beneficiary for your RRSP or Registered Retirement Income Fund (RRIF) can significantly affect estate taxes. If your beneficiary is a spouse or financially dependent child/grandchild, taxes may be deferred or avoided by rolling the funds into their registered plan. If a rollover isn’t an option, the fair market value is reported on the deceased’s final tax return, and any gains after death are taxed to the beneficiary. Naming a beneficiary for your TFSA is also recommended, and if you have a spouse or common-law partner, naming them as a “successor holder” for a TFSA can simplify the administrative process and help maintain its tax-free status.

Also, establishing a testamentary trust, a type of trust stipulated in a Will that comes into effect upon death, can be an effective way to gain more control over how your assets are used by your beneficiaries. It can also come with some tax benefits, such as income splitting amongst your beneficiaries. Typically, income retained in a trust is taxed at the top marginal rates. However, within the first 36 months after death, the deceased individual’s unadministered estate can potentially take advantage of graduated tax rates if assets are not distributed during this period.

Consider U.S. estate tax implications if you own U.S. property

Many Canadians own U.S. property, whether that’s a second home or American stocks or bonds in their portfolio. If you own more than US$60,000 in U.S. investments or U.S. situs assets at the time of death, and your global estate is worth more than US$13.99 million in 2025, and US$15 million for deaths in 2026, you could be subject to U.S. estate taxes. Tax rates can range from 18% to 40%, depending on the value of your estate, and can include U.S. assets in an RRSP or TFSA. Fortunately, tax treaties and careful planning can help minimize the hit. Of course, as with any of these tips, talk to a professional to make sure you’re tax planning properly.

For more timely tax advice, be sure to check out BMO’s Tax Tips for Investors, 2026 Edition. For more personalized tax advice, it’s always a good idea to speak with your tax advisor.

DISCLAIMER:

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. (\"BMO NBI\"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO NBI or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. BMO NBI -will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.

BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.