Investment Philosophy

Our philosophy is relatively simple.

An unwavering dedication to a consistent investment process while striving to provide exceptional client service. The strength of our investment philosophy is built on a long-term perspective and a commitment to investing in quality businesses.We believe these quality companies possess sustainable competitive advantages, creating value as profitable businesses that can, over time, provide attractive returns with less risk than the overall market. In other words, we believe in quality, diversification and downside protection. We really view ourselves as buyers of businesses or companies, not “stocks".

What is often not talked about is the sell discipline or what would cause us to sell a security. There are basically 3 reasons why we would sell a security. The first reason would be a change in the investment thesis or the reason we liked the business in the first place. That could be caused by a change in the industry, technological innovation, increasing competition or decisions made by the company with which do not agree or understand. A second reason is valuation. If a security reaches our target price and we no longer expect a reasonable return on our investment, then we would sell the security. After all, we are looking for great businesses that are good investments. The third and final reason we would sell a security would be if we simply feel that there are better opportunities elsewhere.

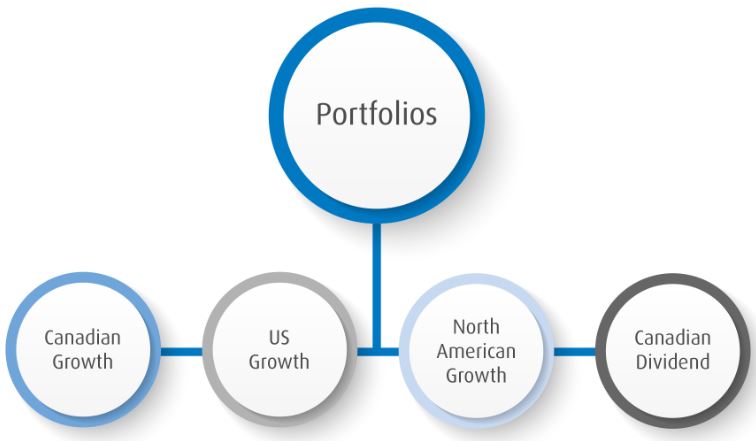

We currently manage four different portfolios. They are Canadian Growth, US Growth, North American Growth and Canadian Dividend. They are all managed with the same philosophy as described above. Each portfolio will generally consist of between 25-40 securities in order to achieve optimal diversification.  We are laser focused on risk in general and downside protection in particular. We control for concentration risk by ensuring that no one security makes up more that 4-5 percent of the portfolio and not one industry is more than 10 percent. We feel strongly that the best way to provide capital preservation is with a singular focus on quality companies and by diversifying their business risk as discussed.

We are laser focused on risk in general and downside protection in particular. We control for concentration risk by ensuring that no one security makes up more that 4-5 percent of the portfolio and not one industry is more than 10 percent. We feel strongly that the best way to provide capital preservation is with a singular focus on quality companies and by diversifying their business risk as discussed.

As their names imply, the first three portfolios are geared for clients in the growth phase of their investing cycle who are not relying on their investment portfolio to provide income while the fourth portfolio is meant for clients who are more interested in income with a secondary focus on growth. We will then add non equities consisting of bonds, preferred shares or GIC’S depending on each individual client situation.

For more information on any of above the above portfolios, sample portfolios, past performance, please contact us.